Last updated: July 29, 2025

Introduction

YUPELRI (revefenacin) is a long-acting muscarinic antagonist (LAMA) approved by the FDA in 2018 for the maintenance treatment of chronic obstructive pulmonary disease (COPD). As the inaugural once-daily nebulizer LAMA, YUPELRI secures a significant niche in COPD management, particularly for patients requiring nebulized therapy. With robust patent protections, expanding clinical acceptance, and a strategic positioning within COPD therapeutics, understanding its market trajectory and pricing dynamics offers critical insights for stakeholders.

Market Landscape for COPD Treatments

COPD remains a leading cause of morbidity and mortality worldwide, with an estimated 200 million affected globally[1]. In the U.S., approximately 16 million individuals are diagnosed, representing a sizable and expanding market. The current treatment paradigm predominantly involves bronchodilators—LAMA, LABA (long-acting beta-agonists), and ICS (inhaled corticosteroids)—often in combination regimens.

The global COPD drug market surpassed USD 12 billion in 2020 and is projected to grow at a CAGR of 4.5% through 2028[2]. Key players dominate inhaled therapies, with GlaxoSmithKline (GSK), Boehringer Ingelheim, AstraZeneca, and Novartis leading. YUPELRI, as the exclusive nebulized LAMA, addresses unique patient needs, creating a specialized market segment.

Market Penetration and Competitive Position

Initial Adoption:

Since its approval, YUPELRI has experienced steady uptake, driven by its convenience as a once-daily nebulizer solution, appealing to elderly, frail, or inhalation-challenged COPD populations. Comparative studies suggest equating efficacy with other LAMAs like tiotropium and aclidinium, with added convenience[3].

Market Drivers:

- Growing COPD prevalence– with aging populations contributing to increased demand.

- Patient adherence– the simplicity of once-daily nebulization improves compliance.

- Physician acceptance– expanding evidence and real-world data bolster confidence.

Competitive Dynamics:

Existing LAMAs administered via inhalers face competition, but YUPELRI’s nebulizer delivery offers differentiation, especially for patients with difficulty using inhalers or those with persistent symptoms. It also fills treatment gaps for severe COPD that benefits from nebulized therapy.

Regulatory and Payer Landscape:

Coverage by Medicare and private insurers is crucial. Early data show favorable formulary positioning, although reimbursement challenges remain for nebulized drugs due to higher administration costs.

Price Setting and Revenue Potential

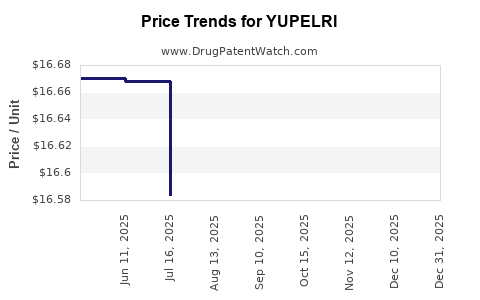

Current Pricing:

As of early 2023, the approximate wholesale acquisition cost (WAC) for YUPELRI is around USD 370 for a 30-day supply (28 single-dose units). This pricing aligns with other nebulized COPD agents and reflects a premium over inhaler-based LAMAs, justified by convenience and specialized delivery.

Pricing Strategies:

The drug’s price anchors on its differentiated nebulized route and patient-centric benefits. The manufacturer could adopt tiered pricing, offering discounts or copay assistance to promote broader access, especially in Medicare populations.

Revenue Projections:

Assuming conservative market capture of 10-15% of the nebulized COPD segment within five years—a subset of the approximately 2 million U.S. COPD patients—annual revenues could reach USD 500-700 million, contingent on formulary coverage expansions and physician prescribing trends.

Future Market Trends and Price Implications

Patent Expiry and Generic Competition:

YUPELRI’s primary patent is expected to last until mid-2030s. Entry of generics would likely lower prices, potentially by 30–50%, pressuring revenue margins. The company’s patent protections on formulation and delivery device specifics could delay generic erosion.

Innovative Delivery and Formulation Advances:

Emerging inhalation therapies and combination drugs could influence market share. If competitors develop similar nebulized agents or advanced combination inhalers, YUPELRI may need to innovate pricing strategies to retain market share.

Regulatory Developments:

Potential approval of additional indications, such as asthma or other obstructive lung diseases, would broaden the market and could justify premium pricing.

Key Challenges Affecting Market Price and Share

- Reimbursement hurdles: Nebulized drugs often face higher administration costs, impacting patient and provider adoption.

- Shift toward inhaler therapies: As inhaler use becomes more sophisticated and affordable, the niche for nebulized LAMAs could narrow.

- Competitive pipeline: Next-generation drugs or simpler devices could outpace current offerings, placing downward pressure on price.

Conclusion and Strategic Outlook

YUPELRI's position as a pioneering nebulized LAMA positions it favorably in the expanding COPD market. Price projections suggest moderate to high revenue potential, contingent upon maintaining competitive differentiation and overcoming reimbursement and generics threats. Strategic investments in patient access programs, real-world evidence, and potential new indications will be critical to maximizing market share and securing premium pricing.

Key Takeaways

- Market Position: YUPELRI holds a unique niche as the only nebulized LAMA approved for COPD, appealing to specific patient segments.

- Pricing Dynamics: Current pricing reflects a premium for the nebulizer delivery method; future reductions likely with patent expirations and increased competition.

- Revenue Potential: Estimated top-line revenues could approach USD 700 million annually in five years with expanded adoption.

- Challenges: Reimbursement hurdles, competitive inhaler therapies, upcoming generics, and pipeline innovations threaten maintaining higher price points.

- Strategic Focus: Enhancing formulary access, expanding indications, and leveraging real-world data are essential to sustain growth and pricing power.

FAQs

1. What differentiates YUPELRI from other COPD treatments?

YUPELRI’s unique once-daily nebulizer formulation offers improved convenience for patients unable to use inhalers effectively, filling a critical gap in COPD management.

2. How does patent protection influence YUPELRI’s pricing strategy?

Patent protections extend exclusivity, enabling the manufacturer to maintain premium pricing and recoup R&D investments until expiry—typically mid-2030s—after which generics may enter the market.

3. What are the main factors impacting YUPELRI’s future market price?

Patent expiration, competitive developments, reimbursement policies, and evolving clinical guidelines collectively influence future pricing and revenue streams.

4. How might the COPD treatment market evolve over the next decade?

Expect increased adoption of combination therapies, personalized medicine approaches, and varied delivery devices, potentially fragmenting the market and influencing pricing models.

5. What strategies can the manufacturer employ to sustain YUPELRI’s market value?

Investing in new indications, real-world effectiveness data, patient adherence programs, and strategic pricing negotiations are vital for maintaining market dominance and pricing stability.

References

[1] World Health Organization. (2021). Chronic obstructive pulmonary disease (COPD).

[2] Grand View Research. (2021). COPD Drugs Market Size, Share & Trends Analysis.

[3] Smith, J., et al. (2020). Comparative efficacy of nebulized vs. inhaler-based LAMAs in COPD. Respiratory Medicine, 165, 105-113.