Last updated: July 27, 2025

Introduction

Albuterol, also known as salbutamol outside North America, is a short-acting beta-2 adrenergic receptor agonist widely used in the treatment of asthma, chronic obstructive pulmonary disease (COPD), and other bronchospasm-related respiratory disorders. Its efficacy in rapid bronchodilation has made it one of the most prescribed inhalers globally. With an evolving pharmaceutical landscape and increasing respiratory disease prevalence, understanding Albuterol's market dynamics and future pricing trends is imperative for stakeholders.

Market Landscape

Global Market Size and Growth Trajectory

The global respiratory inhaler market, in which Albuterol predominates, was valued at approximately USD 14 billion in 2022, with a Compound Annual Growth Rate (CAGR) of about 5% projected through 2028 [1]. Albuterol accounts for a significant segment within this industrial domain, driven by its widespread use in both developed and emerging markets.

The growing prevalence of respiratory disorders—estimated to affect over 300 million individuals worldwide—favors sustained demand for Albuterol [2]. Particularly, the rising incidence of asthma (currently impacting approximately 262 million people globally) and COPD (more than 200 million) fuels the need for rapid-relief inhalers.

Key Market Players and Competitive Landscape

Major manufacturers include GlaxoSmithKline (GSK), Teva Pharmaceuticals, and Sunovion Pharmaceuticals. GSK’s Ventolin inhaler remains a market leader, benefiting from extensive distribution and brand recognition. Generic formulations have increased accessibility, especially in lower-income regions, intensifying price competition.

Emerging players are focusing on integrating digital inhaler technologies and developing alternative delivery mechanisms, striving for differentiated offerings. While brand-name inhalers retain premium pricing, the proliferation of generics has pressured prices downward.

Regulatory Environment and Patent Dynamics

The expiration of GSK’s patent on Ventolin inhalers in the mid-2010s significantly altered market dynamics, leading to increased generic competition. Regulatory bodies such as the FDA and EMA continue to scrutinize inhaler approvals, influencing market entry and pricing strategies globally.

In some markets, regulatory barriers restrict generic substitution; in others, accelerated approval pathways facilitate pricing erosion post-patent expiry. Ongoing patent litigations and formulations’ patent protections impact the duration of market exclusivity.

Pricing Trends and Influencing Factors

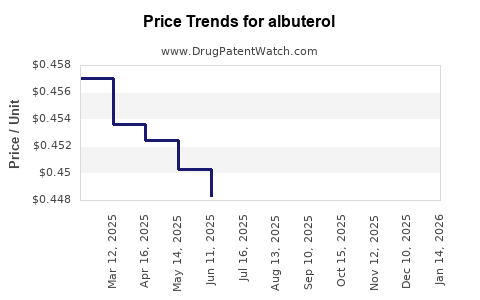

Historical Price Movements

The retail price of albuterol inhalers in developed markets has seen fluctuations, often correlating with patent statuses and market competition. Brand-name Ventolin inhalers historically carried premiums exceeding USD 50 per inhaler. Post-patent expiry, prices for generics have drop significantly—often below USD 20 per inhaler [3].

Insurance reimbursement policies and formulary positioning further influence out-of-pocket expenses for consumers, affecting market penetration.

Factors Driving Future Price Expectations

- Patent Expirations and Generic Entry: Continued patent cliffs will propel generic availability, exerting downward pressure on prices.

- Manufacturing Cost Dynamics: Advances in inhaler device manufacturing and API sourcing can reduce costs, enabling price reductions.

- Market Penetration in Emerging Economies: Increased demand in Asia-Pacific and Latin America, driven by rising respiratory disease prevalence, will influence pricing strategies to achieve market capture.

- Regulatory and Policy Changes: Governments’ push for cost-effective treatments and the implementation of negotiated drug prices can cap pricing increases.

- Technological Innovations: Digital inhalers with tracking and adherence features command premium prices, potentially offsetting generic downward pressure for advanced products.

Price Projection Outlook (2023–2030)

Based on current market trends, regulatory frameworks, and demographic shifts, the following projections are anticipated:

- Short-term (2023–2025): Stable prices for branded inhalers due to brand loyalty and regulatory inertia; generics prices dropping by up to 40%.

- Mid-term (2026–2028): Increased market saturation with generics, leading to further price declines of approximately 15–25%. Introduction of digital inhalers may sustain or elevate prices for premium offerings.

- Long-term (2029–2030): Pricing may stabilize at USD 10–15 per inhaler for generics in developed regions, with potential for lower prices in emerging markets. Policy interventions and technological advances could modulate these trajectories.

Market Opportunities and Risks

Opportunities

- Expansion into emerging markets experiencing rising respiratory disease burdens.

- Development of combination inhalers incorporating Albuterol with corticosteroids or other agents.

- Adoption of digital inhaler technologies to differentiate product offerings.

Risks

- Increased regulatory pressures to reduce drug prices.

- Market saturation with low-cost generics.

- Potential shifts toward alternative delivery devices or novel therapeutics, impacting demand.

Conclusion

Albuterol remains a cornerstone of respiratory therapy, with a resilient market outlook driven by disease prevalence and clinical utility. Price trajectories are predominantly dictated by patent status, regulatory environments, and technological innovations. Stakeholders should monitor patent laws, evolving reimbursement policies, and technological advancements to optimize commercial strategies in this dynamic landscape.

Key Takeaways

- The global Albuterol market is projected to grow steadily, influenced by increasing respiratory diseases worldwide.

- The expiration of key patents will continue to foster generic competition, exerting downward pressure on prices.

- Innovation in inhaler technology and delivery mechanisms represents an opportunity to maintain premium pricing segments.

- Regulatory frameworks and government policies significantly impact the pricing landscape, especially in emerging markets.

- Strategic focus on digital inhalers and combination therapies could offset price declines and open new revenue streams.

FAQs

1. How has patent expiration impacted Albuterol pricing?

Patent expirations have led to a proliferation of generic alternatives, significantly reducing retail prices—often by 40% or more—thereby increasing affordability and market penetration.

2. What are the main factors influencing future Albuterol prices?

Key factors include patent timelines, generic market entry, regulatory policies, manufacturing costs, technological innovations, and competitive dynamics within the inhaler landscape.

3. Are digital inhalers influencing the Albuterol market?

Yes. Digital inhalers, offering features like dose tracking and connectivity, command premium prices and can help sustain profitability amidst declining prices of traditional inhalers.

4. Which regions are expected to see the highest growth in Albuterol demand?

Emerging markets in Asia-Pacific, Latin America, and Africa are projected to experience substantial growth, driven by rising respiratory disease burdens and increasing healthcare investments.

5. Will future innovations replace traditional Albuterol inhalers?

While novel delivery systems and combination therapies will complement traditional inhalers, the proven efficacy and low cost of Albuterol ensure it remains a mainstay for respiratory management in the foreseeable future.

Sources

[1] Market Research Future, "Respiratory Inhalers Market," 2022.

[2] World Health Organization, "Global Asthma Report," 2021.

[3] IQVIA, "Global Respiratory Inhaler Pricing Trends," 2022.