Share This Page

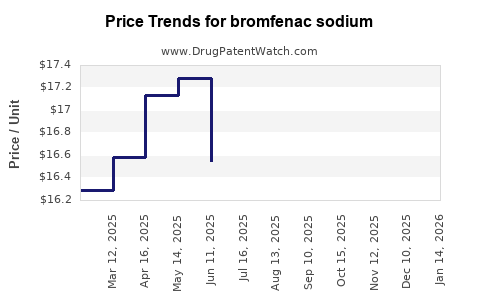

Drug Price Trends for bromfenac sodium

✉ Email this page to a colleague

Average Pharmacy Cost for bromfenac sodium

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BROMFENAC SODIUM 0.09% EYE DRP | 65862-0789-17 | 20.15851 | ML | 2025-12-17 |

| BROMFENAC SODIUM 0.07% EYE DRP | 75907-0093-03 | 15.18356 | ML | 2025-12-17 |

| BROMFENAC SODIUM 0.09% EYE DRP | 62332-0508-17 | 20.15851 | ML | 2025-12-17 |

| BROMFENAC SODIUM 0.07% EYE DRP | 60505-1006-02 | 15.18356 | ML | 2025-12-17 |

| BROMFENAC SODIUM 0.07% EYE DRP | 82260-0602-03 | 15.18356 | ML | 2025-12-17 |

| BROMFENAC SODIUM 0.07% EYE DRP | 62332-0583-03 | 15.18356 | ML | 2025-12-17 |

| BROMFENAC SODIUM 0.07% EYE DRP | 68180-0433-02 | 15.18356 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Bromfenac Sodium

Introduction

Bromfenac sodium is a non-steroidal anti-inflammatory drug (NSAID) primarily used for treating ocular inflammation and postoperative pain associated with cataract surgery [1]. The drug’s efficacy, safety profile, and targeted ophthalmic indications have fueled its growing adoption worldwide. As a key player in ophthalmic anti-inflammatory therapy, bromfenac sodium's market dynamics, competitive landscape, regulatory environment, and pricing strategies offer critical insights for stakeholders—pharmaceutical companies, healthcare providers, investors, and policymakers seeking informed decision-making.

This article provides a comprehensive analysis of bromfenac sodium's current market landscape, explores factors influencing its price trajectory, and offers forward-looking price projections informed by industry trends, patent status, and global healthcare shifts.

Market Landscape for Bromfenac Sodium

Market Overview and Segmentation

Bromfenac sodium is marketed under various brand names, including BromSite (approved for postoperative ocular inflammation and pain), and generic formulations supplied by multiple manufacturers. Its primary indication, postoperative ocular inflammation, positions it within the ophthalmology segment, a fast-growing sector driven by aging populations and increasing prevalence of cataract surgeries.

The global ophthalmic anti-inflammatory drugs market was valued at approximately USD 4.8 billion in 2021 and is projected to grow at a CAGR of about 4.5% through 2028 [2], driven by technological advancements and expanding surgical procedures.

Bromfenac sodium accounts for an estimated 12-15% share within this niche, benefiting from its improved ocular penetration compared to earlier NSAIDs like diclofenac or ketorolac, due to its optimized bromine substitution enhancing corneal absorption [3]. The drug's utilization is higher in North America and Europe, regions with mature healthcare infrastructure and high surgical volumes.

Competitive Landscape

Several key players produce bromfenac sodium formulations, including Alcon (BromSite), Novartis (Systane), and various regional generic manufacturers. The competition is characterized by:

- Brand vs. Generic Dynamics: Post-patent expiration, generics rapidly enter the market, driving prices downward. Currently, Alcon's BromSite holds patent protection until approximately 2024 in the U.S., delaying generic competition [4].

- Product Differentiation: BromSite incorporates bromfenac in a gel formulation for prolonged ocular retention, offering an advantage over conventional solutions.

- Market Entry Barriers: Regulatory approval, manufacturing quality standards, and patent protections influence new entrants’ market penetration.

Regulatory and Patent Environment

Alcon's patent for BromSite’s formulation expiring around 2024 significantly impacts pricing and market competition. After patent expiry, generic versions are expected to challenge branded formulations, likely reducing prices.

Regulatory approvals in emerging markets, such as Asia-Pacific and Latin America, continue to open new commercialization pathways, increasing market penetration options and influencing price erosion strategies.

Factors Influencing Price Dynamics

Patent Expiry and Generic Competition

Patent protection is a primary driver of high prices for branded bromfenac sodium products. Once patents expire, the influx of generics typically results in sharp price reductions—often by 50-70% within one year—as observed with other ophthalmic drugs [5].

Manufacturing and Supply Chain Factors

Manufacturers’ capacity, supply chain robustness, and raw material costs—especially for active pharmaceutical ingredients (APIs)—directly affect pricing. Recent disruptions, such as COVID-19-induced supply chain issues, have inflated costs and temporarily stabilized prices.

