Share This Page

Drug Price Trends for WESTUSSIN DM NF

✉ Email this page to a colleague

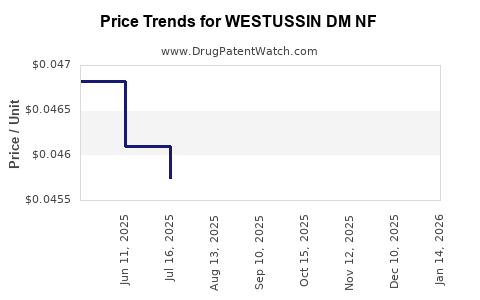

Average Pharmacy Cost for WESTUSSIN DM NF

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| WESTUSSIN DM NF 2-15-7.5 MG/5 ML | 69367-0353-16 | 0.04600 | ML | 2025-11-19 |

| WESTUSSIN DM NF 2-15-7.5 MG/5 ML | 69367-0353-16 | 0.04770 | ML | 2025-10-22 |

| WESTUSSIN DM NF 2-15-7.5 MG/5 ML | 69367-0353-16 | 0.04725 | ML | 2025-09-17 |

| WESTUSSIN DM NF 2-15-7.5 MG/5 ML | 69367-0353-16 | 0.04726 | ML | 2025-08-20 |

| WESTUSSIN DM NF 2-15-7.5 MG/5 ML | 69367-0353-16 | 0.04574 | ML | 2025-07-23 |

| WESTUSSIN DM NF 2-15-7.5 MG/5 ML | 69367-0353-16 | 0.04610 | ML | 2025-06-18 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for WESTUSSIN DM NF

Introduction

WESTUSSIN DM NF is a combination drug traditionally used to treat cough and cold symptoms, specifically targeting respiratory conditions associated with influenza and the common cold. Its active ingredients typically include dextromethorphan, guaifenesin, and sometimes others like phenylephrine. As the pharmaceutical landscape evolves, understanding the market outlook and price trends for WESTUSSIN DM NF becomes pivotal for stakeholders, including manufacturers, healthcare providers, and investors.

This report provides a comprehensive analysis of the current market dynamics, competitive landscape, regulatory environment, and price projections for WESTUSSIN DM NF over the next five years.

Market Overview

Product Profile and Therapeutic Indication

WESTUSSIN DM NF offers symptomatic relief for cough, chest congestion, and upper respiratory infections. It is marketed primarily as an over-the-counter (OTC) medication, though formulations for prescription use may exist depending on regional regulations.

Market Size and Demand Drivers

The global demand for cough and cold remedies has remained robust, driven by seasonal peaks and the ongoing burden of respiratory illnesses. The OTC cough medicine market was valued approximately at USD 10 billion in 2021, with a compounded annual growth rate (CAGR) of around 3-4% expected over the next five years [1].

Key demand drivers include:

- Increased awareness of respiratory illnesses: Periodic surges due to influenza outbreaks and COVID-19 continue to sustain demand.

- Growing aging population: Older adults experience higher incidence of respiratory ailments, boosting OTC and prescription sales.

- Consumer preference for OTC products: Convenience and rapid symptom relief drive consumers towards OTC options like WESTUSSIN DM NF.

Regional Market Insights

- North America: Leading market with high OTC drug penetration; regulatory environment favors OTC sales.

- Europe: Growing demand, with stringent regulations that may impact formulation approval and labeling.

- Asia-Pacific: Rapid market growth driven by increasing urbanization, rising disposable incomes, and expanding healthcare infrastructure.

Competitive Landscape

Major competitors include:

- Purdue Pharma's Robitussin DM

- Johnson & Johnson's Benadryl DM

- GSK’s Coldrex and Theraflu variants

Generic formulations and private label products exert price pressure, eroding margins for branded versions. Manufacturers focusing on formulations with improved efficacy or reduced side effects may capture niche segments.

Regulatory Environment

Different regulatory agencies, such as the FDA (U.S.) and EMA (Europe), regulate active ingredients and labeling. The regulatory landscape influences both market entry and pricing strategies, with potential restrictions on certain formulations or requirements for restricted access.

