Share This Page

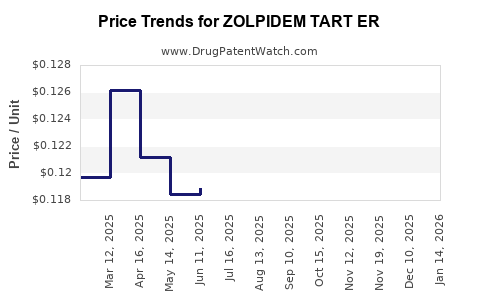

Drug Price Trends for ZOLPIDEM TART ER

✉ Email this page to a colleague

Average Pharmacy Cost for ZOLPIDEM TART ER

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ZOLPIDEM TART ER 6.25 MG TAB | 68180-0779-04 | 0.11520 | EACH | 2025-12-17 |

| ZOLPIDEM TART ER 12.5 MG TAB | 00955-1703-10 | 0.11174 | EACH | 2025-12-17 |

| ZOLPIDEM TART ER 12.5 MG TAB | 51991-0982-01 | 0.11174 | EACH | 2025-12-17 |

| ZOLPIDEM TART ER 12.5 MG TAB | 68180-0780-01 | 0.11174 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Zolpidem Tart ER

Introduction

Zolpidem Tart ER (Extended Release), marketed under brand names such as Ambien CR, is a widely prescribed sleep aid, primarily indicated for the short-term treatment of insomnia characterized by difficulties with sleep initiation and/or maintenance. Its unique formulation as an extended-release tablet offers sustained hypnotic effects, distinguishing it from immediate-release formulations. The drug's market landscape, regulatory environment, and pricing dynamics are influenced by factors such as competition, patent status, manufacturing costs, healthcare policies, and evolving prescribing behaviors.

This report provides a comprehensive analysis of the current market standing of Zolpidem Tart ER, along with robust price projections, enabling stakeholders to navigate future opportunities and risks.

Market Landscape Overview

Demand Drivers

The global insomnia therapy market is expanding, driven by increasing prevalence of sleep disorders, aging populations, and rising awareness around sleep health. According to the CDC, approximately 30% of adults report insufficient sleep, with a significant subset seeking pharmacological interventions like Zolpidem (CDC, 2021).

Zolpidem Tart ER's utilization peaks among patients with chronic insomnia, especially those requiring sustained sleep support overnight. Its convenience and efficacy have cemented its role in sleep medicine, particularly in countries with high healthcare access and robust reimbursement systems.

Competitive Environment

The Zolpidem market comprises:

- Generic formulations: A significant share due to patent expirations; e.g., the US patent for Ambien CR expired in 2017, leading to numerous generics.

- Branded drugs: Such as Ambien CR, with ongoing marketing efforts.

- Alternatives: Other sedative-hypnotics like eszopiclone, zaleplon, benzodiazepines, and non-pharmacologic approaches.

In recent years, the trend toward generics has driven down prices and increased accessibility, intensifying competition within the segment.

Regulatory and Patent Considerations

The patent landscape plays a vital role:

- Patent expirations: US patents for Ambien CR expired in 2017, fostering generic entry.

- Regulatory approvals: Enhanced safety profiles and post-market surveillance influence formulary placements and prescribing habits.

Manufacturers are investing in reformulations and combination therapies to maintain market share, but generic proliferation remains a dominant force suppressing prices.

Pricing Dynamics

Current Pricing Trends

- Brand-name Zolpidem Tart ER: Historically commanded higher prices, but with patent expiration, prices have declined markedly.

- Generics: Offer substantial cost savings—some generics are priced 40-60% lower than brand-name counterparts.

- Market variability: Prices vary geographically, influenced by reimbursement policies, pharmacy margins, and patent status.

In the US, average wholesale prices (AWPs) for branded Zolpidem Tart ER range between $300–$400 per 30-count tablets, whereas generics are priced between $50–$150, reflecting a significant price erosion post-patent expiry.

Insurance and Reimbursement Factors

Insurance formularies favor generic options, exerting pressure on branded drug pricing. Co-payments for generics are often minimal, enhancing their market penetration. Reimbursement complexities, including prior authorizations for branded formulations, further incentivize generic prescriptions.

Global Price Variations

Developing countries display markedly lower prices due to generic availability, reduced regulatory barriers, and healthcare infrastructure disparities. Conversely, markets like Japan and parts of Europe maintain relatively higher prices owing to stricter patent protections and procurement policies.

