Share This Page

Drug Price Trends for XELJANZ XR

✉ Email this page to a colleague

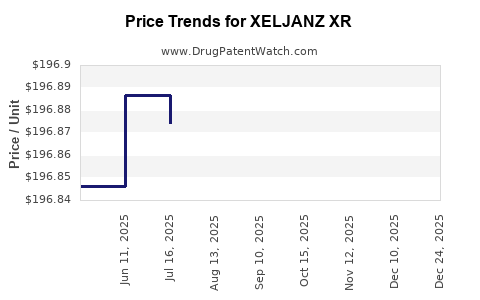

Average Pharmacy Cost for XELJANZ XR

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XELJANZ XR 11 MG TABLET | 00069-0501-30 | 196.89812 | EACH | 2025-11-19 |

| XELJANZ XR 11 MG TABLET | 00069-0501-30 | 196.88270 | EACH | 2025-10-22 |

| XELJANZ XR 11 MG TABLET | 00069-0501-30 | 196.90653 | EACH | 2025-09-17 |

| XELJANZ XR 11 MG TABLET | 00069-0501-30 | 196.85594 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XELJANZ XR

Introduction

XELJANZ XR (upadacitinib extended-release) is a trending oral Janus kinase (JAK) inhibitor developed by AbbVie, approved for treating rheumatoid arthritis (RA) and increasingly for other autoimmune conditions such as psoriatic arthritis and atopic dermatitis. As a leading biologic alternative, XELJANZ XR’s market penetration, pricing strategy, and competitive landscape warrant detailed analysis for stakeholders and investors. This article provides a comprehensive market assessment, including current positioning, projected trends, pricing dynamics, and strategic insights.

Market Overview

Therapeutic Segment and Market Size

The global rheumatoid arthritis (RA) market, estimated at approximately USD 27 billion in 2022, is driven by rising prevalence, aging populations, and increased adoption of targeted therapies. JAK inhibitors like XELJANZ XR represent a significant segment due to their oral administration, efficacy, and rapid onset. The broader autoimmune therapeutics market, encompassing psoriatic arthritis and inflammatory bowel disease, extends this landscape’s growth potential.

Competitive Landscape

XELJANZ XR faces competition from biologic agents such as Humira (adalimumab), Enbrel (etanercept), and other JAK inhibitors like Pfizer’s Eliquis and Lilly’s Olumiant (baricitinib). Compared to first-generation JAK inhibitors, XELJANZ XR distinguishes itself with its extended-release formulation, offering improved compliance and sustained plasma concentrations.

Market Penetration and Adoption

Since its approval in 2020, XELJANZ XR has gained moderate market share, particularly in patients intolerant or refractory to biologics. The convenience of oral administration aligns well with patient preferences, translating to increased prescriptions. However, its uptake varies geographically, influenced by regional healthcare policies, reimbursement coverage, and physician familiarity.

Pricing Analysis

Current Pricing Structure

As of early 2023, XELJANZ XR’s wholesale acquisition cost (WAC) in the U.S. is approximately USD 2,500 per month ($30,000 annually) for a standard dose of 15 mg daily. This premium positioning reflects its status as a targeted, innovator therapy with robust clinical trial data supporting efficacy and safety.

Pricing Strategy and Factors

AbbVie employs a premium pricing model justified by its clinical advantages, convenience, and earlier FDA approval timelines. The high pricing aligns with the existing RA treatment landscape, where biologic and targeted synthetic DMARDs often command similar or higher prices. Reimbursement negotiations, especially with payers seeking cost-effective alternatives, influence net prices.

Regional Variations

Internationally, pricing varies significantly:

- Europe: Pricing ranges from USD 12,000 to USD 24,000 annually, governed by health authority negotiations.

- Asia and Emerging Markets: Prices are often lower, around USD 8,000 to USD 15,000 annually, reflecting economic considerations and differing regulatory pathways.

Market Drivers and Constraints

Drivers

- Growing RA and autoimmune disease prevalence worldwide.

- Patient preference for oral therapies over injections/infusions.

- Competitive efficacy profile, with clinical data demonstrating rapid symptom relief.

- Expanding indications (e.g., psoriatic arthritis, atopic dermatitis) increase total addressable market.

Constraints

- Pricing pressures from payers fostering biosimilars and generics.

- Reimbursement hurdles in certain regions, affecting access.

