Last updated: July 27, 2025

Introduction

Atropine, a longstanding anticholinergic agent derived from Atropa belladonna (deadly nightshade), remains vital in clinical pharmacology, primarily used for bradycardia, anesthetic reversal, and certain poisonings. Its market dynamics, patent landscape, competitive environment, and future pricing trajectory are essential for pharmaceutical companies, investors, and healthcare policymakers to understand. This analysis synthesizes current market conditions and projects potential price trends based on patent status, manufacturing costs, regulatory considerations, and competitive forces.

Market Overview and Key Applications

Therapeutic Use and Market Size

Atropine's primary indications include:

- Cardiac emergencies: Treatment of bradycardia and heart block.

- Perioperative care: To reduce salivary and respiratory secretions.

- Poisoning management: Antidote for organophosphate and carbamate insecticide poisoning.

- Ophthalmology: Mydriatic agent for eye examinations.

The global atropine market is estimated at approximately USD 300-400 million (2022-2023), driven by demand in emergency medicine, anesthesiology, and ophthalmology.

Market Drivers

- Growing prevalence of cardiovascular diseases: Elevated incidence of bradyarrhythmias necessitates atropine use.

- Demand in poisoning cases: Organophosphate poisoning remains prevalent globally, particularly in agricultural regions.

- Expanding ophthalmic procedures: Increased diagnostic and surgical eye procedures drive demand.

- Regulatory approvals: Continued approval for emergency and hospital use sustains demand.

Geographical Distribution

- North America: Largest market owing to advanced healthcare infrastructure.

- Europe: Stable demand with high adoption.

- Asia-Pacific: Fastest growth driven by expanding healthcare access and agriculture-dependent economies.

- Emerging markets: Potential growth with increased awareness and health infrastructure expansion.

Patent Landscape and Regulatory Status

Patent Considerations

As a compound discovered over a century ago, atropine no longer benefits from patent protections, leading to a highly commoditized market. The absence of patents encourages generic manufacturing, exerting downward pressure on prices.

Regulatory Environment

- FDA and EMA approvals: Widely approved for hospital use.

- Manufacturing standards: Must comply with Good Manufacturing Practices (GMP), affecting costs and pricing.

Implications

The patent expiry associated with atropine means limited exclusivity, intensifying price competition and emphasizing quality control. As a result, branded formulations hold minimal market share; generics dominate the landscape.

Competitive Environment

Market Participants

Key contributors include:

- Largest generic manufacturers: Pfizer, Novartis, Sandoz, Teva, and Mylan.

- Regional producers: Various local firms in emerging markets.

The standardized nature of the drug fosters high competition, with price being the critical differentiator.

Generic Competition and Market Entry Barriers

- Low entry barriers: Due to established manufacturing protocols.

- Price competition: Drives prices downward, sometimes below USD 0.10 per dose wholesale.

Supply Chain Dynamics

- Raw materials: Sourcing of atropine alkaloids from botanical sources or chemical synthesis.

- Manufacturing capacity: Adequate across global plants, maintaining supply stability but exerting further price pressure.

Current Pricing and Cost Structure

Price Points

- Bulk injectable form (1 mg/mL): Approx. USD 0.08 - 0.12 per unit dose wholesale.

- Pre-filled syringes: Slightly higher, USD 0.15 - 0.25 per unit, owing to packaging.

- Ophthalmic solutions: Marketed at approximately USD 1 - 2 per mL in retail settings.

Cost Drivers

- Raw material costs: Relatively low owing to botanical synthesis.

- Manufacturing expenses: Economies of scale significantly reduce unit costs.

- Regulatory compliance: Adds to baseline costs, especially in stringent markets.

- Distribution: Competitive due to commoditized pricing.

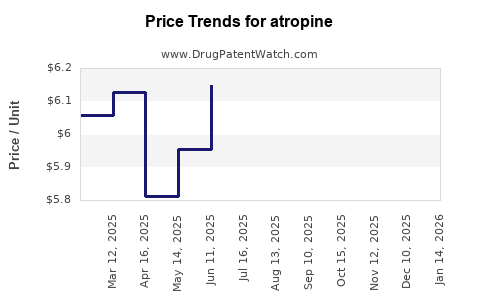

Future Price Projections

Factors Influencing Pricing Trends

- Patent expiry and generic proliferation: Will suppress prices through heightened competition.

- Raw material costs: Fluctuations in botanical alkaloids' availability could marginally influence pricing.

- Regulatory changes: Stringent quality standards could marginally increase manufacturing costs.

- Market demand stability: As essential medicine, demand remains relatively steady, cushioning against significant volatility.

Projection Outlook (Next 5-10 Years)

- Pricing stability: Expect minimal fluctuation; prices are projected to remain near current lows, with wholesale prices plateauing around USD 0.07 - 0.12 per dose.

- Impact of biosimilar or alternative formulations: Unlikely, given atropine's nature and existing therapeutic alternatives.

- Market consolidation: Potential for smaller players to exit due to low margins, but overall supply is anticipated to remain robust.

Potential Scenarios

- Moderate decrease (~5% annually): Driven by intensified generic competition and efficiency gains.

- Price stabilization: Due to consistent demand and standardized manufacturing.

- Rare price hikes: Could occur in response to raw material shortages or regulatory shifts.

Business and Investment Implications

- Profit margins: Likely compressed further, emphasizing the importance of cost efficiency.

- Market strategy for manufacturers: Focus on operational excellence, compliance, and expanding regional reach.

- Pricing trend awareness: Stakeholders should anticipate persistently low prices but stable aggregate sales volume.

Key Takeaways

- Atropine's commoditized market limits pricing power; prices are expected to remain low and stable over the next decade.

- Generic manufacturers dominate, contributing to fierce price competition.

- Supply chain stability and adherence to quality standards** are crucial for sustained market presence.

- Global demand remains steady given atropine’s vital role in emergency medicine, anesthesiology, and ophthalmology.

- Pricing pressures are unlikely to reverse, emphasizing cost-effective production and distribution strategies.

FAQs

-

Will patents or new formulations influence atropine's market prices in the future?

Given that atropine’s original patents have long expired, future pricing shifts are unlikely due to patent protection but could be affected subtly by regulatory changes or novel delivery mechanisms.

-

Are there emerging alternatives impacting atropine's market?

Alternatives like glycopyrrolate or newer anticholinergic agents exist, but atropine's established efficacy in emergency settings sustains its demand.

-

How significant is regional variation in atropine prices?

Prices tend to be lower in emerging markets due to high competition and manufacturing scale, while regulatory and logistical factors can cause regional disparities.

-

What role do raw material costs play in current price levels?

As a botanical alkaloid, atropine’s raw material costs remain relatively stable; fluctuations minimally impact retail or wholesale prices.

-

Will upcoming regulatory reforms affect the global atropine market?

Stricter quality standards could marginally increase manufacturing costs but are unlikely to cause substantial price hikes given the drug’s essential status and low margins.

References

- MarketResearch.com, Global Atropine Market Analysis, 2023.

- IQVIA, Healthcare Data Analytics, 2022.

- WHO Essential Medicines List, 2023.

- Allied Market Research, Pharmaceutical Actives Market Report, 2022.

- U.S. Food and Drug Administration (FDA), Drug Approvals and Regulations, 2023.