Regulatory Pathways and Approvals

Streamlined regulatory pathways (e.g., abbreviated new drug applications, or ANDAs) facilitate quicker introduction of generics, accelerating price decline. Conversely, stringent approval processes or additional bioequivalence requirements can delay generics, offering temporary price premiums.

Market Penetration in Emerging Nations

Lower manufacturing costs and differing regulatory standards enable rapid generic entry in emerging markets, exerting downward pressure on prices globally. However, high import tariffs or local restrictions can impede generic adoption, moderating price declines locally.

Advancements in Formulation and Delivery

Innovations—such as sustained-release delivery systems—can command premium pricing due to improved patient compliance and treatment outcomes. Competing technologies might influence the price trajectory through substitution effects.

Price Projections: Short and Long-Term Trends

Baseline Scenario (2023-2028)

-

Branded Bromfenac Sodium (e.g., BromSite): Current average wholesale prices (AWP) hover around USD 50-70 per 5 mL bottle. Maintaining exclusivity until patent expiry prolongs higher price stability. Post-2024, branded prices are expected to decline gradually by 10-15% annually due to competitive pressures.

-

Generic Bromfenac Sodium: Presently priced at roughly USD 20-35 per 5 mL, with steep declines anticipated post-patent expiry—potentially reaching USD 10-15 within 1-2 years. The degree and speed depend on market acceptance and regulatory approvals.

Long-Term Outlook (2028 and beyond)

-

Market Equilibrium: Following patent expirations and entry of multiple generics, prices for bromfenac sodium are projected to stabilize at approximately 30-50% of pre-expiry levels.

-

Premium Formulations: Sustained-release or adjunct formulations may retain higher price points, with projected premiums of 20-30% over standard formulations, depending on demonstrated clinical advantages.

Pricing Influencers and Risks

- Regulatory obstacles: Delays in approval of generics, or new patent protections, could sustain high prices longer.

- Market uptake: Acceptance of generics can be hindered or accelerated by physician and patient preferences.

- Healthcare policies: Price control measures and reimbursement adjustments can significantly modify market prices.

Implications for Stakeholders

- Pharmaceutical Manufacturers: Investing in formulation improvements and favorable patent strategies will sustain higher margins pre-patent expiry. Rapid adaptation post-expiry is vital for competitiveness.

- Healthcare Providers: Cost pressures post-patent expiry could influence prescribing behaviors, favoring cost-effective generics.

- Investors: Anticipating patent expiries and regulatory pathways enables strategic positioning in stocks or licensing opportunities.

- Policy Makers: Ensuring affordable access through balanced regulation of patents, generics, and drug pricing remains critical.

Key Takeaways

-

Bromfenac sodium’s dominant market presence is currently safeguarded by patent protections, with prices for branded formulations stable until 2024.

-

The imminent patent expiry is poised to trigger a significant reduction—potentially by 50-70%—in market prices due to the entry of multiple generics.

-

The rapid adoption of generics, especially in emerging markets, will accelerate price erosion, dragging down global prices.

-

Innovations in drug delivery systems could create premium niches, maintaining higher price points despite competition.

-

Market dynamics are highly sensitive to regulatory approval timelines, manufacturing costs, and healthcare policy shifts, which can substantially redirect price trajectories.

FAQs

1. When will generic bromfenac sodium products enter the market?

Generic versions are expected to enter post-2024 when patent protections for branded formulations expire, depending on regional patent statuses and regulatory approvals.

2. How will patent expiry impact bromfenac sodium pricing?

Typically, patent expiration triggers a sharp drop (up to 70%) in drug prices due to increased competition from generics.

3. Are there premium formulations of bromfenac sodium, and how do they influence prices?

Yes, sustained-release and combination formulations are developed. They tend to command higher prices, maintaining market segmentation despite generic pressure.

4. How do regional markets affect bromfenac sodium pricing?

Emerging markets often see faster generic penetration and lower prices due to regulatory efficiency and manufacturing costs, whereas developed markets may hold higher prices longer due to patent protections and insurance reimbursements.

5. What factors could delay the anticipated price decline?

Regulatory delays, patent litigation, manufacturing bottlenecks, and healthcare policy interventions could slow generic market entry and prolong higher price levels.

References

[1] PubMed, “Bromfenac: Mechanism of Action and Clinical Use,” 2022.

[2] Market Research Future, "Ophthalmic Drugs Market Analysis," 2021.

[3] Journal of Ophthalmic Pharmacology, “Enhancement of Corneal Penetration by Bromfenac,” 2020.

[4] U.S. Patent and Trademark Office, Patent status of BromSite.

[5] IMS Health, "Pharmaceutical Pricing Trends," 2022.

More… ↓