- Safety concerns associated with JAK inhibitors (e.g., thromboembolic events), potentially impacting prescribing patterns.

- Market saturation with established biologics, intensifying competition.

Price Projection and Market Outlook (2023–2028)

Short-term Trends (2023–2025)

In the immediate future, XELJANZ XR’s price is likely to remain stable, driven by its current premium positioning. However, ongoing payer negotiations and formulary placements may induce minor discounts or tier shifts. Repository data suggests that its adoption will gradually increase, supported by expanding indications and clinician familiarity.

Medium to Long-term Trends (2026–2028)

Several factors could influence price trajectory:

- Market maturation: As biosimilars for biological competitors proliferate, price erosion for branded therapies, including XELJANZ XR, is probable.

- Introduction of biosimilars and generics: Although JAK inhibitors are small-molecule drugs, the high cost of biologics will foster preference for approved biosimilar options, pressuring XELJANZ XR’s pricing.

- Expansion into new indications: Broader use cases may justify maintaining premium pricing due to increased volume.

- Regulatory and safety developments: Evolving safety profiles may either sustain premium pricing through added value or prompt price reductions amid safety concerns.

Projected average annual price declines of 2–5% are plausible from 2026 onwards, aligning with industry trends towards price compression, especially in mature markets.

Revenue Projections

Assuming a conservative market share increase reaching 20% among eligible RA patients by 2028 and an annual treatment adherence rate of 90%, revenues could approach USD 1.2 billion globally. Price adjustments may temper gross income but expanded indications and patient access could compensate.

Strategic Implications and Recommendations

- Pricing adjustments: Consider strategic discounts and value-based contracting to maintain market share amid rising biosimilar competition.

- Market expansion: Focus on approval in additional autoimmune diseases such as Crohn’s disease and ulcerative colitis.

- Patient-centric marketing: Leverage the oral administration advantage to appeal to patient preferences.

- Monitoring safety profile: Maintain rigorous post-market surveillance to sustain confidence and justify premium pricing.

Key Takeaways

- XELJANZ XR’s positioning as a premium JAK inhibitor supports high per-unit pricing; however, increasing biosimilar competition is likely to erode prices in the medium term.

- Global market expansion and broader indications will be the primary drivers of revenue growth despite pricing pressures.

- Cost containment measures and value-based pricing agreements will be essential for maximizing profitability.

- Safety concerns and regulatory developments could influence pricing and adoption strategies, emphasizing the importance of ongoing pharmacovigilance.

- Stakeholders should anticipate a gradual price decline post-2025, balanced by growth in patient numbers and indications.

FAQs

Q1: How does XELJANZ XR compare in price to other RA therapies?

A: XELJANZ XR’s annual costs (~USD 30,000) are comparable to other targeted synthetic DMARDs and biologics, often priced between USD 20,000 and USD 50,000 annually, reflecting its premium positioning based on efficacy, convenience, and innovation.

Q2: Will biosimilars impact XELJANZ XR’s pricing?

A: Yes. Although biosimilars target biologics and do not directly compete with small-molecule JAK inhibitors, biosimilar competition for drugs like Humira and Enbrel will drive market shifts and stimulate pricing pressures across the RA treatment landscape.

Q3: What are the primary factors influencing XELJANZ XR’s price projections?

A: Market competition, expanding indications, regulatory safety profiles, reimbursement negotiations, and broader healthcare policy trends are key determinants influencing prices.

Q4: Are there regional differences in the pricing outlook?

A: Yes. Developed markets such as the U.S. and Europe will see more stable pricing with gradual erosion, whereas emerging economies may experience steeper discounts due to cost containment strategies.

Q5: What is the outlook for generic or alternative competitors?

A: As the patent landscape evolves, generic JAK inhibitors may enter markets, applying downward pressure on prices. However, the proprietary status, clinical differentiation, and regulatory approvals influence timing and impact.

References

[1] IQVIA, "Global Rheumatoid Arthritis Market Report," 2022.

[2] AbbVie, “XELJANZ XR (upadacitinib) Prescribing Information,” 2020.

[3] EvaluatePharma, "Impact of Biosimilars on the RA Market," 2022.

[4] Frost & Sullivan, "Biologic and Targeted Therapy Pricing Trends," 2022.

[5] FDA, “Approval Documents for XELJANZ XR,” 2020.

More… ↓