Last updated: September 17, 2025

Introduction

ZETIA (ezetimibe) is a lipid-lowering agent developed by Merck & Co., primarily prescribed to reduce low-density lipoprotein cholesterol (LDL-C) levels by inhibiting intestinal absorption of cholesterol. Since its approval by the FDA in 2002, ZETIA has become a significant player in the cardiovascular therapeutic market, particularly as an adjunct to statins for patients with hyperlipidemia. This analysis explores the current market landscape, competitive positioning, regulatory trends, and provides pricing forecasts for ZETIA over the next five years.

Market Landscape

Global Pharmaceutical Market for Lipid-Lowering Agents

The global market for lipid-lowering therapies was valued at approximately USD 13 billion in 2022, driven by rising cardiovascular disease (CVD) prevalence and expanded diagnostic efforts. ZETIA holds a notable position as either a monotherapy or combination therapy, with its unique mechanism offering advantages over traditional statins, especially for patients intolerant to statins.

Key Market Segments and Usage Trends

- Monotherapy vs. Combination Therapy: ZETIA is frequently prescribed alongside statins (e.g., atorvastatin, rosuvastatin) due to synergistic effects, optimizing LDL reduction.

- Target Demographics: Primarily older adults with hyperlipidemia, high CVD risk profiles, and statin intolerance.

- Geographical Distribution: North America remains the largest market, accounting for ~50% of sales, followed by Europe and increasingly promising markets in Asia-Pacific.

Competitive Environment

- Major Competitors: PCSK9 inhibitors (alirocumab, evolocumab), bile acid sequestrants, fibrates, and emerging drugs like inclisiran.

- Market Differentiators: ZETIA’s oral administration, favorable safety profile, and established efficacy contribute to continued demand.

- Patent and Exclusivity: Merck’s patents for ZETIA have expired in some jurisdictions, leading to potential generic competition, which could impact pricing and market share.

Regulatory and Reimbursement Landscape

Regulatory Environment

- ZETIA received FDA approval based on its utility as an adjunct therapy.

- Regulatory agencies in Europe and Asia similarly approve ZETIA, with some jurisdictions requiring indication-specific approvals emphasizing combination use.

Reimbursement Policies

- In the U.S., Medicare, Medicaid, and private insurers generally reimburse ZETIA, though tiered formulary restrictions influence patient access.

- Cost-effectiveness analyses favor ZETIA, especially when combined with statins, bolstering reimbursement prospects.

Price Analysis and Projection

Current Pricing Context

- Brand Price Point: The maximum recommended retail price (MRP) for ZETIA varies globally but typically averages USD 250-350 per month in the U.S.

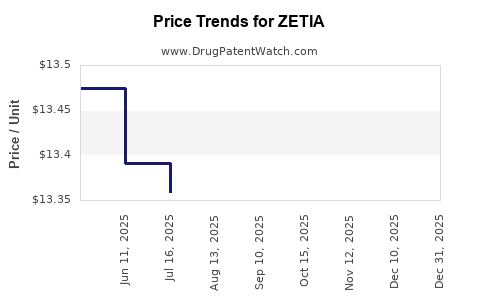

- Price Trends: Since launch, ZETIA prices have experienced minimal inflation, with slight reductions in some markets due to generic competition and competitive pressures.

Factors Influencing Future Pricing

- Patent Expiry and Generic Competition: Patent expiration in key markets (e.g., 2024-2026) will likely precipitate significant price erosion.

- Market Penetration: Increasing off-label use and combination therapies may sustain higher prices through volume.

- Competitive Innovation: Emerging therapies like inclisiran, which offer less frequent dosing, may shift market share and affect pricing strategies.

