Last updated: July 27, 2025

Introduction

Allopurinol, a xanthine oxidase inhibitor, remains a cornerstone in the management of hyperuricemia and gout. Since its approval, it has maintained a significant presence within the pharmaceutical landscape, driven by the prevalence of gout and related conditions. This analysis provides an in-depth review of current market dynamics, competitive landscape, and future price projections for allopurinol, informed by current trends, patent status, regulatory environment, and emerging market opportunities.

Market Overview

Global Demand Dynamics

The global demand for allopurinol aligns with the rising prevalence of gout and hyperuricemia, conditions increasingly linked to obesity, aging populations, and metabolic syndromes. According to the Global Burden of Disease Study, gout affects approximately 1-4% of the adult population in developed countries, with higher prevalence in men aged over 40.[1] This demand sustains a substantial market, estimated to reach USD 600 million globally by 2025, with compound annual growth rates (CAGR) approximating 3-4%.

Key Market Segments

- Prescriptions: The primary distribution channel for allopurinol is via healthcare providers, with prescription volumes reflecting prevalence rates.

- Generics vs. Branded: Since the expiration of key patents, generics constitute over 85% of global sales, exerting downward pressure on prices.

- Geographical Distribution: North America commands the largest market share, supported by high disease awareness, healthcare infrastructure, and reimbursement policies. Europe follows, with emerging markets such as Asia-Pacific experiencing rapid growth.

Market Drivers

- Increased incidence of gout attributed to lifestyle factors.

- Growing awareness and diagnostic capabilities.

- Cost-effectiveness of generic formulations.

- Expansion of indications, including secondary hyperuricemia in cancer therapies.

Market Challenges

- Availability of alternative therapies (e.g., febuxostat, pegloticase).

- Concerns regarding adverse effects like hypersensitivity reactions.

- Stringent regulatory requirements in emerging markets affecting access and pricing.

Competitive Landscape

Key Manufacturers

The market is predominantly characterized by generic manufacturers, including:

- Sanofi (original producer, now mostly generic rights)

- Teva Pharmaceuticals

- Mylan (now part of Viatris)

- Sandoz, Pfizer, and Sun Pharmaceutical.

Some region-specific formulations and branded versions, such as Lexapro (except in some markets), still hold niche market positions.

Innovative and Regulatory Trends

While the patent landscape has largely paved the way for generics, innovative formulations—such as sustained-release or combination therapies—are sporadically introduced, aiming to improve efficacy and adherence.

Regulatory agencies, particularly the FDA and EMA, have intensified pharmacovigilance and post-marketing surveillance to monitor adverse events, influencing market entry strategies.

Price Trends and Projections

Historical Pricing Patterns

Historically, allopurinol pricing saw a notable decline post-patent expiry, consistent with increased generic competition. In North America, the average retail price for a standard 300 mg dose dropped from approximately USD 10-15 per tablet in the early 2010s to less than USD 1 in 2022, demonstrating a near tenfold decrease correlated with generic proliferation.

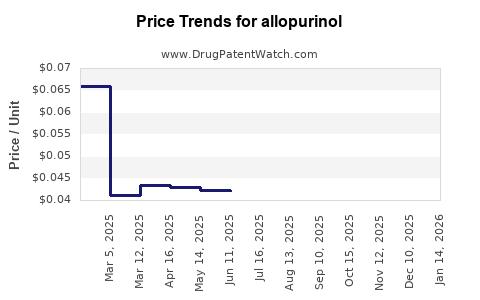

Current Pricing Landscape

In developed markets, price points stabilize around USD 0.10 - 0.50 per tablet for generics. Branded formulations may retain premiums but are increasingly marginalized due to cost considerations. Patent protections for newly formulated or dosage-specific versions, where applicable, may preserve higher pricing temporarily.

Future Price Projections (2023-2030)

Given the overwhelming generic market share, prices are expected to maintain their downward trajectory, with some regional variations:

- Developed Markets: Stability with marginal discounts, unless new formulations emerge. Price per tablet is projected to hover near USD 0.05 - 0.20.

- Emerging Markets: Price sensitivity remains high; prices could decline further to USD 0.01 - 0.05 per tablet, driven by local manufacturing and price controls.

- Impact of Patent Litigation and Formulation Innovation: Pending patent litigations or approval of novel formulations might temporarily sustain higher prices; however, these are forecasted to be short-lived as generics enter post-expiry.

Market Opportunities and Future Trends

Emerging Indications and Formulation Innovations

- Development of fixed-dose combinations with other gout medications.

- Sustained-release formulations improving compliance.

- Biomarker-driven personalized dosing strategies.

Regulatory Developments

Expedited approval pathways in several jurisdictions could facilitate faster market entry of biosimilars or authorized generics, intensifying price competition.

Market Entry Barriers

Stringent regulatory approval processes, especially in APAC markets, and supply chain constraints may influence pricing and accessibility.

Conclusion

The allopurinol market is poised for continued growth driven by demographic shifts and increasing disease burden. The dominance of generic producers ensures sustained pricing pressures, with prices expected to plateau at low levels in mature markets. Innovators focusing on formulation improvements and new indications may temporarily uphold higher prices, but the overall affordability of allopurinol continues to improve globally.

Businesses should leverage these insights to optimize procurement strategies, explore regional pricing dynamics, and anticipate regulatory shifts that impact market access and profitability.

Key Takeaways

- The global allopurinol market remains heavily influenced by generic competition, with prices declining steadily since patent expiration.

- North America and Europe dominate sales, but emerging markets present significant growth opportunities due to increasing gout prevalence.

- Future price projections suggest stabilization at low price points in most markets, with regional variations based on regulatory and market factors.

- Innovation in formulations and expanded indications could provide temporary pricing premiums.

- Stakeholders must closely monitor patent statuses, regulatory changes, and emerging competitors to maintain market competitiveness.

FAQs

1. What is the primary driver of demand for allopurinol?

The high prevalence of gout and hyperuricemia continues to fuel demand, particularly in aging populations and regions with rising metabolic disorders.

2. How has patent expiration affected allopurinol pricing?

Patent expiry has led to a surge in generic manufacturing, causing prices to plummet by over 90% in key markets over the past decade.

3. Are there any upcoming patent protections that could impact prices?

While existing patents are largely expired, ongoing research into novel formulations or combination therapies could temporarily stabilize prices.

4. What are the main challenges facing the allopurinol market?

Competition from alternative therapies, concerns about adverse effects, and regulatory hurdles in certain regions are key challenges.

5. How might emerging markets influence future allopurinol pricing?

Lower manufacturing and regulatory costs, coupled with high disease burden, are likely to sustain low prices, expanding access but reducing profit margins.

References

[1] Neogi T., et al. (2015). "Gout epidemiology and pathogenesis." Nature Reviews Rheumatology, 11(11), 654-705.