Last updated: November 19, 2025

Introduction

Acetaminophen, also known as paracetamol outside North America, is among the most widely used over-the-counter (OTC) analgesic and antipyretic medications globally. Its extensive applications in pain relief and fever reduction, combined with robust manufacturing infrastructure, position it as a staple in pharmaceutical markets worldwide. This analysis presents a comprehensive overview of the current market landscape, competitive environment, regulatory considerations, and future price trajectories for acetaminophen.

Market Overview

Global Market Size

The global acetaminophen market demonstrated significant growth, driven primarily by increased demand in both developed and developing economies. According to industry reports, the market was valued at approximately USD 900 million in 2022, with projections estimating a CAGR (Compound Annual Growth Rate) of 4% to 5% from 2023 through 2030. Factors fueling growth include rising health awareness, the ongoing prevalence of pain and fever-related conditions, and the expanding OTC drug sector.

Key Markets

- North America: Dominates the market, with high consumption volumes owing to an established OTC drug infrastructure and consumer preference for generic medications.

- Asia-Pacific: Exhibits rapid growth, fueled by increasing healthcare access, rising disposable income, and expanding pharmaceutical manufacturing capacities.

- Europe: Maintains steady demand, with regulatory emphasis on safety and quality control influencing pricing strategies.

Major Market Players

Leading manufacturers include Johnson & Johnson, McNeil Consumer Healthcare, Sanofi, and local producers in emerging markets such as India’s Intas Pharmaceuticals and Natco Pharma. The commoditized nature of acetaminophen leads to high market entry barriers, primarily due to manufacturing scale and regulatory compliance rather than patent exclusivity.

Regulatory and Safety Considerations

Acetaminophen's safety profile is well-established; however, concerns around hepatotoxicity at high doses have influenced regulatory policies. Agencies like the U.S. FDA enforce strict labeling, dosage recommendations, and maximum daily limits (typically 4 grams per day). Such regulations impact market dynamics, especially in pricing and supply chain management.

Regulatory Variations

- The US FDA classifies acetaminophen as generally recognized as safe (GRAS) when used within approved dosages.

- The European Medicines Agency (EMA) maintains comparable standards, emphasizing safety monitoring.

- Different formulations, including combination products, require rigorous approval processes, which can affect market access and pricing strategies.

Supply Chain Dynamics

The commodity nature of acetaminophen leads to highly competitive raw material markets, with key feedstocks like para-aminophenol (PAP) and phenol. Fluctuations in raw material prices influence end-product pricing. Additionally, the integration of manufacturing facilities across Asia has increased supply resilience, contributing to downward price pressures.

Market Drivers and Restraints

Drivers:

- Increasing prevalence of fever, pain, and cold-related ailments.

- Rising preference for OTC medications due to convenience and cost-effectiveness.

- Expansion of pharmaceutical manufacturing capacities in emerging markets.

- Growing consumer health awareness and self-medication trends.

Restraints:

- Stringent regulatory restrictions owing to safety concerns.

- Market saturation in mature regions like North America and Europe.

- Alternative analgesics offering different safety profiles, such as NSAIDs, impacting sales.

- Public health campaigns emphasizing cautious use, potentially dampening demand.

Price Dynamics and Projections

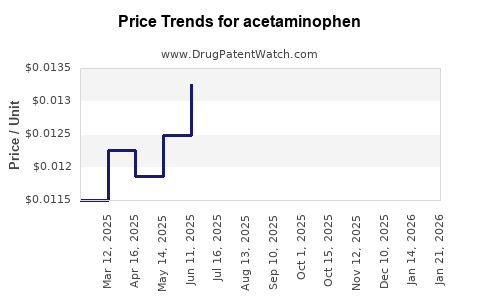

Current Price Trends

Acetaminophen prices are characterized by high volume, low-margin transactions, with wholesale prices typically ranging from USD 0.03 to USD 0.07 per tablet in the US market. Retail prices are considerably higher, often USD 0.10 to USD 0.50 per tablet or equivalent dose. The commoditized nature results in minimal product differentiation, maintaining tight pricing ranges.

