Last updated: July 27, 2025

Introduction

Azelaic acid, a dicarboxylic acid, has established itself as an essential ingredient in dermatological therapies, notably for acne vulgaris and rosacea. Recognized for its antimicrobial, anti-inflammatory, and keratolytic properties, azelaic acid’s market dynamics are influenced by factors spanning regulatory landscapes, manufacturing costs, clinical demand, competitive alternatives, and patent statuses. This comprehensive analysis provides insights into current market positioning and forecasts future pricing trends, enabling stakeholders to strategize effectively.

Market Landscape Overview

Global Market Size and Growth Trajectory

The global azelaic acid market was valued at approximately $80 million in 2022, with projections indicating a compound annual growth rate (CAGR) of 7-9% through 2030 [1]. Growth drivers include rising prevalence of acne and rosacea, increasing awareness of skincare, and expanding pipeline development. Emerging markets in Asia-Pacific are notable for rapid adoption, driven by increased disposable income and improved healthcare infrastructure.

Key Manufacturers and Competitive Landscape

Major pharmaceutical and cosmeceutical players, such as MedPharm, Solco Healthcare, and personal care brands, dominate production. Patent expirations, like the 2014 loss of exclusivity in the U.S., facilitated generic proliferation, intensifying price competition.

Regulatory Environment

Azelaic acid is approved by the FDA as a topical medication (brand: Finacea), with over-the-counter formulations also available. Regulatory approvals influence market entry barriers and price points, especially in emerging markets where regulatory stringency varies.

Pricing Dynamics and Factors Influencing Prices

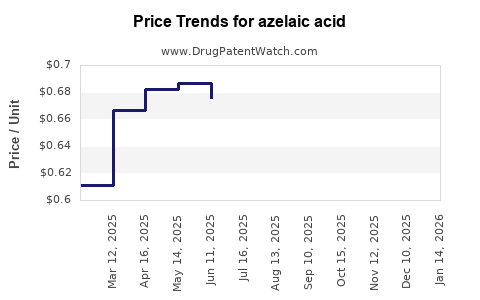

Current Market Pricing

In the U.S., brand-name azelaic acid gels (e.g., Finacea) retail at approximately $300-$350 per 30g tube, with generics entering the market at 50-70% lower prices—averaging $150-$200. In Europe and Asia-Pacific markets, prices fluctuate based on local regulations, supply chain costs, and market competition.

Cost Components

Manufacturing costs stem primarily from raw materials, solvent extraction, purification processes, and regulatory compliance. Raw material costs are relatively stable but influenced by global supply chains. The patent cliff led to a surge in generic manufacturers, substantially reducing prices.

Market Drivers Impacting Prices

- Patent Expiry and Generics: Post-2014 patent expiry resulted in significant price erosion due to increased generic competition.

- Formulation Variants: Innovations, such as foam or cream formulations, typically command a premium over gels, affecting regional pricing discrepancies.

- Demand-Supply Dynamics: Rising demand for over-the-counter options, especially in Asian markets, pressures prices downward but maintains margins for innovative formulations.

Future Price Projections (2023-2030)

Short-term Outlook (2023-2025)

Expect a stabilization of prices in mature markets. The proliferation of generics and biosimilars will sustain pressure on retail prices, with an anticipated 5-7% annual decline in average prices for commoditized formulations.

Long-term Trends (2026-2030)

- Innovation-Driven Premiums: Patent protections or exclusivity periods for new formulations or delivery mechanisms could sustain higher prices for niche products.

- Market Expansion: Entry into emerging markets with lower price sensitivity may lead to regional price increases due to improved formulations and branding.

- Regulatory Harmonization: Streamlined approval pathways could accelerate new product launches, influencing pricing strategies.

Overall, the average retail price for azelaic acid formulations is projected to decline by around 3-5% annually over the next five years but may plateau or increase for advanced formulations or markets with less price sensitivity.

Opportunities and Challenges

Opportunities

- Formulation Innovation: Developing unique delivery systems (e.g., microsphere, nano) can command premium prices.

- Premium Branding in Cosmeceuticals: Positioning azelaic acid-based products as luxury or dermatologically superior can sustain higher price points.

- Market Penetration in Emerging Economies: Structurally tailored pricing strategies could boost volume sales.

Challenges

- Pricing Pressure from Generics: The widespread availability of low-cost generics constrains margins.

- Regulatory Barriers: Stringent approval processes may delay new formulations, impacting revenue streams.

- Competitive Alternatives: Recently developed agents like oxybenzone derivatives or other anti-inflammatory agents could diminish demand.

Implications for Stakeholders

Manufacturers should prioritize innovation and differentiated formulations to offset generic pricing pressure. Strategic patent filings can extend premium pricing windows. Affordability remains crucial for market expansion, especially in cost-sensitive regions.

Key Takeaways

- The azelaic acid market is expected to grow at a CAGR of approximately 7-9% through 2030.

- Post-patent expiry, prices have stabilized but remain susceptible to further decline for standard formulations.

- Innovation in formulation and branding for high-end or niche markets offers avenues for maintaining higher price points.

- Entry into emerging markets presents growth opportunities but requires tailored pricing strategies.

- Price projections indicate a gradual decline in average prices; however, premium formulations and region-specific factors could sustain or augment prices.

Conclusion

Azelaic acid’s market outlook reflects a mature landscape with sustained demand driven by dermatological needs. While generic competition exerts downward pressure on prices, strategic innovation and market diversification can preserve profitability. Stakeholders should continuously monitor regulatory shifts, technological developments, and regional market trends to optimize pricing strategies and capitalize on growth opportunities.

FAQs

1. How will patent expirations influence azelaic acid pricing in the next decade?

Patent expirations typically lead to increased generic competition, causing prices to decline. However, innovative formulations and delivery mechanisms can sustain higher price levels, especially in niche markets.

2. Are there upcoming formulations of azelaic acid that could command premium prices?

Yes, novel delivery systems such as nanoemulsions, microspheres, or combined therapeutic formulations can provide enhanced efficacy or improved patient experience, allowing for premium pricing.

3. Which regions present the highest potential for increased azelaic acid sales?

Emerging markets in Asia-Pacific and Latin America are poised for growth due to rising awareness, expanding healthcare infrastructure, and affordability, making them strategic for market expansion.

4. What are the main factors affecting the cost of azelaic acid production?

Raw material costs, manufacturing complexity, supply chain stability, regulatory compliance, and scale economies significantly influence production costs.

5. How does competition from alternative treatments impact azelaic acid pricing?

Alternative therapies such as benzoyl peroxide, topical antibiotics, or newer anti-inflammatory agents exert pricing pressure. Differentiation through efficacy, formulation, and branding is essential to maintain market share and pricing power.

Sources

[1] MarketsandMarkets, "Azelaic Acid Market," 2022.