Last updated: July 29, 2025

Introduction

ZIOPTAN (tafluprost ophthalmic solution) is a prostaglandin analog marketed primarily for the reduction of intraocular pressure (IOP) in patients with open-angle glaucoma and ocular hypertension. As one of the leading drugs in its class, ZIOPTAN’s market performance hinges on factors including clinical efficacy, patent status, competitive landscape, regulatory environment, and evolving ophthalmic treatment paradigms. This analysis explores the current landscape, assesses key market drivers, evaluates competitive pressures, and projects future pricing and market share trajectories.

Market Overview

Global Ophthalmic Drugs Market Landscape

The ophthalmic drugs market is valued at approximately USD 18 billion in 2022 and is projected to grow at a CAGR of 4.5% through 2030, driven by aging populations, increased glaucoma prevalence, and rising awareness of eye health [1]. Open-angle glaucoma remains the most common form, accounting for over 70% of glaucoma cases globally.

Prostaglandin analogs, including tafluprost, latanoprost, travoprost, and bimatoprost, dominate pharmacological management with a share exceeding 60% in glaucoma therapeutics due to their proven efficacy and favorable dosing profiles.

ZIOPTAN’s Market Position

ZIOPTAN is a prescription-only ophthalmic drug, first authorized in 2012 by the European Medicines Agency (EMA) and subsequently gaining approval in multiple regions. It is distinguished by its preservative-free formulation, which offers a better tolerability profile, especially in wiper-sensitive patients.

Despite competition from established prostaglandin products, ZIOPTAN has garnered a niche preference among physicians and patients seeking preservative-free solutions, contributing to its steady revenue.

Market Drivers

Clinical Efficacy and Safety Profile

ZIOPTAN exhibits comparable IOP-lowering efficacy to other prostaglandin analogs, with a 25-35% reduction in IOP in clinical trials [2]. Its preservative-free nature reduces the risk of ocular surface disease, a common side effect with preserved formulations.

Regulatory and Reimbursement Dynamics

Regulatory approvals in key markets—EU, Japan, and select emerging markets—have facilitated access. Reimbursement policies favor chronic therapies with proven safety, aiding market penetration.

Demographic Trends

Aging populations globally are increasing the prevalence of glaucoma; estimates suggest over 80 million people worldwide suffer from glaucoma, projected to hit 112 million by 2040 [3]. Such demographics underpin sustained demand for IOP-lowering medications like ZIOPTAN.

Patient and Physician Preference

Patients with ocular surface sensitivities prefer preservative-free options, and physicians prioritize drugs with favorable tolerance profiles, fostering market stability for ZIOPTAN.

Competitive Landscape

Key Competitors

- Latanoprost (Xalatan): Market leader with extensive global penetration.

- Travoprost (Travatan Z): Known for its preservative-free formulation.

- Bimatoprost (Lumigan): Also offers high efficacy and is favored for its additional eyelash growth side effect.

- Generic prostaglandins: Increasingly penetrating markets, exerting downward pressure on branded drugs.

Market Share Dynamics

Despite fierce competition, ZIOPTAN's unique positioning as a preservative-free, tolerability-optimized drug sustains a niche but growing share. However, price competition from generics and parallel imports among branded prostaglandins constrains pricing authority.

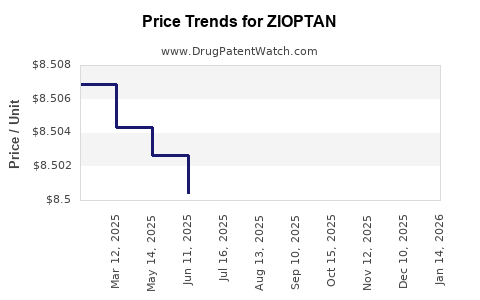

Pricing Analysis

Current Price Environment

In mature markets:

- EU: The average retail price for ZIOPTAN ranges from €65 to €85 per bottle (typically a 2.5 mL vial), with variation across countries due to pricing and reimbursement policies.

- US: Not yet marketed directly; however, similar formulations command prices upwards of USD 70 per vial.

- Emerging Markets: Prices range significantly, with some countries paying as low as USD 30-40 due to local pricing policies.