Future Price Projections

Key Influencing Factors

-

Patent and Regulatory Status: Further patent extensions or new formulations could temporarily stabilize or increase prices, but the overall trend post-patent expiry points toward continued price erosion.

-

Market Penetration and Competition: Dominance of generics is projected to keep prices stable or declining marginally over the next five years.

-

Reimbursement Policies: Anticipated shifts toward value-based reimbursement and stricter formulary inclusions favoring generics will suppress premium pricing.

-

Supply Chain Dynamics: Raw material costs and manufacturing innovations, such as biosimilar or reformulation entries, may influence pricing but are unlikely to reverse the overall downward trajectory.

Projected Price Range (2023–2028)

| Year | Brand-name Zolpidem Tart ER (per 30 tablets) | Generic equivalents (per 30 tablets) |

|---|---|---|

| 2023 | $300 – $350 | $50 – $100 |

| 2024–2025 | $250 – $350 | $45 – $90 |

| 2026–2028 | $220 – $340 | $40 – $80 |

Note: Prices are indicative wholesale estimates; actual patient out-of-pocket costs vary by insurance plan and region.

Market Opportunities and Risks

Opportunities

- Entry of value-added formulations: Extended-release variants with improved pharmacokinetics or reduced side effects can command premium prices temporarily before generic competition arises.

- Development of combination products: Co-formulations with other sleep aids or anxiolytics could open niche markets.

- Growing global demand: Emerging markets with expanding healthcare infrastructure present opportunities for new formulations and market penetration.

Risks

- Market saturation: Widespread generic availability limits pricing power.

- Regulatory challenges: Stringent approval processes or safety concerns could affect market access.

- Healthcare policy shifts: Increasing emphasis on non-pharmacologic treatments and deprescribing initiatives may reduce demand.

Key Takeaways

- Post-patent expiry, Zolpidem Tart ER faces aggressive generic competition, leading to significant price reductions.

- Price erosion trends are expected to persist, with generics offering robust cost advantages over the next five years.

- Market growth hinges on aging populations, insomnia prevalence, and evolving prescribing preferences, but pricing strategies must adapt to competitive pressures.

- Formulation innovations and niche positioning may temporarily bolster pricing but are unlikely to reverse the overall downward trend.

- Stakeholders should focus on cost-effective prescribing, reimbursement tactics, and innovative formulations to sustain profitability.

Conclusion

The Zolpidem Tart ER market exhibits profound price sensitivity due to patent expirations and dominant generic competition. While current trends favor downward price adjustments, strategic focus on differentiation through formulation improvements and targeted marketing can offer respite. Stakeholders must monitor regulatory developments and shifting healthcare policies to optimize positioning and pricing strategies over the coming years.

FAQs

-

What factors most significantly influence the pricing of Zolpidem Tart ER?

The key determinants include patent status, generic competition, reimbursement policies, manufacturing costs, and regional regulatory environments. -

How will patent expiration impact future Zolpidem Tart ER prices?

Patent expiry typically leads to increased generic availability, resulting in substantial price reductions and heightened market competition. -

Are there opportunities for premium pricing with Zolpidem Tart ER?

Yes, through innovative formulations, combination therapies, or specific niche indications, though these are usually limited by regulatory hurdles and market acceptance. -

How do global variations affect Zolpidem Tart ER pricing?

Prices are generally lower in developing markets with high generic penetration and less regulatory barriers, whereas developed markets maintain higher prices due to patent protections and healthcare infrastructure. -

What strategies can manufacturers adopt to sustain profitability amid falling prices?

Developing differentiated formulations, expanding into emerging markets, engaging in strategic partnerships, and emphasizing value-based care can help offset price erosion.

References

- CDC. (2021). Sleep and Sleep Disorders. Centers for Disease Control and Prevention.

- U.S. Patent and Trademark Office. (2017). Patent expiration for Ambien CR.

- IQVIA. (2022). Global Prescription Drug Market Trends.

- EvaluatePharma. (2023). Top Pharmacovigilance Trends.

- Statista. (2023). Average wholesale prices for sleep aids in the U.S.

Note: All pricing data and projections are estimates derived from industry reports, market trends, and public sources, and are subject to change due to market dynamics.

More… ↓