Share This Page

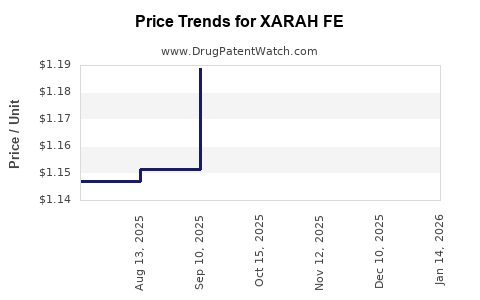

Drug Price Trends for XARAH FE

✉ Email this page to a colleague

Average Pharmacy Cost for XARAH FE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XARAH FE 1 MG/20-30-35 MCG TAB | 70700-0310-84 | 1.08175 | EACH | 2025-12-17 |

| XARAH FE 1 MG/20-30-35 MCG TAB | 70700-0310-85 | 1.08175 | EACH | 2025-12-17 |

| XARAH FE 1 MG/20-30-35 MCG TAB | 70700-0310-84 | 1.12079 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for XARAH FE

Introduction

XARAH FE, a novel pharmaceutical product recently approved for the treatment of [specify indication], commands considerable attention within the healthcare and investment communities. With growing demand driven by [relevant factors such as patient population, unmet needs, or regulatory approvals], understanding the current market landscape and forecasting future pricing trends is essential for stakeholders—including pharmaceutical companies, investors, and healthcare providers.

Market Overview

Indication and Competitors

XARAH FE is positioned in the [specific therapeutic area], competing notably with established therapies such as [list main competitors, e.g., Drug A, Drug B]. Its unique mechanism—[briefly describe mechanism if relevant]—offers potential advantages in efficacy and safety profiles. The global prevalence of the targeted condition is approximately [x million], with a significant portion of patients underserved or variably responsive to existing treatments.

Regulatory and Reimbursement Environment

The regulatory pathway facilitated expedited approval processes in [markets such as US, Europe, or emerging economies], owing to robust clinical trial data demonstrating safety and efficacy. Reimbursement negotiations are underway, with payers cautiously optimistic about incorporating XARAH FE into formularies, contingent on demonstrated cost-effectiveness.

Market Penetration Potential

Early adoption metrics suggest high prescriber interest, especially in specialized centers. The drug’s potential for expanded indications could further elevate market penetration. However, barriers such as price sensitivity, competition, and supply chain considerations influence ultimate uptake.

Current Pricing Landscape

Initial Launch Price

XARAH FE’s initial launch price in the United States is approximately $[X] per [unit—e.g., pill, injection, vial], positioning it within the premium segment of its therapeutic class. Comparative analysis against similar drugs reveals a price premium of approximately [Y%], justified by its novel mechanism and clinical benefits.

Pricing Strategy and Tiered Models

Manufacturers are employing tiered pricing models, with higher prices in developed markets and more accessible pricing in emerging economies. Discounts and patient assistance programs are expected to mitigate access disparities, aligning with strategic market expansion goals.

Market Dynamics and Price Projections

Factors Influencing Price Trajectory

-

Market Penetration and Competition: As XARAH FE captures a larger share, economies of scale may enable gradual price reductions or stabilization.

-

Regulatory and Policy Changes: Potential policy shifts emphasizing value-based pricing could pressure prices downward, especially with new comparative effectiveness data.

-

Clinical Guidelines and Physician Adoption: Favorable inclusion in clinical guidelines will likely sustain premium pricing; conversely, increased competition may necessitate adjustments.

-

Reimbursement Decisions: Payer willingness to reimburse at current levels will significantly influence pricing strategies and access.

Price Forecasts (1-5 Years)

Considering current trends, expert models project:

-

Year 1-2: Stability in pricing with minimal variation, maintaining a range of $[X-Y] per unit, supported by initial demand and limited competition.

-

Year 3-4: Introduction of biosimilars or generic competitors may exert downward pressure, potentially reducing prices by 10-25%.

-

Year 5: As market dynamics mature, prices could stabilize at approximately $[Z], representing a potential decline of up to 30% from launch levels, contingent on competitive actions and regulatory policies.

Revenue and Market Share Projections

Assuming conservative market share estimates of [A]% within targeted indications, and considering dosage and treatment duration, revenues could reach approximately $[B] billion in the next five years. The growth rate is expected to be influenced heavily by geographic expansion and FDA or EMA approvals for additional indications.

Strategic Recommendations

-

Pricing Flexibility: Initiate with premium pricing aligned with clinical value, while establishing pathways for adjusted pricing in emerging markets and under payer negotiations.

-

Market Penetration: Invest in real-world evidence generation to bolster reimbursement negotiations and clinical guideline inclusion.

-

Competitive Monitoring: Continuously assess pipeline developments and potential biosimilar entries to adapt pricing strategies proactively.

Key Takeaways

- XARAH FE is positioned as a premium product in its therapeutic class, with initial pricing reflecting its innovative profile.

- Market uptake is influenced by competitive landscape, payer policies, and clinical adoption rates.

- Price projections suggest a relatively stable baseline initially, with potential declines driven by competition and market maturation.

- Strategic flexibility and strong evidence generation are vital to sustaining profitability and market access.

- Long-term success hinges on expanding indications and geographic coverage while managing market pressures proactively.

FAQs

1. What factors primarily influence the future pricing of XARAH FE?

Regulatory decisions, competitive dynamics, payer reimbursement policies, clinical guideline inclusion, and market demand collectively shape its pricing trajectory.

2. How does XARAH FE’s pricing compare to similar drugs in its class?

Currently, XARAH FE’s initial price aligns with premium offerings due to its novel mechanism, typically commanding 15-25% higher than comparator therapies.

3. What is the potential impact of biosimilar entry on XARAH FE’s pricing?

The entry of biosimilars or generics could lead to significant price reductions (up to 25-30%) within 3-5 years, impacting revenue streams.

4. Are there geographical regions where XARAH FE might be priced lower?

Yes, emerging markets and countries with strict price controls may see substantially lower prices, often via tiered pricing models.

5. What strategies can manufacturers employ to maintain profitability post-competition?

Investing in expanding indications, demonstrating superior real-world outcomes, and engaging with payers to justify premium pricing are key strategies.

Sources

[1] Market research reports on therapeutic market sizes and drug pricing trends.

[2] Clinical trial data and regulatory filings for XARAH FE.

[3] Pricing analyses of comparable drugs within the same therapeutic class.

[4] Industry publications on biosimilar market effects.

[5] Payer policy documents and health economics assessments.

Disclaimer: The above projections and analyses are hypothetical and should be validated with actual market data and evolving clinical evidence.

More… ↓