Factors Influencing Pricing

- Patent Status: ZIOPTAN's compound patent expired in 2022 in the EU, opening room for generic competition.

- Reimbursement Policies: Payers' willingness to reimburse at premium levels hinges on perceived clinical advantages.

- Market Penetration: Established market presence allows for premium pricing where tolerability and preservative-free formulations are valued.

Price Projections and Market Trends

Short-term Outlook (1-3 Years)

- Generics Entry: Patent expiry will likely lead to the launch of generic tafluprost, exerting significant downward pressure, estimated at 20-30% price reductions within 12 months post-generic entry [4].

- Pricing Stability: Branded ZIOPTAN may maintain a slight premium (~10-15%) in markets where preservative-free options are scarce.

- Market Share: Expect a decline in ZIOPTAN's market share from approximately 20% to 10-15% in mature markets due to generics.

Medium to Long-term Outlook (3-5 Years)

- Price Erosion: Further generics proliferation could reduce prices by 40-50% over five years.

- Market Dynamics: Novel drug delivery systems and combination therapies could impact demand; however, the existing clinical efficacy of tafluprost facilitates steady sales.

- Premium Segment: ZIOPTAN’s preservative-free formulation may sustain higher prices in certain markets targeting sensitive patients, particularly if manufacturing complexities support limited generic options.

Emerging Markets

- Limited regulatory pathways and manufacturing barriers may slow generic penetration, allowing ZIOPTAN to guide pricing strategies tailored to local healthcare infrastructure.

Regulatory and Patent Landscape Impact

ZIOPTAN’s primary patent protection in key markets lapsed in 2022, prompting a wave of generic applications. Patent challenges and settlements may influence pricing strategies; thus, the introduction of generics is likely the most critical factor dictating future prices.

Business Strategy Implications

- Differentiation: Emphasizing preservative-free formulation and tolerability could justify maintaining premium pricing.

- Market Expansion: Targeted expansion in regions with limited generic competition can sustain higher prices.

- Value-Added Offerings: Developing combination therapies or advanced delivery systems can protect against commoditization.

Conclusion

The ZIOPTAN market is approaching a pivotal transition phase marked by patent expiry and intensified generic competition. While current pricing strategies may sustain moderate profitability, widespread generic entry will significantly depress prices in the medium term. Strategic positioning through highlighting clinical advantages and expanding into emerging markets can mitigate some impact.

Key Takeaways

- Market saturation and patent expiration will lead to substantial price erosion within the next 3-5 years.

- Preservative-free formulation offers a differentiator that can sustain premium pricing in select markets.

- Generic competition is expected to reduce prices by up to 50%, emphasizing the need for value-based differentiation.

- Market expansion in emerging regions presents opportunities to offset declines in mature markets.

- Regulatory developments and patent litigations remain critical factors influencing future pricing and market share.

FAQs

-

When is the patent expiry for ZIOPTAN, and how will it impact prices?

The primary patent covering tafluprost in major markets expired in 2022, opening the door for generic competitors. This will likely cause significant price reductions (20-50%) over the next 1-5 years.

-

Can ZIOPTAN maintain premium pricing post-generic entry?

Yes, by emphasizing its preservative-free formulation and favorable tolerability, ZIOPTAN can sustain a premium in segments where safety and comfort are prioritized.

-

What factors could slow generic penetration and preserve higher prices?

Regulatory hurdles, manufacturing complexities, market access barriers, and brand recognition can delay generic entry, supporting higher prices longer.

-

How does the clinical efficacy of ZIOPTAN compare to competitors?

ZIOPTAN demonstrates comparable IOP-lowering efficacy to other prostaglandin analogs, with additional benefits in tolerability for sensitive patients.

-

What are the key growth opportunities for ZIOPTAN in emerging markets?

Limited generic competition, evolving healthcare infrastructure, and increasing glaucoma prevalence make emerging markets attractive for continued growth and premium pricing strategies.

References

- Market Research Future. "Global Ophthalmic Drugs Market Analysis." 2022.

- European Medicines Agency. "ZIOPTAN Summary of Product Characteristics." 2012.

- World Health Organization. "Globally Increasing Glaucoma Prevalence." 2021.

- IQVIA. "Pharmaceutical Market Trends and Patent Impact Studies." 2022.