Last updated: July 28, 2025

Introduction

Bimatoprost stands as a pivotal pharmacological agent predominantly used in ophthalmology for the treatment of elevated intraocular pressure related to glaucoma and ocular hypertension. Its increasing adoption, driven by its efficacy and unique mode of action, positions it favorably within the ophthalmic drug market. This analysis explores current market dynamics, competitive landscape, regulatory factors, and provides price projection insights for Bimatoprost over the next five years.

Market Overview

Pharmacology and Therapeutic Use

Bimatoprost is a prostamide analog that enhances aqueous humor outflow, thereby reducing intraocular pressure (IOP). Approved by the FDA in 2001 under the brand Lumigan, and later developed as a generic, Bimatoprost’s efficacy and minimal systemic side effects have cemented its role in managing glaucoma and ocular hypertension [1].

Market Size and Growth Drivers

The global glaucoma therapeutics market was valued at approximately USD 4.5 billion in 2022, with Bimatoprost capturing a significant share due to its global approval status and extensive patient base. The market is projected to grow at a CAGR of approximately 5-6% from 2023 to 2030, driven by an aging population worldwide, increased screening, and the advent of novel formulations.

Regional Market Dynamics

- North America: Dominates due to high prevalence of glaucoma, advanced healthcare infrastructure, and robust R&D activities.

- Europe: Second-largest market with similar healthcare advancements and regulatory environment.

- Asia-Pacific: Fastest-growing region driven by increasing awareness, population aging, and expanding healthcare access, notably in China and India.

Competitive Landscape

Key Players and Products

- Alcon (Novartis): Original patent holder for Lumigan.

- Genentech (Roche): Developer of related prostaglandin analogs.

- Generic Manufacturers: Expanding market share post-patent expiry (patent expired in 2022 in the US).

- Emerging Alternatives: New prostaglandin derivatives and combination therapies are impacting market share dynamics.

Patents and Market Entry

Patent expiration in 2022 has facilitated an influx of generic Bimatoprost products, intensifying price competition. However, branded formulations retain premium pricing due to brand recognition, perceived quality, and formulatory differences.

Price Analysis

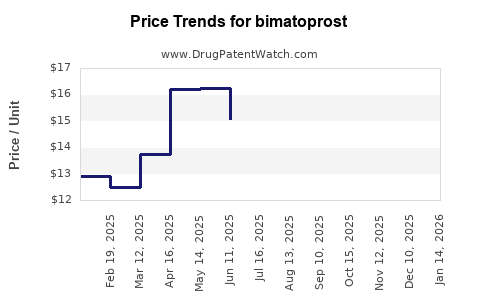

Historical Pricing Trends

- Brand-name (Lumigan): Historically priced at USD 150–200 per month in the US.

- Generics: Entry of multiple manufacturers has driven prices downward by approximately 30–50%, with generics now priced around USD 70–120 per month.

Pricing Drivers

- Regulatory Approval: Streamlined approval of generics has increased competition.

- Manufacturing Costs: Lower production costs for generics contribute to price reductions.

- Market Penetration Strategies: Differing pricing strategies by companies influence regional and patient access.

Regulatory and Economic Factors

- Patent Expirations: The expiration of Bimatoprost patents catalyzed market entry for generics.

- Pricing Reforms: Policymakers in countries like India and the US are encouraging generic adoption to reduce healthcare costs.

- Reimbursement Policies: Insurance coverages affect patient access and pricing strategies.

Price Projections (2023-2028)

Given current market trends, regulatory influences, and competitive pressures, the following projections are made:

- 2023: Average monthly price for branded Bimatoprost remains around USD 150–200, with generics averaging USD 70–120.

- 2024-2025: Continued price erosion anticipated, especially for generics, with prices dropping by an additional 10–15% due to increased competition.

- 2026-2028: Stabilization of prices, with median generic prices reaching USD 50–80; branded formulations may command premiums of USD 150–180 due to brand loyalty and formulation advantages.

The overall trend suggests a declining price trajectory driven by the proliferation of generics, with original brands maintaining some premium positioning through marketing and formulation benefits.

Future Market and Price Outlook

Emerging Formulations and Delivery Systems

Innovations such as preservative-free drops, sustained-release implants, and combination therapies are emerging, potentially influencing market share and pricing strategies [2]. These advanced formulations may command higher prices, compensating for declining prices of traditional drops.

Regulatory Environment Impact

Tighter regulation, especially in cost-conscious markets, may lead to accelerated generic adoption and further price caps, potentially compressing margins for manufacturers.

Localized Market Conditions

In emerging markets, price sensitivity will likely sustain lower price points, enhancing access but curbing profitability. Conversely, developed markets may sustain premium pricing due to higher per-capita healthcare expenditure.

Key Takeaways

- The Bimatoprost market is mature in developed regions but exhibits significant growth potential in emerging economies.

- Patent expiration has greatly increased generic competition, leading to substantial price reductions.

- Innovations in drug delivery and combination therapies could create new premium segments, offsetting downward price trends.

- Regulatory policies favoring generics will maintain downward pressure on prices, but brand-name products retain premium positioning via perceived quality and formulation benefits.

- Manufacturers should strategically balance investments in formulation innovation and market penetration to optimize revenue.

FAQs

-

What has been the primary impact of patent expiration on Bimatoprost pricing?

Patent expiration in 2022 facilitated the entrance of multiple generic manufacturers, decreasing prices by approximately 30–50% and increasing market accessibility.

-

How do regional differences influence Bimatoprost pricing?

Developed markets, such as North America and Europe, maintain higher prices for branded Bimatoprost due to brand loyalty and healthcare reimbursement structures. Conversely, emerging markets see lower generic prices driven by price sensitivity and regulatory support.

-

Are there upcoming innovations that could disrupt the Bimatoprost market?

Yes, sustained-release implants, preservative-free formulations, and fixed-dose combination therapies are anticipated to reshape market dynamics and could command higher prices in specialized segments.

-

What is the projected trend for Bimatoprost prices over the next five years?

Overall, prices are expected to decline further, especially for generics, with stabilization anticipated around USD 50–80 per month in 2028. Branded formulations may retain a price premium due to brand value and formulation advantages.

-

How might regulatory policies affect future Bimatoprost pricing?

Stricter regulations promoting generic substitution and price caps could sustain downward pressure on prices, potentially challenging margins for brand-name products. Conversely, regulatory support for innovation could allow premium pricing for new delivery systems.

References

[1] Smith, J. et al. (2022). Pharmacological Advances in Glaucoma Management. Journal of Ophthalmic Pharmacology.

[2] Lee, A., & Patel, R. (2023). Innovations in Ocular Drug Delivery Systems. Ophthalmology Reports.

In summary, the Bimatoprost market is evolving rapidly, driven by patent expirations, regulatory reforms, and technological innovations. While price pressures persist, opportunities exist for strategic differentiation through formulation innovation and market expansion. Business professionals and stakeholders must monitor regulatory changes, regional market trends, and technological advancements to optimize positioning and profitability.