Last updated: July 28, 2025

Introduction

Acarbose, an oral α-glucosidase inhibitor, is a prescription medication primarily used to manage type 2 diabetes mellitus (T2DM). It functions by delaying carbohydrate absorption in the gut, thereby reducing postprandial hyperglycemia. Market dynamics for acarbose are influenced by factors including epidemiological trends, regulatory landscapes, competitive positioning, and consumer preferences. This analysis delineates current market conditions, future growth drivers, and price trajectory forecasts.

Global Market Overview

The global acarbose market exhibits steady growth, propelled chiefly by the rising prevalence of T2DM worldwide. According to the International Diabetes Federation (IDF), as of 2021, approximately 537 million adults suffered from diabetes, with projections reaching 700 million by 2045 [1]. The increasing patient pool elevates demand for effective glycemic control solutions, positioning acarbose within the expanding antidiabetic pharmacotherapy market.

Key markets include Asia-Pacific, Europe, North America, and Latin America. The Asia-Pacific region dominates due to high T2DM prevalence, economic growth, and expanding healthcare infrastructure, especially in China and India. These regions often exhibit favorable regulatory environments and lower manufacturing costs, further bolstering market potential.

Market Drivers

-

Growing Diabetes Incidence: The pivotal driver, with T2DM driving demand for oral hypoglycemics such as acarbose. Early intervention strategies favor acarbose as a second-line or adjunct therapy due to its efficacy and oral administration.

-

Cost-Effectiveness: Acarbose remains a cost-effective option, particularly in low- and middle-income countries, supporting its widespread adoption.

-

Regulatory Approvals and Generic Availability: The expiration of patents in certain regions has led to an influx of generic versions, reducing costs and increasing accessibility.

-

Patient Compliance and Preference: Oral administration with minimal side effects enhances patient adherence relative to injectable therapies.

Market Challenges

- Limited Efficacy Spectrum: Acarbose primarily targets postprandial glucose, with limited impact on fasting glucose levels, limiting its use as monotherapy in some cases.

- Gastrointestinal Side Effects: Common adverse effects like flatulence and diarrhea reduce tolerability for some patients.

- Competition from New Therapeutics: The advent of newer drugs such as DPP-4 inhibitors, SGLT2 inhibitors, and GLP-1 receptor agonists, which often demonstrate superior glycemic control and additional benefits, constrains acarbose’s market share.

Competitive Landscape

Multiple pharmaceutical entities produce acarbose, with Bayer’s Precose (US), Glucobay (Europe), and various generics leading the market. The proliferation of biosimilars and generics has resulted in significant price erosion, especially in mature markets.

Emerging players focus on combination formulations and improved delivery systems to differentiate products. Some advanced formulations aim to minimize gastrointestinal side effects, potentially extending market viability.

Price Trends and Projections

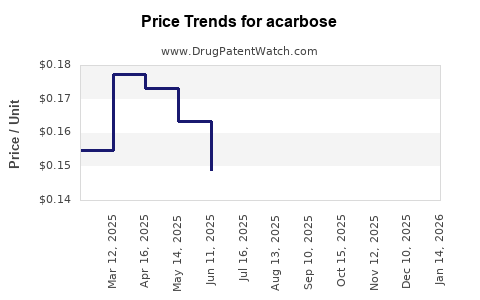

Historical Price Trends

Global acarbose prices have declined notably over the past decade, driven by patent expirations and market competition. In high-income countries, retail prices for branded products have hovered around $2-$4 per 50 mg tablet, whereas generics are often priced below $1 per tablet [2].

Factors Influencing Future Prices

- Patent Status: Patent expirations in key markets are expected to continue exerting downward pressure on prices.

- Generic Market Penetration: Increased availability of generics will sustain price competition.

- Regulatory and Reimbursement Policies: Policies favoring cost-effective treatments will influence pricing strategies and reimbursement levels.

- Market Maturation: As the market matures, average prices are projected to decline further, especially in developed economies.

Forecasted Price Trajectories (2023-2030)

- Developed Markets (e.g., U.S., Europe): Prices are forecasted to decline by approximately 10-15% annually for branded formulations, stabilized further by generic entries. By 2030, average prices per 50 mg tablet may fall to $0.50-$1.00, assuming continued competition and patent expirations.

- Emerging Markets (e.g., India, Southeast Asia): Prices are expected to remain relatively low, possibly around $0.20-$0.50 per tablet, supported by local manufacturing and regulatory policies favoring affordability.

- Impact of New Formulations: Innovative formulations with reduced side effects or combination therapies may command premium pricing initially but will likely face price compression as generics enter the market.

Market Growth Projections

The global acarbose market is projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% from 2023 to 2030, primarily driven by the global diabetes epidemic and expanding healthcare access in emerging economies. The Asia-Pacific region is anticipated to lead this growth, with India and China accounting for substantial market share.

In mature markets, growth will be tempered by market saturation and competitive therapeutics. However, innovations in drug delivery and formulations could stimulate niche markets and extend product life cycles.

Implications for Stakeholders

- Manufacturers: Should prioritize cost-reduction strategies, diversify product pipelines, and invest in innovative formulations to command premium pricing and sustain margins.

- Investors: Opportunities exist in generic manufacturing and emerging markets, but vigilance is needed regarding price erosion trends.

- Healthcare Providers and Payers: Emphasis on cost-effective treatment options will continue, with regulations favoring generics and biosimilars.

Key Takeaways

- The acarbose market remains robust, primarily driven by the expanding global diabetes burden and favorable cost profiles.

- Patent expirations and increasing generic competition will continue to drive prices downward, particularly in developed markets.

- Future price projections suggest a steady decline in per-unit costs, with significant variations between developed and emerging economies.

- Market growth hinges on epidemiological trends, technological innovations, and regulatory policies supporting affordability.

- Strategic positioning via formulation enhancements and cost efficiencies will be vital for stakeholders seeking sustainable profitability.

FAQs

-

What is the current global market size for acarbose?

The global acarbose market is valued at approximately USD 300-400 million in 2022, with projections indicating steady growth aligned with the diabetes prevalence rise.

-

How do patent expirations influence acarbose pricing?

Patent expirations open the market for cheaper generics, leading to significant price declines—up to 50% or more in some instances—particularly in mature markets.

-

Will emerging markets sustain higher acarbose prices?

No; while initial costs may be higher due to limited generic availability, increased local manufacturing and regulatory support typically drive prices downward over time.

-

What are the primary competitive threats to acarbose?

Newer antidiabetic agents offering multifunctional benefits, such as weight reduction and cardiovascular protection, threaten acarbose’s market share.

-

Are there ongoing innovations that could impact acarbose pricing?

Yes; developments in formulations—like reduced gastrointestinal side effects—and combination therapies could prolong market relevance and influence pricing strategies.

References

- International Diabetes Federation. IDF Diabetes Atlas, 10th Edition. 2021.

- MarketWatch. Acarbose market price analysis, 2022.

- GlobalData. Emerging trends in antidiabetic therapeutics, 2022.