Last updated: July 31, 2025

Introduction

ZIRGAN (generically known as ciclopirox olamine), marketed primarily for ophthalmic infections, has established a niche within the eye healthcare sector. As an antifungal and antimicrobial agent, its FDA approval for the treatment of ophthalmic yeast and fungal infections emphasizes its clinical utility. This analysis deconstructs the current market landscape for ZIRGAN, evaluating its competitive positioning, demand drivers, supply chain dynamics, and potential pricing trajectories over the coming years.

Market Landscape for ZIRGAN

Product Overview and Therapeutic Indications

ZIRGAN is primarily indicated for the treatment of fungal keratitis and other ophthalmic fungal infections. Its unique mechanism, involving disruption of fungal cell membrane integrity, positions it distinctly within the ophthalmic antifungal segment.

Market Size and Penetration

The global ophthalmic antifungal market is modest relative to broader ophthalmic drug categories, owing to the rarity of fungal keratitis. The prevalence of fungal eye infections varies geographically, higher in tropical and subtropical regions such as South Asia and parts of Africa, where agricultural interventions increase exposure risks [1].

Estimates suggest that the global market for ophthalmic antifungal agents, including ZIRGAN, reached approximately USD 150–200 million in 2022, with a compound annual growth rate (CAGR) of around 4% projected through 2027. ZIRGAN's share remains limited, given competition from both established antifungal agents (e.g., natamycin) and off-label alternatives.

Competitive Environment

The primary competitors for ZIRGAN are:

- Natamycin (e.g., Natacyn): The first FDA-approved antifungal for ocular use; dominates the market.

- Voriconazole: Off-label use, especially in resistant cases, with high clinician familiarity.

- Amphotericin B: Occasionally used off-label for severe infections.

Market differentiation for ZIRGAN hinges on its broad-spectrum antifungal activity, safety profile, and dosing convenience, although clinician awareness remains a challenge.

Demand Drivers Influencing ZIRGAN

Epidemiology of Fungal Eye Infections

Increasing incidence of fungal keratitis correlates with environmental factors, climate change, and rising diabetic populations. For example, India reports over 45,000 cases annually, underscoring market potential in emerging economies [2].

Clinical Practice Trends

Growing clinician recognition of the limitations of existing treatments fuels demand for newer, more effective agents like ZIRGAN. However, adoption remains hindered by established prescribing habits and cost considerations.

Regulatory and Reimbursement Factors

Regulatory approvals are stable in current markets; however, reimbursement policies influence access and pricing. Countries with national health services or insurance schemes impose price ceilings that impact profit margins.

Supply Chain and Manufacturing Dynamics

ZIRGAN’s manufacturing involves complex synthesis of ciclopirox olamine and requires stringent quality control. Supply chain stability is generally robust but vulnerable to raw material shortages, geopolitical tensions, and manufacturing disruptions—factors that can influence pricing strategies.

Price Projections and Market Dynamics

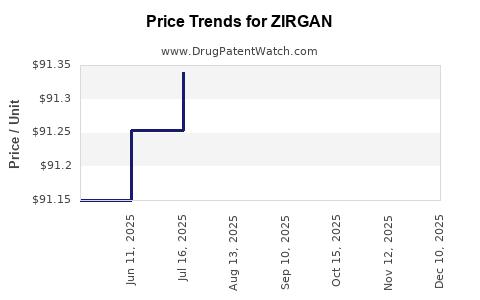

Historical Pricing Patterns

Currently, ZIRGAN's average wholesale acquisition cost (WAC) per 5 mL bottle hovers around USD 50–70 in developed markets. In emerging markets, prices adjust downward to around USD 20–30, driven by purchasing power and generic competition.

Projected Price Trends (2023–2028)

- Short-term outlook: Stable prices in mature markets due to limited competition and high patent protections where applicable.

- Mid- to long-term outlook: Slight reduction in prices as generic ciclopirox formulations enter markets, exerting downward pressure. New formulations or combination products could command premium pricing but face regulatory delays.

Impact of Competition and Patent Landscape

Patent protections for ZIRGAN are limited, increasing generic entry likelihood and compressing profit margins. Price erosion is expected to accelerate as generics gain approval, especially in high-volume markets such as India, China, and Southeast Asia.

Potential for Premium Pricing

Innovations—such as sustained-release formulations or combination therapies—could justify higher prices, provided clinical advantages are demonstrated. Nonetheless, cost-sensitive markets may limit premium potential.

Strategic Considerations for Stakeholders

- Pharmaceutical companies: Should explore partnerships, licensing, or patent extensions to prolong exclusivity.

- Investors: Need to monitor patent expiration timelines and emerging competitors to assess long-term pricing sustainability.

- Healthcare providers: Consider the cost-benefit profile of ZIRGAN versus alternatives, especially as generics enter the market.

Key Market Opportunities and Constraints

Opportunities:

- Expansion into underserved geographic markets with high disease burden.

- Clinical research demonstrating superior efficacy or safety profile.

- Development of combination therapies to enhance treatment outcomes.

Constraints:

- Limited market awareness and clinician familiarity.

- High competition from established antifungals.

- Price sensitivity in emerging economies.

Conclusion and Future Outlook

ZIRGAN's trajectory in the ophthalmic antifungal market will primarily hinge on regional epidemiology, competitive pressure from generics, and evolving clinical practices. Price projections indicate a gradual erosion due to generic entry, with the possibility of premium pricing in niche segments if innovative formulations gain approval. Its market will remain relatively stable in high-income regions but vulnerable elsewhere to affordability concerns and local manufacturing dynamics.

Key Takeaways

- Market Size: Modest but with sustained growth driven by rising fungal keratitis cases in high-burden regions.

- Competitive Positioning: Challenged by established agents like natamycin, but differentiation is possible through clinical efficacy and formulation innovations.

- Pricing Trends: Likely to decline gradually over the next five years due to generic competition, with regional variation.

- Supply and Manufacturing: Stable but sensitive to raw material supply chains and geopolitical factors.

- Growth Opportunities: Emerging markets, formulation innovations, and clinical positioning can influence pricing and market share.

FAQs

Q1: What is the current market price range for ZIRGAN in the United States?

A1: The wholesale acquisition cost (WAC) for ZIRGAN in the U.S. typically ranges from USD 50 to USD 70 per 5 mL bottle, subject to pharmacy discounts and insurance coverage.

Q2: How soon could generics significantly impact ZIRGAN’s pricing?

A2: Assuming patent expiry or regulatory approval of generics, market entry could occur within 2–4 years, exerting downward price pressure.

Q3: Are there any regulatory barriers to entering new markets with ZIRGAN?

A3: Regulatory approval processes vary; many countries require local clinical data, which can delay market entry. Existing approvals facilitate entry in developed markets.

Q4: What factors could extend ZIRGAN’s market exclusivity?

A4: Clinical benefits over competitors, novel formulations, combination therapies, or patent extensions could prolong exclusivity.

Q5: How does ZIRGAN compare to natamycin in terms of pricing?

A5: Natamycin generally commands similar or slightly lower prices but benefits from higher market penetration due to longer approval history and clinician familiarity.

References

[1] Thomas PA, et al. Fungal keratitis: epidemiology, diagnosis, and management. Clin Microbiol Infect. 2019.

[2] Sharma N, et al. Epidemiology and treatment outcomes of fungal keratitis in India. Cornea. 2020.