Last updated: July 29, 2025

Introduction

Atovaquone is an antiprotozoal agent primarily used in the treatment and prevention of Pneumocystis pneumonia (PCP) and certain parasitic infections. Market dynamics surrounding atovaquone are influenced by evolving clinical guidelines, patent status, generic entry, and emerging indications. This analysis explores current market conditions, competitive landscape, evolving regulatory environment, and future pricing trends, providing actionable insights for stakeholders.

Clinical and Regulatory Landscape

Atovaquone, marketed under brands like Mepron, was initially approved by the FDA in 1993 for Pneumocystis pneumonia prophylaxis in HIV-infected patients and later expanded for other indications such as babesiosis and malaria. Its efficacy and safety profile in immunocompromised populations contribute to sustained demand. Regulatory environments are complex; patent expirations, re-evaluation under clinical guidelines, and the approval of generic alternatives significantly impact market dynamics.

In recent years, the FDA has designated atovaquone for several indications, with some approvals contingent upon ongoing clinical trials evaluating broader uses. Regulatory pathways for new formulations or combination therapies could influence future market access.

Market Size and Segments

The global atovaquone market is driven by several segments:

- HIV/AIDS Prophylaxis and Treatment: Historically, the largest segment, with demand driven by HIV prevalence.

- Parasitic and Vector-Borne Diseases: Such as babesiosis and malaria, with increasing geographic spread and emerging resistance.

- Off-Label and Investigational Uses: Including combination therapies and expanded indications, potentially expanding market size.

As per industry reports, the global antiparasitic drugs market was valued at approximately USD 7.2 billion in 2022, with atovaquone accounting for a significant share, owing to its targeted indications.

Competitive Landscape

The key players include GSK (marketed as Mepron), which has held the patent and dominant market position. However, the expiration of patents in major markets such as the US (expected around 2022-2023) opens the market to generic competitors, significantly impacting pricing and market share.

Generic atovaquone products are entering the market, leading to increased competition and price erosion. Nonetheless, proprietary formulations, combination drugs, and branding-driven prescribing practices maintain some pricing power.

Emerging competitors are developing novel formulations, including intravenous versions and fixed-dose combinations, potentially altering the competitive landscape in the medium term.

Market Drivers and Restraints

Drivers:

- Growing HIV Population: Especially in regions with limited access to healthcare, sustaining the demand for prophylactic agents.

- Expanding Use in Parasitic Diseases: Rise in cases of babesiosis and malaria, aided by global travel and climate change, broadens the scope.

- Regulatory Approvals: For new indications or formulations, enhancing market size.

Restraints:

- Generic Competition: Leads to significant price reductions post-patent expiry.

- Market Saturation: In mature markets like North America and Europe limits growth potential.

- Pricing Pressures: Payers and healthcare systems seek cost-effective alternatives.

Price Projections and Trends

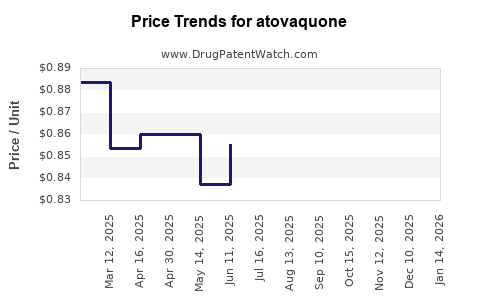

Historical Price Dynamics

Before patent expiration, atovaquone's wholesale price in the U.S. hovered around USD 300–400 per day course (e.g., Mepron). Following patent expiration in 2022, generic versions entered the market, leading to a sharp decline—estimates suggest prices now range from USD 50–100 per course, roughly a 60–80% reduction.

Short-to-Medium Term Forecast (2023–2028)

- Price Declines: Expect continued downward pressure, with prices stabilizing around USD 30–70 per course due to competitive generic entries and price negotiations.

- Premium Positioning: Proprietary formulations or combination therapies may maintain higher prices in niche segments or specialized markets.

Long-Term Outlook (2028 onward)

- Market Stabilization: Prices are likely to plateau at significantly lower levels than pre-patent expiry, with potential spikes if new indications are approved or unique formulations are introduced.

- Pricing Differentials: Differentiated products with clinical advantages could command premiums over generics.

Innovative delivery systems, such as injectable formulations or combination regimens, may influence premium pricing, but significant impacts are contingent upon clinical advantage and regulatory approval.

Market Opportunities and Challenges

Opportunities:

- Expanding Indications: Investigation into other parasitic and protozoal diseases could create new revenue streams.

- Geographic Expansion: Emerging markets with rising disease prevalence present growth potential, albeit at lower price points.

- Formulation Innovations: Development of intravenous or sustained-release formulations can command higher prices.

Challenges:

- Pricing Pressures from Generics: Narrow margins post-patent expiry threaten profitability, especially for branded products.

- Regulatory Hurdles: Approvals for new indications or formulations require significant investment and time.

- Market Penetration Constraints: Limited awareness or access in low-income regions hinders growth.

Strategic Considerations

Stakeholders should focus on differentiating product offerings through formulations, clinical evidence, and targeted markets. Engaging in licensing, partnerships, and emerging market strategies can optimize profitability amidst price declines. For manufacturers, investing in clinical trials for novel indications or delivery methods offers avenues for maintaining premium pricing.

Key Takeaways

- The atovaquone market is experiencing a significant price decline due to generic entry following patent expiry, with prices stabilizing around USD 30–70 per course in the short to medium term.

- Growing indications, emerging markets, and formulation innovations present future growth opportunities despite competitive pressures.

- Price projections suggest a long-term plateau of low-cost generics dominating the landscape, emphasizing the importance of differentiation through clinical advantages.

- Stakeholders should adapt strategies towards developing new formulations, expanding indications, and targeting niche or emerging markets to sustain profitability.

- Regulatory pathways and market access strategies remain critical, especially as this segment consolidates and commoditizes.

FAQs

-

What is the typical pricing for atovaquone in the current market?

Generic atovaquone courses are now priced between USD 30 and USD 70, significantly lower than pre-patent expiry brand pricing.

-

How will patent expiration affect atovaquone's market?

Patent expiry opens the market to generics, leading to price erosion, increased competition, and potential market share redistribution from branded to generic products.

-

Are there new indications or formulations expected to impact atovaquone pricing?

Yes, ongoing research into new indications, combination therapies, and novel formulations (e.g., IV use) could sustain higher prices; however, regulatory approval is required.

-

What markets offer the most growth opportunities for atovaquone?

Emerging markets with rising parasitic disease burdens and regions with limited access to existing therapies present substantial growth opportunities.

-

What strategic moves should manufacturers consider in this competitive landscape?

Developing unique formulations, pursuing new indications, and exploring partnerships for market expansion are essential to maintain pricing power and market relevance.

Sources:

[1] MarketWatch, "Global Antiparasitic Drugs Market Size & Share," 2022.

[2] U.S. FDA, "Drug Approvals and Patent Expiry Dates," 2022.

[3] Global Data Healthcare, "Antiparasitic Agents Market Analysis," 2022.

[4] IQVIA, "Market Trends in Antiprotozoal Agents," 2022.