Last updated: July 27, 2025

Introduction

Acetylcysteine (commonly known as NAC) is a mucolytic agent with extensive applications across respiratory health, hepatology, and as an antioxidant supplement. Its recognition as a critical medication in treating acetaminophen overdose and chronic respiratory conditions shapes a dynamic market landscape. This analysis reviews the current market environment, trends influencing demand and supply, and projects future pricing trajectories based on key variables.

Market Overview

Therapeutic and Industrial Applications

Acetylcysteine’s primary therapeutic uses encompass:

- Respiratory therapy: As a mucolytic to clear mucus in bronchitis, COPD, and cystic fibrosis.

- Acetaminophen overdose treatment: Emergency antidote reducing hepatotoxicity through glutathione replenishment.

- Potential antioxidant roles: Investigated for neurodegenerative diseases, psychiatric conditions, and as a supplement.

Aside from pharmaceuticals, NAC is also used in the food industry as a preservative and in cosmetic products, though these sectors represent a smaller share of demand.

Market Size and Growth Drivers

Global demand for acetylcysteine has grown steadily, with a 2022 estimated market value of approximately USD 400–500 million (based on industry reports [1]). The CAGR is projected at 6–8% over the next five years, driven by:

- Increasing prevalence of respiratory diseases: Aging populations and pollution exposure augment demand.

- Expanding use in overdose management: Regulatory approvals and incorporation into emergency protocols boost sales.

- Growing interest in antioxidant therapy: Emerging research enhances therapeutic scope, potentially widening usage.

Regulatory and Patent Landscape

Regulatory Status

NAC is generally recognized as safe (GRAS) in many jurisdictions, with approved formulations for medical and supplement use. In the U.S., the FDA permitted over-the-counter sales as a supplement; specific formulations for pharmaceutical use are approved for medical indications. Regulatory approvals, or lack thereof, influence market penetration and pricing.

Patent and Exclusivity Status

While NAC itself is a generic compound synthesized since the 1960s, newer formulations—particularly inhaled, intravenous, or controlled-release forms—may enjoy patent protection or proprietary manufacturing methods. Patent expiries approximately in the late 2010s or early 2020s have facilitated market entry by multiple generic manufacturers, increasing supply and pressuring prices [2].

Market Dynamics and Competitive Landscape

Key Players

The market comprises major generic pharmaceutical firms and some specialty biotech companies:

- Generic manufacturers: Mylan, Teva, Cipla, and others dominate by offering affordable NAC formulations.

- Specialty players: Companies developing novel delivery systems or combination therapies aim to secure higher prices through differentiation.

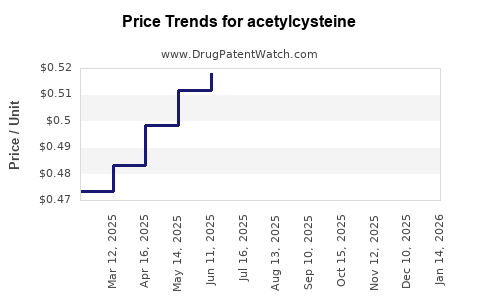

Pricing Trends and Factors

- Supply and demand: Generic competition has driven down prices, especially in mature markets.

- Manufacturing costs: Variations in raw material costs, primarily sulfur and acetic compounds, influence pricing stability.

- Regulatory shifts: Stringent standards or new approvals can temporarily elevate costs but generally lead to more competitive pricing once market entry barriers are lowered.

- Formulation differences: Inhaled or intravenous forms garner higher prices than oral supplements due to convenience and medical necessity.

Current Pricing Landscape

Oral NAC supplements: Typically retail between USD 10–20 for a month’s supply (60–120 capsules).

Pharmaceutical-grade NAC: Intravenous formulations may command prices from USD 50–200 per dose, depending on concentration and regional pricing policies.

Inhalation solutions: Approximately USD 30–60 per treatment course, with some variability based on device compatibility.

