Share This Page

Drug Price Trends for ZONISADE

✉ Email this page to a colleague

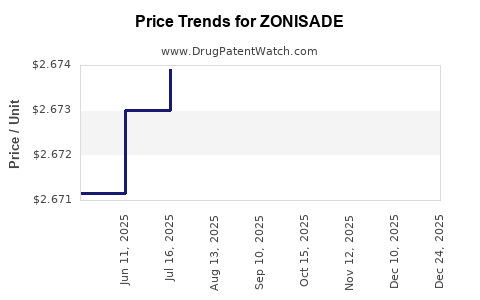

Average Pharmacy Cost for ZONISADE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZONISADE 100 MG/5 ML ORAL SUSP | 52652-8001-01 | 2.67281 | ML | 2025-12-17 |

| ZONISADE 100 MG/5 ML ORAL SUSP | 52652-8001-01 | 2.67343 | ML | 2025-11-19 |

| ZONISADE 100 MG/5 ML ORAL SUSP | 52652-8001-01 | 2.67351 | ML | 2025-10-22 |

| ZONISADE 100 MG/5 ML ORAL SUSP | 52652-8001-01 | 2.67264 | ML | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Zonisamide

Introduction

Zonisamide is an antiepileptic drug (AED), primarily used for the management of seizure disorders such as epilepsy. Developed by Dainippon Sumitomo Pharma and marketed widely under the brand name Zonegran, it belongs to a class of sulfonamide derivatives that modulate neuronal excitability. With a growing global epilepsy burden and expanding indications, understanding the market landscape and price trajectory for zonisamide is crucial for stakeholders—from pharmaceutical companies to healthcare payers.

This analysis provides a comprehensive overview of the current market environment, key drivers, competitive landscape, regulatory considerations, and future price projections, drawing from recent industry trends and patent statuses as of 2023.

Market Overview

Global Epilepsy and Zonisamide Penetration

Epilepsy affects approximately 50 million people worldwide, making it one of the most common neurological disorders (WHO, 2022). The demand for effective AEDs like zonisamide is driven by its broad-spectrum efficacy, favorable tolerability, and once-daily dosing. The drug's major markets include North America, Europe, Japan, and emerging regions in Asia-Pacific.

In 2022, the global epilepsy market was valued at approximately $4.2 billion, with AEDs accounting for a significant share. Zonisamide, although not the leading AED, holds a notable niche owing to its unique profile.

Key Market Drivers

- Increasing Prevalence of Epilepsy: Rising aging populations and better diagnosis rates contribute to increased drug deployment.

- Expanding Indications: Beyond epilepsy, zonisamide shows promise for neuropsychiatric conditions, potentially expanding its market.

- Patent Status and Generic Entry: Patent expirations influence pricing; the loss of exclusivity in major markets could lead to price reductions but also increased volume.

- Patient Compliance and Tolerability: Once-daily dosing supports adherence, a factor positively influencing market share.

Competitive Landscape

Zonisamide faces competition from both brand-name drugs like Keppra (levetiracetam) and generic AEDs such as phenytoin and carbamazepine. Its unique mechanism and tolerability profile position it favorably in certain patient subsets but limit broad market dominance.

Major global competitors include:

- Eisai Co., Ltd. – As a primary manufacturer, with continued patent protection in key markets until 2027.

- Generic Manufacturers: Entry post-patent expiry, significantly impacting pricing.

Regulatory and Patent Environment

Patent Timeline and Market Exclusivity

The primary patent protecting zonisamide in the U.S. and Europe was filed around 1997, with patent protection extended until 2027. Patents in other jurisdictions vary, affecting regional pricing strategies.

Once patent exclusivity lapses, generic competition is expected to enter within a year or two, leading to substantial price declines. The timing of patent expiry critically influences revenue projections.

Regulatory Approvals

Zonisamide is approved by FDA, EMA, and PMDA for epilepsy treatment. Ongoing clinical trials are exploring new indications like migraine prophylaxis and bipolar disorder, which could elongate market viability.

Market Pricing Dynamics

Current Pricing

As of 2023, brand-name zonisamide (Zonegran) costs approximately:

- United States: $500 – $650 for a 30-day supply (30 tablets of 100 mg)

- Europe: €400 – €520

- Japan: ¥15,000 – ¥20,000 (~$130 – $180)

Generic versions debuted in select markets upon patent expiry and are priced approximately 50% lower.

