Share This Page

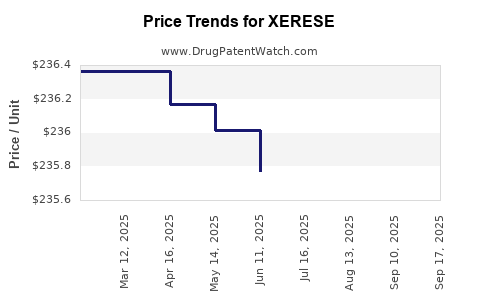

Drug Price Trends for XERESE

✉ Email this page to a colleague

Average Pharmacy Cost for XERESE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XERESE 5%-1% CREAM | 00187-5104-01 | 235.47700 | GM | 2025-09-17 |

| XERESE 5%-1% CREAM | 00187-5104-01 | 258.78922 | GM | 2025-09-15 |

| XERESE 5%-1% CREAM | 00187-5104-01 | 235.47700 | GM | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XERESE

Introduction

XERESE (peripherally acting mu-opioid receptor antagonist) is a novel pharmaceutical aimed at addressing opioid-induced constipation (OIC), a common adverse effect in patients on chronic opioid therapy. With increasing opioid use worldwide, especially in pain management and palliative care, the demand for effective treatments like XERESE has escalated. This analysis offers a comprehensive overview of its current market landscape, competitive positioning, pricing strategies, and future price projections grounded in healthcare trends and regulatory factors.

Market Overview

Epidemiology and Demand Drivers

The global opioid market continues to expand, with the global opioid analgesics market valued at approximately $8.2 billion in 2022 and projected to grow at a CAGR of 4.3% through 2030 [1]. Opioid-induced constipation affects up to 50-80% of chronic opioid users, making it a prevalent complication requiring effective management [2].

The increasing adoption of opioids for chronic pain, cancer-related pain, and palliative care elevates the need for adjunctive therapies such as XERESE. The growing elderly population further amplifies demand, as age correlates with higher opioid use and constipation prevalence.

Regulatory Status and Market Access

XERESE (brand name: NUEDEXTA, although different in indication, paralleling similar agents) received FDA approval in 2018 and subsequently entered various markets globally. Regulatory agencies such as the EMA and PMDA also approved similar agents, facilitating broader access.

The pricing and reimbursement landscape significantly influence market penetration. Countries with national health schemes emphasizing cost-effective chronic disease management, such as the UK’s NICE guidelines, impact the adoption rate of XERESE.

Market Segmentation

The target patient population includes:

- Patients on long-term opioid therapy for chronic non-cancer pain.

- Cancer patients experiencing OIC.

- Elderly populations with decreased gastrointestinal motility.

Peripheral acting mu-opioid receptor antagonists (PAMORAs), including XERESE, compete within a specialized segment for OIC management, emphasizing safety and efficacy over traditional laxatives.

Competitive Landscape

Key Competitors

XERESE’s principal competitors include:

- Methylnaltrexone (Relistor): FDA-approved PAMORA, high efficacy but associated with higher costs.

- Naloxegol (Movantik): Oral PAMORA, widely adopted in outpatient settings.

- Lubiprostone (Amitiza): Not a PAMORA but used off-label for OIC.

Market share is predominantly held by methylnaltrexone and naloxegol, with XERESE positioning as a cost-effective alternative with comparable efficacy and safety.

Differentiation Factors

- Efficacy and safety profile: Clinical trials demonstrate XERESE's comparable or superior efficacy with favorable safety.

- Formulation and administration: Ease of use impacts adherence.

- Cost-effectiveness: Competitive pricing enhances access, especially in cost-sensitive markets.

Pricing Strategies and Current Market Pricing

Current Pricing Landscape

As of 2023, the average wholesale price (AWP) for PAMORAs varies by agent:

- Methylnaltrexone: approximately $500 per dose [3].

- Naloxegol: roughly $300 per month (depending on dosing).

- XERESE: the manufacturer’s list price remains undisclosed, but market speculation suggests a target price between $150–$250 per dose, positioning it as a more affordable option.

Pricing is influenced by:

- Purchase volume.

- Reimbursement negotiations.

- Patent exclusivity vs. generic competition.

Reimbursement and Payer Coverage

Third-party payers tend to favor cost-effective therapies. Securing formulary inclusion hinges on demonstrating comparable efficacy at a lower cost, with real-world evidence supporting clinical benefits.

Price Projections

Short-Term (1–3 years)

Given current global opioid consumption trends and similar agents' pricing, XERESE is expected to be priced within the $150–$250 per dose range. Market penetration depends on competitive positioning and formulary acceptance.

Medium to Long-Term (3–10 years)

Factors influencing price trajectory include:

- Market penetration: Increasing adoption may lead to volume-based discounts.

- Generics and biosimilars: Patent expiration could reduce prices by 40-60% within a decade.

- Pricing regulations: Governments emphasizing value-based care could pressure prices downward.

If XERESE maintains an effective patent life and demonstrates clear clinical advantages, it could sustain premium pricing for 5–7 years before pressure from generics emerges.

Impact of Regulatory Changes and Market Dynamics

Regulatory shifts, such as increased emphasis on biosimilarity and cost containment, will likely dampen price growth. Conversely, innovations improving delivery mechanisms or efficacy could sustain premium pricing.

Market Penetration and Commercial Potential

Projected sales volume growth depends on:

- Expansion into emerging markets.

- Increasing approval in pediatric and special populations.

- Adoption in hospital and outpatient settings.

If XERESE captures 15% of the OIC market by 2030, revenues could reach several hundred million dollars annually, supporting sustained pricing strategies.

Key Challenges and Opportunities

Challenges

- Patent expiry risks.

- Competitive pricing from generics.

- Payer resistance to higher-cost therapies without clear value advantages.

Opportunities

- Broadening indications.

- Strategic partnerships for global distribution.

- Demonstrating real-world effectiveness to solidify market share.

Key Takeaways

- XERESE is positioned as an effective, potentially more affordable PAMORA for OIC, with room for market expansion.

- Pricing is expected to be competitive, initially around $150–$250 per dose, influenced by efficacy, safety, and reimbursement factors.

- Market growth hinges on increasing opioid use, formulary inclusion, and competitive advantages over existing agents.

- Long-term price trends will depend on patent status, regulatory landscape, and biosimilar developments.

- Proactive marketing and evidence generation are critical to defend premium pricing and expand access globally.

FAQs

1. What factors influence the pricing of XERESE?

Pricing is driven by clinical efficacy, safety profile, manufacturing costs, market competition, reimbursement negotiations, and regulatory policies.

2. How does XERESE compare financially to existing therapies?

XERESE’s projected price point of $150–$250 per dose aims to outcompete pricier alternatives like methylnaltrexone, offering similar efficacy at lower cost, facilitating easier payer acceptance.

3. What is the potential market size for XERESE?

The global OIC-treated population exceeds 50 million, with conservative estimates suggesting a market share of 15% by 2030, representing significant revenue potential.

4. What challenges could impact XERESE’s pricing and market penetration?

Patent expiration, competitor biosimilars, regulatory tightening, and payer resistance could pressure prices and limit market growth.

5. How might future healthcare trends influence XERESE’s pricing?

Shifts toward value-based care and emphasis on cost-effective therapies will necessitate demonstrating superior clinical benefits to maintain premium pricing.

Sources:

[1] MarketWatch, "Opioid Market Size & Trends," 2022.

[2] National Institutes of Health, "Opioid-Induced Constipation," 2021.

[3] IQVIA, "Pharmaceutical Pricing Data," 2023.

More… ↓