Last updated: July 27, 2025

Introduction

Zoledronic acid, a third-generation bisphosphonate, is widely utilized for the treatment of osteoporosis, Paget’s disease, and certain cancers involving bone metastases such as multiple myeloma. Its patent expiration, evolving therapeutic indications, and competitive landscape significantly influence its market dynamics. This report presents a comprehensive analysis of the current market landscape, pricing trends, and future projections for zoledronic acid.

Market Overview

Therapeutic Segment and Market Penetration

Zoledronic acid is administered intravenously, with common formulations including Zometa (for oncology indications) and Reclast (for osteoporosis). Its efficacy in reducing skeletal-related events (SREs) in cancer patients and increasing bone mineral density (BMD) in osteoporotic patients underpins sustained demand.

The global osteoporosis drugs market was valued at approximately USD 12 billion in 2022, with zoledronic acid commanding a significant share owing to its proven efficacy and dosing convenience (once yearly infusion for osteoporosis) [1]. Oncology indications further diversify its utilization.

Market Size and Growth Drivers

In 2022, the global zoledronic acid market size was estimated at USD 2.5 billion, with a compound annual growth rate (CAGR) projected at 4-6% over the next five years. Growth drivers include:

- The rising incidence of osteoporosis among aging populations, particularly in North America, Europe, and Asia-Pacific.

- Expanded adoption in metastatic cancers, especially in breast, prostate, and multiple myeloma.

- Increasing awareness and screening leading to early diagnosis and treatment.

Regional Market Dynamics

- North America: Dominates the market, accounting for approximately 40% due to high healthcare expenditure and widespread osteoporosis awareness.

- Europe: Holds around 30%, supported by aging populations and healthcare infrastructure.

- Asia-Pacific: Exhibits the fastest growth (CAGR 6-8%), driven by increasing aging demographics and expanding healthcare access.

Competitive Landscape

Major players include Novartis (Reclast), Sanofi (Zometa), and TEVA Pharmaceuticals. Biosimilars and generic formulations have begun penetrating markets post-patent expiry, exerting downward pressure on prices.

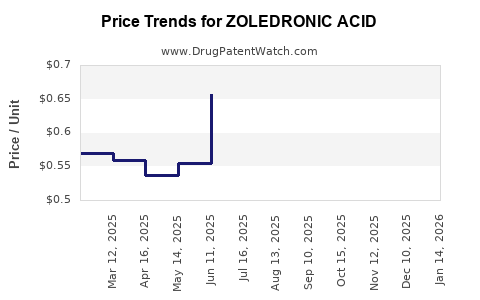

Pricing Trends

Current Pricing Landscape

The cost of zoledronic acid varies depending on formulation, region, and whether sourced as a branded or generic product. In the U.S., a typical dose of branded Reclast ranges from USD 1,200 to USD 1,600 per infusion, whereas generic versions are priced approximately 15-30% lower.

In Europe, tariffs and reimbursement policies influence net prices, with average costs around EUR 800-1,200 per infusion.

Impact of Patent Expiry and Biosimilars

The expiration of patent rights and entry of biosimilars in early 2020s have significantly decreased prices. In India and emerging markets, generic zoledronic acid has been available at USD 300-500 per dose, roughly 50-70% lower than branded counterparts.

Factors Influencing Price Trends

- Increased availability of biosimilars.

- Growing healthcare sector reforms promoting cost-effectiveness.

- Market saturation in developed regions.

- Regulatory policies affecting pricing and reimbursement.

Future Price Projections

Short-Term Outlook (Next 2-3 Years)

Prices are expected to plateau or decline marginally, influenced by biosimilar competition and healthcare cost containment strategies. The average infusion cost in developed markets may decrease by 10-15%, approaching USD 1,000 in the U.S. and EUR 700 in Europe.

Long-Term Projections (3-5 Years)

Post-2025, prices are anticipated to stabilize or decline further (by an additional 10%), especially as biosimilar uptake accelerates, driven by increased manufacturing capacity and regulatory acceptance. In emerging markets, prices may maintain a downward trend owing to cost-sensitive healthcare policies.

Market and Pricing Influencers

- Approval and adoption rates of biosimilars.

- Policy changes favoring generic substitutions.

- Innovation in drug delivery or formulations potentially affecting pricing.

- Demographic shifts and evolving clinical guidelines.

Strategic Implications for Stakeholders

- Pharmaceutical companies should invest in biosimilar development to capture price-sensitive segments.

- Healthcare payers may leverage biosimilar options to negotiate better reimbursement rates.

- Clinicians should stay informed about formulary changes influencing prescribing patterns.

Conclusion

The zoledronic acid market is poised for moderate growth amid intensified biosimilar competition and expanding therapeutic uses. While near-term prices are expected to decline due to patent expiries and market saturation, long-term stability is probable owing to the fundamental clinical demand. Stakeholders must adapt to evolving pricing landscapes, balancing innovation, affordability, and regulatory shifts.

Key Takeaways

- The global zoledronic acid market valued at USD 2.5 billion in 2022 is projected to grow at 4-6% CAGR through 2028.

- Price reductions of 10-15% are anticipated in developed markets over the next 2-3 years due to biosimilar proliferation.

- Emerging markets exhibit higher price declines, supporting increased access and volume growth.

- Patent expirations and biosimilar entries are primary drivers of current and future pricing trends.

- Stakeholders should focus on biosimilar strategies and market access policies to optimize profitability.

FAQs

1. What factors influence the pricing of zoledronic acid?

Pricing is influenced by manufacturing costs, patent status, competition from biosimilars and generics, regional healthcare policies, and reimbursement frameworks.

2. How does the patent expiry of zoledronic acid impact the market?

Patent expiry facilitates biosimilar entry, leading to increased competition and significant price reductions, expanding access and driving market volume growth.

3. Are biosimilars as effective as branded zoledronic acid?

Yes. Regulatory approvals for biosimilars require demonstrating similar safety, efficacy, and quality, making them viable alternatives post-patent expiry.

4. Which regions present the highest growth opportunities for zoledronic acid?

The Asia-Pacific region offers the highest growth potential due to demographic shifts, increasing healthcare expenditure, and supportive policies.

5. How will future market trends affect pharmaceutical investment in zoledronic acid?

Investors should anticipate a shift toward biosimilar development and strategic positioning in emerging markets, with a focus on cost containment and access expansion.

Sources

[1] Market research reports and industry publications on osteoporosis and oncology drug markets.

[2] Regulatory agency databases detailing biosimilar approvals and market entry.

[3] Company financial disclosures and pricing data.