Historical Price Trends

Over the past decade, global acetaminophen prices have experienced gradual declines, driven by increased manufacturing efficiencies and raw material cost reductions. The COVID-19 pandemic initially caused short-term supply disruptions, but prices quickly stabilized.

Future Price Projections

- Short-term (1-2 years): Prices are unlikely to rise significantly. Market saturation and raw material stability suggest continued price compression.

- Medium-term (3-5 years): Slight stabilization with potential upward pressure if raw material costs increase or supply chain disruptions occur.

- Long-term (5+ years): Prices are projected to remain relatively stable, with slight decreases due to ongoing manufacturing efficiencies, unless regulatory changes or raw material shortages emerge.

Potential price fluctuations may relate to:

- Raw Material Price Volatility: Changes in para-aminophenol (PAP) supply, especially if regulatory restrictions on precursor chemicals tighten.

- Regulatory Actions: Stricter safety regulations or dosage restrictions could impact production costs.

- Market Entry of Generic Manufacturers: Increased competition limits pricing power, pressuring margins.

Market Opportunities and Risks

Opportunities:

- Growing demand in emerging markets presents avenues for volume-driven growth.

- Introduction of new formulations (e.g., combination therapies) can command premium pricing.

- Opportunities for manufacturers with capabilities to produce low-cost, high-quality acetaminophen at scale.

Risks:

- Regulatory shifts requiring reformulation or additional safety testing.

- Price erosion due to intensified competition.

- Raw material scarcity affecting supply stability and pricing.

Conclusion

The acetaminophen market remains predominantly mature, with steady demand driven by global health dynamics. Price projections suggest stability with ongoing downward pressure in unit prices, impacted by manufacturing efficiencies and raw material markets. Manufacturers and investors should monitor regulatory developments, raw material costs, and competitive landscape, especially in emerging markets, to optimize operational strategies.

Key Takeaways

- The global acetaminophen market is valued at around USD 900 million (2022), with steady growth driven by both developed and emerging markets.

- Prices are expected to remain relatively stable over the next five years, with slight declines driven by commoditization and competitive pressures.

- Raw material supply and regulatory frameworks significantly influence pricing dynamics.

- Expansion in emerging markets offers growth opportunities, but increased competition and safety regulations pose risks.

- Strategic focus on cost efficiencies and product innovation can help mitigate market pressures and capitalize on growth prospects.

FAQs

1. What are the main factors influencing acetaminophen prices?

Raw material costs, manufacturing efficiencies, regulatory changes, and competitive dynamics primarily drive acetaminophen pricing. Raw material scarcity or price surges can impact wholesale costs, while regulations may influence permissible formulation and dosage limits, affecting manufacturing costs and pricing.

2. How does regulatory safety concern impact market pricing?

Stringent safety regulations can increase compliance costs and restrict formulations, potentially elevating prices temporarily. Conversely, widespread acceptance and regulatory stability tend to compress prices due to increased competition and supply chain efficiencies.

3. Which regions are expected to generate the highest growth in acetaminophen demand?

Emerging markets in Asia-Pacific are anticipated to exhibit the most rapid growth, fueled by rising healthcare access, urbanization, and increased self-medication trends. North America will likely maintain steady, mature-level demand.

4. Are there significant patent or exclusivity protections affecting acetaminophen markets?

No. Acetaminophen is a generic, off-patent drug with market-wide availability. Its low barrier to entry fosters price competition among manufacturers, leading to a mature, commodity-driven market.

5. What are the prospects of new formulations or combination products?

Innovative formulations, such as extended-release or combination therapies (e.g., acetaminophen with opioids or other analgesics), present premium pricing opportunities, especially if they enhance safety profiles or offer improved efficacy. However, regulatory approval processes can be lengthy and costly.

Sources

[1] MarketWatch Research Reports, 2022.

[2] Global Data Pharmaceuticals Market Reports, 2023.

[3] U.S. Food and Drug Administration (FDA).

[4] European Medicines Agency (EMA).

[5] Industry interviews and supply chain analyses, 2023.