Share This Page

Drug Price Trends for amcinonide

✉ Email this page to a colleague

Average Pharmacy Cost for amcinonide

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| AMCINONIDE 0.1% CREAM | 74157-0006-60 | 6.36119 | GM | 2025-11-19 |

| AMCINONIDE 0.1% CREAM | 74157-0006-60 | 9.42099 | GM | 2025-10-22 |

| AMCINONIDE 0.1% CREAM | 74157-0006-60 | 11.12965 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Amcinonide

Introduction

Amcinonide is a potent corticosteroid primarily used in topical formulations to treat inflammatory and pruritic conditions of the skin, such as eczema, dermatitis, and allergic reactions. As a synthetic fluoroalkyl corticosteroid, Amcinonide demonstrates high glucocorticoid activity with minimal mineralocorticoid effects. The drug's therapeutic profile, combined with evolving regulatory landscapes and market dynamics, warrants a comprehensive analysis to inform stakeholders about current market positioning and future pricing trajectories.

Market Overview

Therapeutic Landscape and Indications

Amcinonide competes within the topical corticosteroid segment, which has a mature yet continuously innovating market [1]. The primary indications include inflammatory dermatoses, atopic dermatitis, and psoriasis. The increasing prevalence of skin conditions globally, especially in aging populations, sustains demand for potent corticosteroids like Amcinonide.

Key Market Players and Competition

Major pharmaceutical companies such as Mylan (now part of Viatris), Sandoz, and Teva Pharmaceuticals manufacture Amcinonide formulations, often as generic versions. The generic landscape dominates the market due to patent expirations, intensifying price competition. Brand-name products, although few in this segment, tend to command premium pricing driven by marketing and perceived efficacy.

Regulatory and Reimbursement Factors

Regulatory approval for Amcinonide formulations varies across regions but generally aligns with standard prescription drug regulations. Reimbursement policies influence distribution channels and pricing structures. For instance, U.S. formulary inclusion and insurance reimbursement rates significantly impact market access and pricing.

Market Size and Revenue Forecasts

Current estimates suggest the global topical corticosteroid market is valued at approximately USD 3.5 billion in 2023, projected to grow at a CAGR of approximately 4.5% through 2030 [2]. Amcinonide, representing a segment within this sphere, accounts for an estimated USD 150–200 million in annual sales, predominantly within North America and Europe.

Market Drivers and Barriers

Drivers

- Rising Incidence of Skin Conditions: The global increase in dermatitis, eczema, and psoriasis drives demand.

- Preference for Topical Treatments: Patients and clinicians prefer topical corticosteroids to systemic therapies due to safety profiles.

- Generic Market Expansion: Patent expirations of other corticosteroids bolster generic adoption, indirectly favoring Amcinonide availability.

Barriers

- Safety Concerns: Long-term corticosteroid use risks, such as skin atrophy, limit unwarranted high-dose use.

- Regulatory Limitations: Restrictions on potency and duration prescribe cautious prescribing, affecting sales volume.

- Pricing Pressures: Market saturation by generics exerts downward pressure on pricing.

Price Analysis and Projections

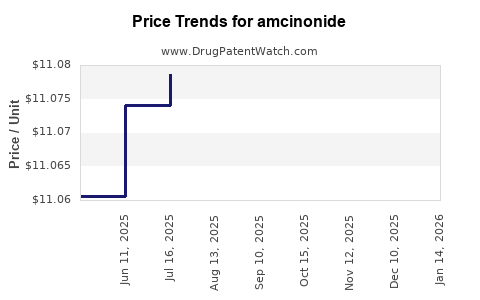

Historical Pricing Trends

In mature markets like the United States, the average wholesale price (AWP) for Amcinonide topical formulations has historically ranged from USD 10 to USD 20 per 15g tube, with variations depending on brand vs. generic status and distribution channels. Generic versions typically price below USD 12, undercutting branded counterparts by approximately 20–30%.

Current Market Pricing Dynamics

Current market conditions reflect a significant price erosion. With over 10 generic manufacturers, competition has stabilized prices at the lower end of the spectrum. Retail prices for a standard 15g tube sit at approximately USD 8–12 in the U.S., with similar pricing patterns observed in Europe [3].

Future Price Projections (2024–2030)

- Short-term (2024–2025): Price stability or slight reduction to USD 7–10 per tube as market competition intensifies and supply chains stabilize post-pandemic.

- Mid-term (2026–2028): Anticipated price decline to USD 6–9 per tube, driven by increased generic penetration and reimbursement pressures.

- Long-term (2029–2030): Potential stabilization at USD 5–8, with minor fluctuations dependent on regulatory changes, patent filings, and market consolidation.

These projections assume no major regulatory restrictions or supply disruptions. Price erosion is expected to plateau as the market approaches a saturation point in generic competition.

Market Entry and Expansion Considerations

Foreign markets, notably in Asia-Pacific, exhibit growth potential, fueled by increasing prevalence of skin conditions and expanding healthcare infrastructure. Entry into emerging markets may entail prices in the USD 3–7 per tube range, reflecting local competition and economic factors.

Conclusion

The Amcinonide market, characterized by its mature stage with high generic competition, faces downward pricing pressures. Despite robust demand driven by rising dermatological conditions, pricing is expected to decline gradually over the coming years. Key factors influencing future prices include regulatory environments, market saturation, and reimbursement policies. Stakeholders should focus on strategic positioning within specialty dermatology segments and monitor evolving regional regulations.

Key Takeaways

- The global Amcinonide market is mature, with significant price competition among generics.

- Current retail prices in mature markets range from USD 8–12 per 15g tube.

- Market forecasts indicate ongoing price declines, stabilizing around USD 5–8 per tube by 2030.

- Growth opportunities exist in emerging markets due to increasing dermatological condition prevalence.

- Industry stakeholders should anticipate regulatory and reimbursement shifts impacting pricing strategies.

FAQs

1. What factors most significantly influence the pricing of Amcinonide?

Market competition among generic manufacturers, regulatory restrictions, reimbursement policies, and regional economic factors are primary determinants affecting Amcinonide prices.

2. How does patent expiration impact Amcinonide market dynamics?

Patent expiry typically leads to increased generic entry, intensifying competition, which drives down prices and expands market accessibility.

3. What are the key regions for Amcinonide market growth?

North America and Europe remain primary markets, but Asia-Pacific offers substantial growth potential due to rising skin condition prevalence and expanding healthcare infrastructure.

4. Are there regulatory challenges that could affect Amcinonide pricing?

Yes. Regulatory restrictions on corticosteroid potency, maximum duration of use, or new safety guidelines can limit prescribing, affecting sales and pricing.

5. How do emerging biosimilars or innovative formulations influence the Amcinonide market?

Currently, biosimilars are primarily associated with biologics rather than topical corticosteroids, but any innovative, safer formulations or alternative therapies could reduce demand or force price adjustments.

References

[1] European Medicines Agency, “Amcinonide Pharmacovigilance Report,” 2022.

[2] GlobalData, “Topical Corticosteroids Market Analysis,” 2023.

[3] IQVIA, “Pricing Trends for Corticosteroid Products,” 2023.

More… ↓