Price Projection Analysis

Short-term Outlook (1-2 years)

- Stability in prices: Given the saturation of the market with generics, prices are expected to remain stable, with minimal reductions.

- Potential upticks: Short-term price increases may occur due to supply chain disruptions or raw material cost fluctuations, especially amidst ongoing geopolitical tensions and pandemic recovery efforts.

Mid-term Outlook (3-5 years)

- Gradual decline in oral supplement prices: Competition likely to further compress margins, driving prices down by 3–5% annually in mature markets.

- Premium formulations dominate: Innovator or branded formulations (e.g., inhaled or pediatric-specific) may sustain higher prices due to differentiation and patent protections.

Long-term Outlook (5+ years)

- Innovative delivery systems: Expect increased adoption of inhaled and injectable forms with premium pricing, especially if new indications emerge from ongoing research.

- Market expansion in emerging economies: Increased healthcare spending and rising prevalence of respiratory conditions will expand global demand, potentially supporting stable or slightly increasing prices in those regions.

- Regulatory impacts: Future approvals for additional indications or formulations could disrupt current pricing trends, creating either upward or downward pressures.

Key Price Drivers

| Drivers |

Impact on Price |

Details |

| Generic competition |

Downward |

Increased availability tends to reduce prices. |

| Raw material costs |

Upward/downward |

Fluctuations in sulfur and acetic acid prices influence manufacturing costs. |

| Regulatory changes |

Variable |

Approvals or restrictions can alter supply and demand dynamics. |

| Innovation and formulations |

Upward |

Proprietary delivery forms command premium prices. |

| Regional healthcare policies |

Variable |

Pricing controls or reimbursements affect availability and cost. |

Conclusion and Recommendations

The acetylcysteine market is poised for gradual price compression driven by generics and evolving formulations. Stakeholders should focus on:

- Investing in novel delivery technologies to retain premium pricing potential.

- Monitoring raw material markets to anticipate cost-driven price adjustments.

- Expanding presence in emerging markets to capitalize on growing demand outside mature economies.

- Staying ahead of regulatory developments to optimize product portfolio strategies.

Business professionals should align procurement and pricing strategies with these dynamics to optimize profit margins and market positioning.

Key Takeaways

- The global acetylcysteine market is approximately USD 400–500 million with a forecasted CAGR of 6–8%.

- Prices for oral supplements are expected to decline gradually, while innovative formulations may sustain higher margins.

- Increased competition from generics has driven prices downward, but branded or specialty products still command premium prices.

- Market growth is primarily fueled by respiratory disease prevalence, emerging therapeutic uses, and expansion into developing economies.

- Regulatory and raw material cost fluctuations remain key short-term risks influencing pricing strategies.

FAQs

1. What are the primary therapeutic indications driving acetylcysteine demand?

Respiratory conditions like COPD and cystic fibrosis, and its role as an antidote for acetaminophen overdose, are the main demand drivers. Emerging uses in antioxidant therapy also influence future growth.

2. How do patent expirations affect acetylcysteine pricing?

Patent expirations enable multiple generic manufacturers to enter the market, increasing supply and exerting downward pressure on prices, especially for standard formulations.

3. What factors could lead to a rise in acetylcysteine prices in the future?

Innovative drug delivery platforms, new clinical indications, regulatory exclusivities, and supply chain constraints could elevate prices for certain formulations.

4. Is there a significant difference in prices between formulations (oral, inhaled, injectable)?

Yes. Inhaled and injectable forms typically command higher prices due to their medical necessity and specialized delivery systems compared to over-the-counter supplements.

5. How will emerging markets impact the global acetylcysteine market?

Growing healthcare infrastructure and increasing disease prevalence in emerging economies are projected to expand demand, potentially stabilizing or increasing prices in those regions.

Sources:

[1] MarketResearch.com. "Global Acetylcysteine Market Analysis 2022."

[2] FDA and EMA regulatory filings and patent status reports.