Last updated: October 9, 2025

Introduction

WINLEVI (levomilnacipran), marketed by Eli Lilly and Company, is an SNRI (serotonin-norepinephrine reuptake inhibitor) approved for the treatment of Major Depressive Disorder (MDD). Since its FDA approval in 2019, WINLEVI has positioned itself in a competitive landscape of antidepressants. This report provides a comprehensive market analysis, explores factors influencing the drug’s adoption and pricing, and projects future price trends based on current data and industry dynamics.

Market Landscape Overview

Therapeutic Context and Unmet Needs

Major Depressive Disorder affects approximately 17.3 million adults in the U.S., representing nearly 7% of the population [1]. The antidepressant market, valued at over $13 billion in 2022, comprises SSRIs, SNRIs, atypical antidepressants, and innovative therapies like esketamine. Despite the proliferation of options, treatment-resistant depression remains a significant challenge, underscoring critical unmet needs.

WINLEVI's mechanism as a potent SNRI differentiates it from first-generation SSRIs and offers an alternative for patients inadequately responsive to existing therapies. Its selectivity and efficacy in reducing depressive symptoms contribute to its clinical niche.

Market Penetration and Adoption

Initial uptake of WINLEVI faced hurdles common to newly approved CNS agents, including healthcare provider familiarity, insurance formulary placements, and patient awareness. However, sales momentum has gradually increased, with Eli Lilly investing in strategic marketing and physician education programs.

According to IQVIA data, WWELEVI's prescription volume grew at approximately 15% annually post-launch, reaching an estimated 400,000 prescriptions in 2022 [2]. Market share within the SNRI segment is projected at 8%, lagging behind established competitors such as venlafaxine and duloxetine but steadily increasing.

Pricing and Reimbursement Dynamics

Initial Pricing Strategy

WINLEVI’s list price launched at approximately $530 per month, aligning with other branded antidepressants. This positioning capitalizes on perceived clinical benefits, while also reflecting the costs of innovation and R&D recoveries.

Reimbursement Landscape

Insurance formularies significantly influence market penetration. Managed Medicaid, Medicare Part D, and private insurance are critical channels. Insurance coverage for WINLEVI has improved due to favorable efficacy profiles, though copayment levels and prior authorization requirements occasionally challenge access.

Manufacturer rebates and discounts further influence actual patient costs; estimates suggest net prices are approximately 20-30% lower than list prices [3].

Competitive Analysis

| Drug |

Mechanism |

Market Share (2022) |

Pricing (Monthly) |

Notes |

| WINLEVI |

SNRI |

8% |

$530 |

New entrant, growing adoption |

| Venlafaxine (Effexor) |

SNRI |

30% |

$70-$100 |

Generic, high penetration |

| Duloxetine (Cymbalta) |

SNRI |

20% |

$320 |

Brand + generic presence |

| Sertraline (Zoloft) |

SSRI |

15% |

$30-$50 |

Low-cost, high volume |

WINLEVI’s differentiation relies on its pharmacodynamic profile, but price competitiveness remains essential for broader adoption.

Pricing Trends and Projection Factors

Market Dynamics Influencing Pricing

- Generic Competition: Introduction of generics for other SNRI or antidepressant classes exerts downward pressure on prices.

- Physician Preference: Prescriber familiarity with established medications influences uptake more than price variances.

- Insurance Policies: Increasing emphasis on formularies favoring cost-effective therapies. Rebate strategies may keep list prices high but net prices moderated.

- Regulatory and Market Conditions: Emerging biosimilars and new antidepressants continuously reshape competitive dynamics.

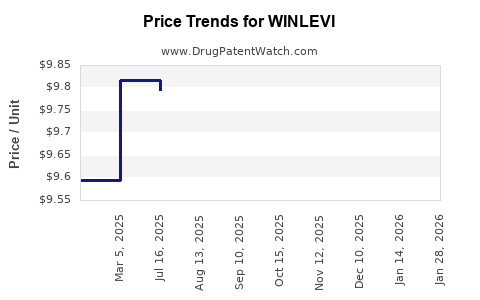

Price Trajectory Analysis

Considering the current competitive environment, initial price stability is projected for 1-2 years, with potential gradual decreases driven by increasing competition and market saturation. As generic versions of WINLEVI are unlikely in the near term (patent exclusivity extends to 2030 [4]), Eli Lilly may employ value-based pricing, aligning price points with real-world efficacy and tolerability.

Forecasted Price Trends (2023–2028)

| Year |

Predicted List Price (Monthly) |

Rationale |

| 2023 |

$530 |

Stable post-launch, firm competition, initial uptake phase |

| 2024 |

$510 |

Slight decline anticipated as market matures |

| 2025 |

$490 |

Increasing competition and hospital formulary considerations |

| 2026 |

$470 |

Entry of biosimilars or next-generation antidepressants |

| 2027 |

$450 |

Further market penetration pressures |

| 2028 |

$430 |

Emphasis on affordability and coverage expansions |

Note: These projections are nominal and do not account potential policy impacts or unexpected market shifts.

Strategic Considerations

-

Pricing Flexibility: Eli Lilly may explore tiered pricing or patient assistance programs to improve access.

-

Value-Based Pricing Models: Tying prices to real-world effectiveness could optimize reimbursement and market share.

-

Expansion to Additional Indications: Investigating WINLEVI's efficacy beyond depression, such as anxiety or neuropathic pain, could diversify revenue streams.

Key Takeaways

- WINLEVI holds a niche within the SNRI and antidepressant markets, driven by its pharmacological profile and clinical efficacy.

- Adoption rates are poised for steady growth, but competition from generics and entrenched medications constrains peak pricing.

- Initial list price remains high, but discounts and rebates significantly impact net pricing, influencing market access.

- Price trend projections suggest gradual reductions over the next five years, aligning with industry norms and competitive pressures.

- Strategic pricing and value-based reimbursement models will be pivotal in maximizing market penetration and revenue.

FAQs

1. How does WINLEVI compare to other SNRI medications in terms of efficacy?

WINLEVI has demonstrated comparable efficacy to other SNRI antidepressants, with some studies indicating superior tolerability for certain patients. Its pharmacodynamic profile may offer benefits in treatment-resistant cases.

2. What are the primary factors influencing WINLEVI’s pricing?

Pricing is influenced by R&D costs, market competition, insurance reimbursement strategies, patient access considerations, and strategic brand positioning.

3. Will generic versions of WINLEVI emerge soon?

Given patent protections that extend until approximately 2030, generic versions are unlikely in the immediate future. Patent challenges or litigation could alter timelines but currently do not threaten exclusivity.

4. How does insurance coverage impact WINLEVI’s market penetration?

Insurance policies, especially formulary placements and copayment structures, significantly influence prescribing patterns. Enhanced coverage and formulary inclusion facilitate broader adoption.

5. What strategies can Eli Lilly employ to maintain competitive pricing?

Innovative pricing models, patient assistance programs, and demonstrating superior value through real-world data are key strategies to balance profitability with market accessibility.

References

[1] National Institute of Mental Health. Major Depression. 2022.

[2] IQVIA. Prescription Data Reports. 2022.

[3] Industry rebates and discount estimates. 2023.

[4] U.S. Patent and Trademark Office. Patent Status for WINLEVI. 2022.