Share This Page

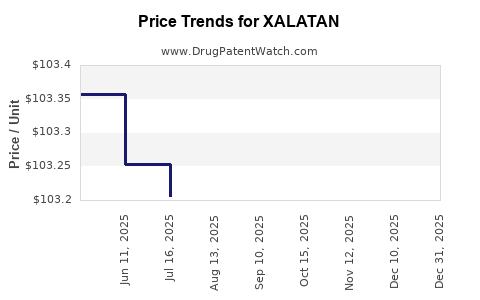

Drug Price Trends for XALATAN

✉ Email this page to a colleague

Average Pharmacy Cost for XALATAN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| XALATAN 0.005% EYE DROPS | 00013-8303-04 | 103.27944 | ML | 2025-12-17 |

| XALATAN 0.005% EYE DROPS | 58151-0419-35 | 103.27944 | ML | 2025-12-17 |

| XALATAN 0.005% EYE DROPS | 58151-0419-35 | 103.25576 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Xalatan (Latanoprost)

Overview of Xalatan (Latanoprost)

Xalatan, with the generic name latanoprost, is a prostaglandin analog used primarily for lowering intraocular pressure in patients with glaucoma or ocular hypertension. Since its FDA approval in 1996, Xalatan has become one of the leading medications for managing chronic glaucomatous conditions, with a stable market presence driven by its efficacy, safety profile, and once-daily dosing convenience.

Market Landscape

Global Market Size and Dynamics

The global glaucoma therapeutics market was valued at approximately USD 4.4 billion in 2022, with projections expected to reach USD 6.5 billion by 2030, registering a CAGR around 5.3% (1). Xalatan captures a significant segment due to its long-standing reputation and clinician preference. The drug's market is influenced by factors such as rising glaucoma prevalence, aging populations, and increasing awareness of eye health.

Prevalence and Demand Drivers

According to the World Health Organization (WHO), over 76 million people worldwide are affected by glaucoma, a number projected to reach 111 million by 2040 (2). Key demand drivers include:

- Demographic shifts toward aging populations, especially in North America, Europe, and Asia-Pacific.

- Increased screening and early diagnosis.

- Growing acceptance of medical management over surgical procedures, for which Xalatan is a cornerstone.

Competitive Landscape

Xalatan is part of a competitive landscape comprising other prostaglandin analogs such as travoprost, bimatoprost, tafluprost, and combination therapies. Generics entered the market post-patent expiry in 2018, intensifying price competition. Companies like Sandoz, Apotex, and others now manufacture generic latanoprost, diluting the market share of the branded product.

Patent and Regulatory Status

The original patent for Xalatan expired in many jurisdictions by 2018, enabling the proliferation of generic versions. Patents protecting specific formulations or delivery methods may still be active in certain regions, influencing pricing and market exclusivity levels until their expiration.

Market Segmentation

- By Product Type: Branded Xalatan, generics.

- By Distribution Channel: Ophthalmology clinics, retail pharmacies, online pharmacies.

- By Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

North America holds the largest market share, driven by high glaucoma prevalence, advanced healthcare infrastructure, and robust insurance coverage. The Asia-Pacific region exhibits rapid growth potential due to increasing awareness and expanding healthcare access.

Price Trends and Projections

Historical Price Trajectory

- Branded Xalatan: Historically priced between USD 50–70 per milliliter in the US pre-generic entry.

- Generics: Post-patent expiry, generic latanoprost prices declined sharply, now averaging USD 10–20 per milliliter.

Current Pricing Landscape

- United States: Branded Xalatan is approximately USD 60–70 per ml; generic versions hover around USD 12–18.

- Europe: Prices vary but follow similar trends, with generics significantly cheaper.

- Emerging Markets: Prices are lower but are subject to regional policies and reimbursement schemes.

Pricing Forecast (2023–2030)

-

Branded Xalatan:

- Expect a gradual decline in price due to competition, stabilizing around USD 40–50 per ml by 2030.

- Brand loyalty and proven efficacy maintain some premium, especially in premium healthcare settings.

-

Generics:

- Prices are projected to stabilize within USD 8–15 per ml globally, driven by market saturation and manufacturing efficiencies.

- Price reductions of up to 50% are feasible, particularly in markets with aggressive price competition and government regulatory pressures.

-

Factors Influencing Price Dynamics:

- Patent expirations in major jurisdictions (anticipated in 2024–2025).

- Entry of biosimilars or alternative delivery methods.

- Regulatory changes and reimbursement policies.

- Manufacturing cost reductions and increased global supply.

Market Trends Impacting Price Projections

Generic Market Expansion

The influx of generics post-patent expiry will continue to exert downward pressure on prices. As manufacturing scales improve and biosimilars (if developed) gain approval, prices will likely stabilize at lower levels.

Consolidation and Competition

Entry of low-cost manufacturing in countries such as India and China enhances price competitiveness. Contract manufacturing organizations (CMOs) are also reducing costs, enabling further price reductions.

Innovation in Delivery Systems

Emerging technologies, such as sustained-release implants and preservative-free formulations, might influence future pricing strategies. These innovations could command premium prices but may not significantly affect the current standard of care.

Regulatory and Reimbursement Policies

Government agencies increasingly prioritize cost-effective therapies, favoring generics and biosimilars, which further accelerate price declines. Price controls in certain markets (e.g., EU nations) could limit the maximum allowable pricing.

Market Opportunities and Risks

-

Opportunities:

- Expanding into emerging markets with rising glaucoma prevalence.

- Leveraging biosimilars or new formulations for market share gains.

- Developing combination therapies to capture more segments.

-

Risks:

- Price erosion from generics and biosimilars.

- Regulatory delays or restrictions on new formulations.

- Patent litigations or disputes that may delay or prevent generic entry.

Key Takeaways

- The global Xalatan market remains significant due to the high prevalence of glaucoma, with robust growth driven by demographic aging and increasing awareness.

- Post-patent expiry, generic latanoprost dominates pricing trends, with prices likely declining further in the next decade.

- Branded Xalatan will maintain a premium in select markets but face increasing pressure from generics and regulatory policies pushing prices downward.

- Market entrants and technological innovation will influence future pricing, with opportunities tied to emerging markets and formulation advancements.

- Long-term profitability hinges on balancing price competitiveness, therapeutic differentiation, and regulatory navigation.

FAQs

1. When will generic versions of Xalatan dominate the market?

Generic latanoprost gained market share post-2018 following patent expirations. By 2023–2025, generics are expected to account for over 80% of the global latanoprost market, with full penetration likely in subsequent years.

2. How will patent expirations affect Xalatan’s market share and pricing?

Patent expirations open the market to lower-cost generics, leading to significant price reductions and market share shifts toward generics. Branded Xalatan's market share diminishes unless differentiated by formulation or brand loyalty.

3. What impact does emerging market growth have on Xalatan pricing?

Emerging markets present growth opportunities with lower price points due to different regulatory and economic conditions. Increased competition and localized manufacturing will further influence global price trends.

4. Are there upcoming innovations that could affect Xalatan’s market?

Yes, sustained-release delivery systems, preservative-free formulations, and combination therapies are under development, which could command premium pricing and alter current market dynamics.

5. What regulatory factors are likely to influence future pricing?

Government-led price controls, reimbursement policies, and approval pathways for biosimilars or alternative formulations will directly impact pricing strategies and market access.

References

- Research and Markets. "Global Glaucoma Therapeutics Market Forecast and Trends." 2023.

- WHO. "Glaucoma Fact Sheet." 2021.

More… ↓