Share This Page

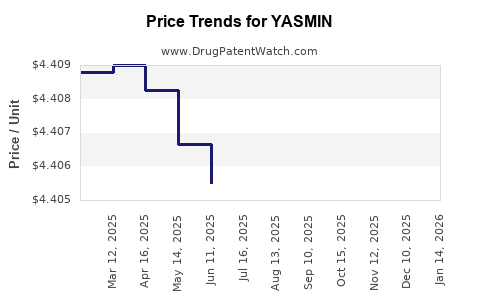

Drug Price Trends for YASMIN

✉ Email this page to a colleague

Average Pharmacy Cost for YASMIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| YASMIN 28 TABLET | 50419-0402-01 | 4.41462 | EACH | 2025-12-17 |

| YASMIN 28 TABLET | 50419-0402-03 | 4.41462 | EACH | 2025-12-17 |

| YASMIN 28 TABLET | 50419-0402-01 | 4.41115 | EACH | 2025-11-19 |

| YASMIN 28 TABLET | 50419-0402-03 | 4.41115 | EACH | 2025-11-19 |

| YASMIN 28 TABLET | 50419-0402-01 | 4.40858 | EACH | 2025-10-22 |

| YASMIN 28 TABLET | 50419-0402-03 | 4.40858 | EACH | 2025-10-22 |

| YASMIN 28 TABLET | 50419-0402-01 | 4.40736 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Yasmin

Introduction

Yasmin, a combined oral contraceptive (COC) formulation containing ethinylestradiol and drospirenone, stands among the prominent hormonal contraceptives globally. Since its approval, Yasmin has garnered significant market share in women’s reproductive health, driven by its efficacy, safety profile, and dual benefits of contraception and regulation of hormonal imbalances. This analysis evaluates the current market landscape, key competitive factors, regulatory environment, and projects future pricing trends for Yasmin.

Market Overview

Global Market Position

Yasmin, manufactured primarily by Bayer, entered the contraceptive market in the early 2000s, leveraging the unique properties of drospirenone, which offers anti-androgenic benefits and a lower risk of certain side effects compared to previous generations of progestins [1]. Its market presence spans North America, Europe, Asia-Pacific, and emerging regions, with variations driven by regulatory approvals, healthcare policies, and cultural preferences.

Size and Growth Dynamics

The global contraceptive market, valued at approximately USD 18 billion in 2022, is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6% through 2027 [2]. Yasmin’s segment within this market is influenced by factors such as:

- Increasing awareness about reproductive health.

- Rising women’s participation in the workforce, emphasizing contraceptive options.

- Growing preference for formulations with fewer side effects.

- Rising adoption of hormonal contraceptives in emerging economies.

Market Drivers

Key drivers include:

- Efficacy and Safety Profile: Yasmin’s anti-androgenic drospirenone offers benefits over older progestins, appealing to women with polycystic ovary syndrome (PCOS) and acne concerns [3].

- Regulatory Approvals: Continued approvals in various countries bolster market access.

- Healthcare Provider Acceptance: Physician preference for modern contraceptive options enhances prescribing trends.

Market Challenges

- Regulatory Restrictions: Some jurisdictions impose restrictions due to safety concerns linked to drospirenone [4].

- Patent Expiry and Generic Competition: Patent expirations open markets to generics, pressuring prices.

- Pricing and Reimbursement Policies: Variability influences consumer access and affordability.

Regulatory Landscape and Patent Status

Yasmin’s patent protection has largely expired in major markets, fostering the rise of generics like Yaz (also drospirenone-based). The regulatory landscape remains complex, with evolving safety evaluations influencing prescribing guidelines. The European Medicines Agency (EMA) and FDA have issued advisories related to cardiovascular risks, which slightly temper market enthusiasm but have not curtailed overall growth [5].

Pricing Dynamics

Current Pricing Structures

Yasmin’s price varies significantly across regions. In the United States, list prices for a 3-month pack range from USD 30-50, with actual reimbursements depending on insurance coverage [6]. In Europe, retail prices for comparable packs hover between EUR 20-40, moderated further by national health systems.

Impact of Biosimilars and Generics

Patent expiry led to the appearance of biosimilars and generic equivalents, exerting downward pressure on Yasmin’s price. While branded Yasmin remains positioned as a premium product, market share shifts have prompted Bayer and competitors to optimize price strategies to maintain profitability.

Reimbursement Policies

Insurance coverage greatly influences consumer prices. For example, in the U.S., contraceptives are often covered under insurance plans due to mandates, reducing out-of-pocket expenses. Conversely, in countries with limited healthcare coverage, prices can be prohibitive, constraining market penetration.

