Last updated: September 8, 2025

rket Analysis and Price Projections for Aripiprazole

Introduction

Aripiprazole, marketed under brand names such as Abilify, is an atypical antipsychotic medication widely prescribed to treat schizophrenia, bipolar disorder, and major depressive disorder. Since its initial FDA approval in 2002, aripiprazole has become a cornerstone therapy within the mental health treatment landscape. This market analysis explores the current demand dynamics, competitive environment, patent landscape, and price projections, offering strategic insights relevant for pharmaceutical stakeholders.

Market Overview and Demand Dynamics

The global aripiprazole market has experienced steady growth driven by increasing prevalence of schizophrenia, bipolar disorder, and treatment-resistant depression. According to the World Health Organization (WHO), schizophrenia affects approximately 20 million people worldwide, with bipolar disorder impacting about 45 million individuals globally [1]. Elevated awareness and improved diagnostic practices further propel demand.

In North America, the United States dominates the market, owing to high prevalence rates, robust healthcare infrastructure, and widespread insurance coverage. The U.S. accounted for over 45% of the global antipsychotics market in 2021 [2]. Europe follows, with increasing adoption of atypical antipsychotics, including aripiprazole, attributed to their improved side effect profile compared to first-generation drugs.

Emerging markets, particularly in Asia-Pacific, exhibit rising adoption due to expanding healthcare access, urbanization, and increasing mental health awareness. The Asia-Pacific region is projected to witness the fastest CAGR (~8%) from 2022-2030, further expanding market reach.

Competitive Landscape and Patent Environment

Key Players and Patent Expiration

Pfizer and Otsuka Pharmaceutical originally developed aripiprazole; Pfizer markets Abilify, while Otsuka originated the compound. As patents expire, biosimilars and generics have entered the market, intensifying competition. The U.S. patent covering Abilify's original formulation expired in 2015, prompting multiple generic entrants [3].

Pricing Impact of Patent Expiry

Patent expiration typically leads to substantial price erosion—often 25-60%—as generics enter the market. For aripiprazole, generic versions now constitute the majority of prescriptions in key markets, exerting downward pressure on prices.

Market Penetration of Biosimilars and Generics

Biosimilar development for aripiprazole remains limited, owing to the complexity of demonstrating biosimilarity for complex molecules. Nonetheless, generic versions dominate the market, which significantly influences overall pricing strategies.

Price Trends and Projections

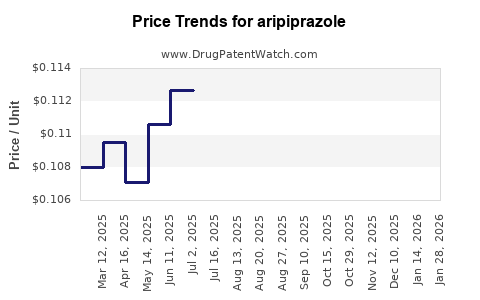

Historical Pricing Data

In the U.S., the average wholesale price (AWP) for branded aripiprazole was approximately $1,200 per month in 2014. Post-patent expiry and generic entry, prices dropped to around $300-$400 per month by 2017 [4].

Current Pricing Landscape

Generic aripiprazole is now widely available at approximately $300 for a 30-day supply, depending on the distributor and insurance coverage. The trend indicates sustained pricing stability, driven by manufacturing efficiencies and increased competition.

Future Price Trajectory

Projections suggest that wholesale prices for generic aripiprazole will stabilize within the $250-$350 range over the next 3-5 years. The following factors influence these projections:

- Market Saturation: As generic penetration consolidates, pricing is likely to stabilize; however, further generic entrants may introduce minor price reductions.

- Formulation Innovations: Development of long-acting injectable formulations (e.g., Abilify Maintena and Aristada) commands premium pricing, approximately $4,000-$5,000 per month, influencing overall market value.

- Regulatory and Reimbursement Policies: Price controls and formulary preferences impact retail prices; increased preferential coverage for generics in insurance plans supports downward pressure.

- Emerging Markets: Entry in developing economies might lead to lower priced versions, broadening affordability but pressuring mature markets' prices.

Impact of Long-Acting Injectables (LAIs)

LAIs like Abilify Maintena and Aristada are premium products, with prices significantly higher than oral formulations. Their market share is expected to grow, especially in elderly and adherence-challenged populations. This niche commands premium pricing, thus diversifying revenue streams beyond oral formulations.

Regulatory and Market Opportunities

The increasing global burden of mental health disorders, coupled with unmet needs in treatment adherence, positions aripiprazole-related products as attractive candidates for next-generation formulations and biosimilars. Regulatory environments aiming for cost containment could incentivize the development of biosimilars or generic formulations with even lower prices.

Furthermore, expanding indications—such as in autism spectrum disorder (where aripiprazole is approved for irritability)—provide additional revenue avenues, thus influencing market size and price considerations.

Key Price Drivers and Potential Risks

Drivers

- Patent expiration and generic competition

- Growing demand in emerging markets

- Long-acting injectable formulations with premium pricing

- Expanding approved indications

Risks

- Regulatory price controls reducing profit margins

- Entry of biosimilars or advanced formulations

- Competitive drugs with similar efficacy but lower costs

- Prescriber and patient preference shifts toward newer therapies

Conclusion

The aripiprazole market remains dynamic, with prices under pressure from generic competition yet supported by high demand for effective mental health medications. While oral formulations see prices stabilizing around $250-$350, injectable variants maintain a premium positioning. Strategic focus on biosimilar development, formulation innovation, and emerging markets can capitalize on growth opportunities while mitigating price erosion.

Key Takeaways

- The patented aripiprazole product’s patent expiry has prompted a significant price decline, with generics now dominating the market.

- Overall price stability for oral generics is expected at approximately $250-$350 per month over the next 3-5 years.

- Long-acting injectable formulations represent a high-margin niche, with prices around $4,000–$5,000 monthly, promising additional revenue streams.

- Market expansion into emerging economies offers growth but may exert downward pricing pressure globally.

- Regulatory trends towards price controls and increased biosimilar competition pose ongoing risks.

FAQs

1. How has patent expiration affected aripiprazole pricing?

Patent expiration in 2015 led to an influx of generic manufacturers, causing wholesale prices to drop from approximately $1,200 per month to around $300, expanding affordability and access.

2. What are the main factors influencing future aripiprazole prices?

Key factors include generic market saturation, formulation innovations (long-acting injectables), regulatory policies, competition from biosimilars, and emerging market penetration.

3. Are biosimilars viable for aripiprazole, and what is their impact?

Biosimilar development faces technical challenges due to aripiprazole’s complex structure; currently, biosimilars are limited. Their potential could further reduce prices if introduced.

4. What is the outlook for branded long-acting injectable formulations?

These formulations command premium prices (~$4,000–$5,000/month) and are expected to grow as non-adherence remains a significant issue in psychiatric treatment.

5. How do regional differences affect aripiprazole prices?

Prices are higher in North America due to brand dominance and insurance structures, whereas emerging markets often see lower generic prices owing to market competition and pricing regulations.

References

[1] World Health Organization. (2021). Mental Health.

[2] Grand View Research. (2022). Antipsychotics Market Size, Share & Trends.

[3] U.S. Patent and Trademark Office. (2015). Patent expiration for Abilify.

[4] IQVIA. (2017). Pharmaceutical Pricing and Market Trends.