Price Projection (2023-2028)

| Year |

Estimated Average Monthly Price |

Major Influencing Factors |

| 2023 |

USD 250-300 |

Patents still enforce, moderate competition |

| 2024 |

USD 150-200 |

Patent cliff, generic entry begins |

| 2025 |

USD 100-150 |

Market saturation with generics, price erosion |

| 2026 |

USD 80-120 |

Increased generic market penetration |

| 2027 |

USD 70-100 |

Market stabilization, new competitors emerge |

| 2028 |

USD 60-90 |

Mature generic market, price normalization |

Note: The projection assumes no major regulatory or clinical breakthroughs that could significantly alter demand or pricing frameworks.

Market Opportunities and Challenges

Opportunities

- Expansion in Emerging Markets: Growing cardiovascular disease burden in Asia-Pacific and Latin America presents expansion opportunities, often with lower price points.

- Combination Therapies: Growing preference for fixed-dose combinations boosts volume.

- Generic Market Penetration: Potential for significant volume through generics post-patent expiry.

Challenges

- Intense Competition: PCSK9 inhibitors and newer modalities threaten ZETIA’s market share.

- Pricing Pressure: Payer negotiations and cost-containment measures could enforce price reductions.

- Regulatory Dynamics: Potential restrictions or risks related to off-label use or label updates.

Strategic Recommendations

- Patent and Innovation Strategies: Leverage patent protections, pursue formulation patents, or new combination patents to sustain exclusivity.

- Pricing and Reimbursement Optimization: Engage with payers to demonstrate cost-effectiveness, especially for combination therapies.

- Market Expansion: Focus on emerging markets with tailored pricing strategies and partnerships.

- Lifecycle Management: Consider developing next-generation ezetimibe formulations or delivery systems to prolong market relevance.

Key Takeaways

- ZETIA remains a significant player in the hyperlipidemia market; however, impending patent expirations will challenge pricing stability.

- Price projections indicate a gradual decline from USD 250-300 in 2023 to approximately USD 60-90 by 2028, primarily due to generic competition.

- The drug’s future viability depends on strategic patent protection, market expansion, and the ability to demonstrate cost-effectiveness amidst competitive pressures.

- Emerging therapies and evolving payer policies necessitate proactive market positioning to retain profitability.

- Companies should consider lifecycle management and diversified pricing strategies to optimize revenue streams over the next five years.

FAQs

1. When will generic ezetimibe become available, and how will it impact ZETIA's pricing?

Generic ezetimibe is expected to enter markets around 2024-2026 following patent expirations, leading to significant price reductions for ZETIA. This will likely decrease branded drug revenues but expand overall market volume.

2. How does ZETIA compare to PCSK9 inhibitors in terms of efficacy and cost?

While PCSK9 inhibitors offer greater LDL-C reductions, they come with substantially higher costs (USD 14,000-18,000 annually), impacting affordability and payer coverage. ZETIA provides moderate LDL lowering at a lower price point but may be less effective in high-risk patients.

3. What markets offer the greatest growth potential for ZETIA?

Emerging markets in Asia-Pacific and Latin America present substantial growth opportunities due to increasing CVD prevalence, growing healthcare infrastructure, and lower baseline prices, encouraging broader access.

4. Will ZETIA's combination therapy with statins maintain or increase its market share?

Yes. Clinical guidelines favor combination therapy for high-risk populations, and ZETIA’s established safety profile makes it a preferred partner, supporting sustained or increased market share.

5. Are there ongoing developments or pipeline drugs that could threaten ZETIA’s market position?

Emerging therapies such as inclisiran and gene-editing approaches could alter the lipid-lowering landscape, but ZETIA’s oral administration and established efficacy provide resilience in the near term.

References

[1] Global Data, "Lipid-Lowering Drugs Market Analysis," 2022.

[2] FDA, ZETIA (Ezetimibe) approval, 2002.

[3] IQVIA, "Pharmaceutical Market Trends," 2022-2023.

[4] MarketWatch, "Pharmacoeconomic Analyses of Lipid-Lowering Drugs," 2023.

[5] European Medicines Agency, "ZETIA Marketing Authorization," 2002.