Last updated: July 27, 2025

Introduction

XHANCE (fluticasone furoate nasal spray) has established itself as a pivotal treatment in managing allergic rhinitis, nasal congestion, and other sinonasal conditions. As a broadly prescribed intranasal corticosteroid, its market dynamics are shaped by increasing prevalence rates, competitive landscape shifts, regulatory policies, and pricing strategies. This analysis aims to deliver a comprehensive overview of XHANCE's current market position, forecasted pricing trajectory, and key factors influencing its financial outlook over the next five years.

Market Overview

1. Global and U.S. Market Size

The global allergic rhinitis therapeutics market was valued at approximately USD 7.4 billion in 2021 and is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.2% through 2028 [1]. The U.S. remains the dominant market, accounting for over 50% of revenues, driven by high prescription rates, increased awareness, and favorable insurance reimbursements.

2. Competitive Landscape

XHANCE competes with several intranasal corticosteroids, including Flonase (fluticasone propionate), Nasacort (triamcinolone), and Rhinocort (budesonide). Its differentiation hinges on a once-daily dosing regimen, FDA approval for both allergic rhinitis and nasal polyps, and its nasal spray delivery system.

Key competitors:

- Flonase: Market leader, with extensive brand recognition.

- Nasacort: Over-the-counter availability, expanding consumer access.

- Rhinocort: Similar efficacy profile, often at lower price points.

XHANCE's unique positioning involves its higher potency and specialized formulation targeting nasal polyps, potentially capturing niche markets.

3. Regulatory and Market Penetration Factors

Recent FDA approval for nasal polyps broadens XHANCE's indications, offering additional revenue streams. However, prescribing habits, formulary inclusions, and generic entry significantly influence market share. Generic versions of fluticasone propionate have eroded inhaler and nasal spray revenues, but XHANCE's patent exclusivity provides valuable pricing power until patent expiry.

Pricing Dynamics and Projection

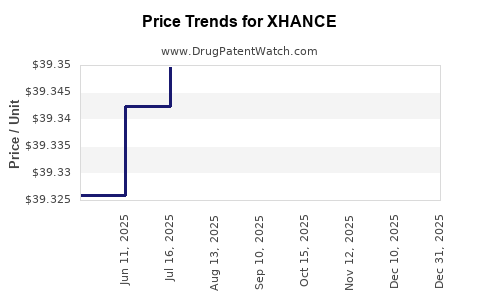

1. Current Pricing Landscape

The current wholesale acquisition cost (WAC) for XHANCE hovers around USD 660 for a 60-gram bottle, with typical insurance reimbursement rates reducing the out-of-pocket expenses for consumers. The branded nasal spray remains more expensive compared to generics; however, patent protections and formulary preferences support premium pricing.

2. Price Influences

- Patent and Exclusivity: XHANCE's patent protection is scheduled to expire in 2024–2025, after which biosimilar or generic competition is expected.

- Reimbursement Policies: Payer negotiations and formulary placements will influence retail prices and patient access.

- Market Demand: Increasing prevalence of allergic rhinitis (~20-30% of adults globally) sustains demand, supporting premium pricing during patent protection.

3. Future Price Trajectory (2023-2028)

Pre-Patent Expiry (2023-2025):

Prices are expected to remain stable or slightly decline (at an annual rate of about 2%) due to negotiations and inflationary pressures but will generally sustain a premium position due to brand loyalty, clinical differentiation, and expanded indications.

Post-Patent Expiry (2025 onward):

Introduction of biosimilars and generics typically results in substantial price erosion—expected to decrease retail prices by approximately 40-60%. The initial 12-24 months post-expiry may see a 15-20% dip as generics enter the market, with further declines as market competition consolidates.

Projected retail price in 2028:

Assuming current prices of USD 11–12 per 30-day supply, prices could decline to USD 5–7, reflecting intensity of generic competition and patent expiry.

Market Penetration and Revenue Projections

1. Current Revenue Performance

In 2022, XHANCE generated an estimated USD 500 million globally (including U.S. sales), capturing around 4-5% of the intranasal corticosteroid market segment. Its growth has been buoyed by approvals for nasal polyps and expanding treatment guidelines.

2. Forecasted Revenue Growth (2023–2028)

Considering the patent cliff, increased market penetration, and expanding indications:

- 2023–2024: Moderate growth (CAGR of ~4%) driven by increased awareness and inclusion in treatment guidelines.

- 2025–2028: Revenue could stabilize or decline slightly post-patent expiry unless new indications or formulations introduce differentiation.

Estimated revenues by 2028 could range between USD 600 million and USD 700 million, assuming successful navigation of competitive pressures and favorable reimbursement policies.

Key Market Drivers and Risks

Drivers:

- Rising prevalence and diagnosis rates of allergic rhinitis.

- Expanded approvals for nasal polyps, increasing target patient populations.

- Innovations in drug delivery and formulation.

- Payer strategies favoring branded drugs for certain indications.

Risks and Challenges:

- Entry of biosimilars and generics post-2024–2025.

- Price compression pressures.

- Regulatory hurdles in expanding indications.

- Competition from over-the-counter options like nasacort.

Strategic Considerations for Stakeholders

- Manufacturers: Focus on patent protections, expand indications, and accelerate pipeline development for new formulations.

- Payers: Balance cost-effectiveness with clinical benefits, influencing formulary decisions.

- Patients and Providers: Prioritize access and efficacy, potentially influenced by out-of-pocket costs and formulary restrictions.

Key Takeaways

- XHANCE's market is poised for moderate growth during patent exclusivity, supported by expanding indications and increasing prevalence.

- Price stability is expected until patent expiry, after which significant price reductions are likely due to generic competition.

- Revenue trajectories hinge on successful market penetration, regulatory pathways, and reimbursement strategies.

- Price erosion post-patent expiry could halve the current retail price, impacting profit margins but potentially expanding patient access.

- Continuous innovation and pipeline development are vital to sustain market share and vendor profitability amid intensifying market competition.

FAQs

Q1: How does XHANCE compare to other intranasal corticosteroids in price and efficacy?

A: XHANCE commands a premium over many generics due to its clinical differentiation, higher potency, and indications. Its efficacy is comparable or superior in certain patient populations, especially nasal polyps, but price sensitivity may influence prescribing decisions.

Q2: What is the expected timeline for generic competition to impact XHANCE prices?

A: Patent exclusivity is projected to expire around 2024–2025, with generics entering the market within 6-12 months thereafter, leading to significant price declines.

Q3: How will expanding indications influence XHANCE’s market share?

A: The FDA approval for nasal polyps broadens its target population, potentially increasing revenue streams and market penetration, especially if clinicians prefer a single medication for multiple indications.

Q4: What are the main factors that may cause XHANCE’s price to increase before patent expiry?

A4: Price increases may occur due to rising production costs, improved formulations, or added value through new indications, but are limited by payer resistance and competitive pressures.

Q5: How critical is reimbursement policy in determining XHANCE’s market success?

A: Extremely critical; favorable reimbursement and formulary placement are essential for maintaining market share and premium pricing, especially as generic alternatives become available.

References

[1] MarketWatch. "Global Allergic Rhinitis Therapeutics Market Size, Share & Trends Analysis Report." 2022.