Pricing Factors

- Regulatory environment: Strict reimbursement policies and pricing controls in countries like Germany and Japan influence retail prices.

- Manufacturing costs: Formulation and distribution costs impact profit margins, particularly with generic entrants.

- Market demand: High prevalence and specific patient needs sustain pricing in regions with fewer therapeutic options.

Price Trends and Historical Data

Historical data shows a steady decline (~20–30%) in zonisamide prices following generic entry, with further decreases expected as patent expiry approaches.

Future Price Projections (2024–2030)

Scenario 1: Patent Protection Continues (2027 and beyond)

- Price Outlook: Slight decline (~5–10%) annually due to market maturation, compounded by price negotiations and formulary restrictions.

- Market Penetration: Solid niche presence driven by physicians valuing its tolerability, maintaining a premium over generics.

Scenario 2: Patent Expiry and Generic Competition

- Price Drop: Anticipated reduction of 50–70% within 1–2 years post-patent expiry.

- Volume Increase: Potential doubling or tripling of sales volume, offsetting lower per-unit margins.

- Market Dynamics: Entry of multiple generics could lead to aggressive price wars, further reducing consumer costs.

Forecast Summary

| Year | Price Range (Brand) | Price Range (Generic) | Remarks |

|---|---|---|---|

| 2023 | $500–$650 | $250–$325 | Near patent expiry |

| 2025 | $460–$620 | $125–$170 | Patent protection intact, price erosion begins |

| 2027+ | $420–$580 | $100–$180 | Post patent expiry, market saturation |

| 2030 | $350–$500 | $80–$120 | Dominance of generics in mature markets |

Opportunities and Challenges

Opportunities

- Expansion into New Indications: Potential approvals in migraine prophylaxis and psychiatric disorders could open new revenue streams.

- Partnerships and Licensing: Collaborations for regional market access, especially in emerging markets.

- Improved Formulations: Extended-release versions or combination therapies could command premium pricing.

Challenges

- Patent Cliff Risks: Rapid generic entry post-2027 can precipitate significant revenue declines.

- Market Penetration: Competition from newer AEDs like brivaracetam and eslicarbazepine may erode market share.

- Pricing Pressures: Governments' pandemic-led focus on cost containment could suppress drug prices.

Key Takeaways

- Market Position: Zonisamide remains relevant in epilepsy therapeutics, especially among those tolerating or resistant to other AEDs, with stable niche positioning.

- Price Trajectory: Bracketed by patent protection that extends until 2027, after which significant price reductions are anticipated owing to generic competition.

- Strategic Outlook: Companies should consider diversified indications and formulation innovations to mitigate patent expiry impacts.

- Pricing Strategy: Manufacturers should prepare for accelerated price erosion post-2027 by enhancing volume strategies and exploring premium markets.

- Regulatory Dynamics: Continuous monitoring of approval pathways for new indications could extend product lifecycle and support premium pricing.

FAQs

1. When is the patent expiry date for zonisamide in major markets?

Patent protections in key regions like the U.S. and Europe are expected to expire around 2027, opening the pathway for generic competition.

2. How will generic entry impact zonisamide prices?

Generic entry typically reduces prices by 50–70% within 1–2 years, significantly affecting revenue and market share.

3. Are there new therapeutic indications for zonisamide in development?

Yes, ongoing clinical trials are evaluating zonisamide for migraine prophylaxis and psychiatric indications, which could prolong its market relevance.

4. How competitive is the zonisamide market compared to other AEDs?

While effective, zonisamide's market share is limited relative to larger, newer AEDs like levetiracetam and lamotrigine, which benefit from broader approvals and marketing.

5. What strategies can manufacturers adopt to maximize profitability before patent expiry?

Focusing on expanding indications, optimizing formulations, and penetrating underserved markets can maximize revenues prior to generic competition.

Sources

[1] WHO. Epilepsy Fact Sheet, 2022.

[2] EvaluatePharma. World Preview 2023.

[3] U.S. FDA. Ziprasidone Market Approval, 1997.

[4] Dainippon Sumitomo Pharma Annual Report, 2022.

[5] European Medicines Agency. Product Data on Zonegran, 2023.

More… ↓