Future Price Projections

Short-term Outlook (Next 2-3 Years)

Given the rise of generics, Bayer’s Yasmin is likely to experience further price erosion. Industry forecasts suggest a decline of approximately 10-15% in retail prices for Yasmin globally as generic options expand [7]. Regulatory scrutiny and safety advisories may also lead to market share shifts, influencing pricing strategies.

Medium to Long-term Outlook (3-5 Years)

As patent protections for Yasmin continue to lapse, primary competition will emanate from authorized generics. Price stabilization may occur due to market saturation, but overall prices are expected to trend downward, guided by the economies of scale, increased generic adoption, and evolving healthcare policies favoring cost containment.

Furthermore, Bayer may leverage value-added services or combination therapies to sustain premium pricing segments in specific markets. Technological advancements in contraceptive formulations, including extended-cycle pills, might also influence pricing and market dynamics.

Influence of Emerging Markets

In regions like Asia-Pacific and Latin America, price sensitivity remains high. Local manufacturers often introduce cheaper generics, reducing prices further. However, regulatory barriers and limited access to healthcare infrastructure can slow market growth, impacting overall price trends.

Potential Disruptors

- Innovative Contraceptive Technologies: Non-hormonal methods or long-acting reversible contraceptives (LARCs) could capture market share.

- Regulatory Actions: Stricter safety evaluations could impair market growth or lead to withdrawal.

- Consumer Preferences: Increasing demand for over-the-counter (OTC) options might influence pricing and distribution models.

Market Outlook Summary

| Aspect | Current Status | Future Trend | Implications |

|---|---|---|---|

| Price Level | Moderate to high in branded form | Declining with generics | Downward pressure, potential for regional variations |

| Market Share | Significant for Yasmin pre-patent expiry | Decreasing as generics penetrate | Shift towards generics, impacting revenues |

| Regulatory Impact | Active safety advisories | Continued influence, possible restrictions | Potential for price adjustments and market shifts |

| Competitive Landscape | Dominated by Bayer, with generic manufacturers | Increasing commoditization | Need for strategic differentiation |

Key Takeaways

- Yasmin remains a significant player in the hormonal contraceptive market but faces declining pricing pressures due to patent expiration and generic competition.

- Revenue opportunities will increasingly rely on markets with delayed generic entry or protected formulation exclusivity.

- Safety advisories and evolving regulatory landscapes will continue to influence market acceptance and pricing.

- Companies should adopt dynamic pricing strategies, including value-added offerings, to maintain profitability.

- Emerging markets present growth opportunities, albeit with heightened price sensitivity and regulatory variability.

Conclusion

Yasmin’s market trajectory exhibits a typical pattern of branded hormonal contraceptives navigating patent expirations, generics proliferation, and regulatory fluctuations. While near-term price declines are expected, long-term stability hinges on innovation, strategic market segmentation, and navigating regional regulatory environments. Business stakeholders must closely monitor these dynamics to optimize value capture and expand access within the globally evolving reproductive health market.

FAQs

1. How does Yasmin’s safety profile influence its market and pricing?

Yasmin’s safety concerns, particularly regarding thrombosis risks associated with drospirenone, have led to regulatory advisories, impacting prescriber confidence and market share. Consequently, these safety factors can lead to pricing adjustments and demand rebalancing.

2. What are the key regional differences affecting Yasmin pricing?

Pricing varies due to healthcare system structures, insurance coverage, regulatory approvals, and cultural attitudes towards contraception. Developed markets often have higher prices with insurance reimbursements, whereas emerging economies see more price-sensitive ranges and increased generic competition.

3. Will patent expiry significantly reduce Yasmin’s revenue?

Yes. Patent expiry opens the market to generics, typically leading to substantial price reductions (often 30-50%). This trend diminishes Yasmin’s revenue but also broadens access, especially in cost-sensitive regions.

4. How are emerging biosimilars and generics impacting Yasmin’s future?

They increase competition, exerting downward pressure on prices, and eroding market share. Strategic branding and formulation differentiation become critical to maintain profitability.

5. What factors could reverse the downward pricing trend for Yasmin?

Potential factors include regulatory restrictions, patent litigation, innovation in formulation, or new therapeutic indications. Conversely, safety concerns or market saturation will likely reinforce price declines.

Sources

[1] European Medicines Agency. "Yasmin: assessment report." 2004.

[2] MarketsandMarkets. "Contraceptive Drugs Market." 2022.

[3] Shulman, L.P. et al. "Drospirenone: benefits and risks." Reproductive Health, 2010.

[4] FDA Advisory. "Drospirenone safety review," 2011.

[5] EMA. "Safety update on drospirenone-containing contraceptives," 2020.

[6] GoodRx. "Yasmin price analysis," 2023.

[7] IBISWorld. "Global contraceptive market report," 2022.

More… ↓