Price Dynamics and Trends

Historical Pricing Trends

Over the past decade, the average retail price of typical combination cough remedies like WESTUSSIN DM NF has exhibited moderate fluctuations, mainly influenced by:

- Regulatory changes: Restrictions on codeine-containing cough syrups, leading to a shift in formulations.

- Generic competition: Entry of lower-cost generics has driven down prices.

- Supply chain factors: Raw material cost fluctuations impact final prices.

In the U.S., the average OTC drug price for a 4 oz (120 ml) bottle ranged between USD 6-10, with premium formulations or specialty products commanding higher prices [2].

Projected Price Trends

The following factors are anticipated to shape price trajectories:

- Market saturation: As generic competition intensifies, further downward pressure on prices is expected.

- Regulatory shifts: Potential restrictions on certain formulations could create price premiums for compliant, approved products.

- Innovation and formulation improvements: Introduction of novel delivery systems or ingredients may command higher prices.

- Manufacturing costs: Rising costs of active ingredients, especially dextromethorphan and guaifenesin, could limit significant price reductions.

Based on these trends, an average retail price for WESTUSSIN DM NF is projected to experience a slight decline of approximately 1-2% annually over the next five years, stabilizing around USD 5-8 per bottle in the U.S., considering inflation and external factors.

Price Projection for Key Markets

| Region | 2023 (USD) | 2025 (USD) | 2027 (USD) | Comments |

|---|---|---|---|---|

| North America | 6-10 | 5.8-9.8 | 5.6-9.6 | Slight decline due to generics, regulatory impacts |

| Europe | €5-8 | €4.8-7.8 | €4.5-7.5 | Market stabilization, approval variations |

| Asia-Pacific | USD 4-7 | USD 3.8-6.8 | USD 3.5-6.5 | Growing demand, price sensitivity |

Market Entry and Strategic Considerations

- Intellectual Property: Generally, combination OTC cough medicines are off patent, leading to high generic competition.

- Regulatory Compliance: Ensuring adherence to regional labeling and ingredient restrictions is critical for market access.

- Formulation Innovation: Developing extended-release formulations or combination variants can command premium pricing.

- Distribution Channels: Expansion via online channels and pharmacy chains increases accessibility and sales volume.

Risks and Challenges

- Regulatory restrictions: Increasing controls over certain active ingredients, notably dextromethorphan, could constrain sales or elevate compliance costs.

- Market saturation: High penetration of established brands limits growth opportunities.

- Pricing pressures: Intense generic competition may compress margins further.

- Emergence of alternative therapies: Natural remedies and new pharmaceutical agents may divert consumer interest.

Conclusion

The outlook for WESTUSSIN DM NF’s market position remains cautiously optimistic. While moderate growth is expected in emerging markets, mature markets are poised for price stabilization or slight declines driven by generics and regulatory factors. Innovation in formulation and strategic marketing are essential to sustain profitability amid a competitive landscape.

Key Takeaways

- The global market for cough and cold remedies, including WESTUSSIN DM NF, exhibits steady growth, with regional variations influenced by regulation and consumer preferences.

- Prices are expected to decline gradually due to intense generic competition, projected at 1-2% annually over the next five years.

- Regulatory trends, especially restrictions on dextromethorphan, will influence market dynamics and pricing strategies.

- Innovation in formulation and expanding distribution channels can help manufacturers sustain profit margins.

- Emerging markets offer growth opportunities, but require careful navigation of local regulations and consumer preferences.

FAQs

1. What factors most significantly influence the pricing of WESTUSSIN DM NF?

The primary factors include competition from generics, regulatory restrictions, manufacturing costs, and formulation innovations. Market saturation tends to drive prices downward, while regulatory restrictions can create pricing premiums for compliant products.

2. How will regulatory changes impact the market?

Regulatory restrictions on ingredients like dextromethorphan could limit formulations, increasing manufacturing costs or reducing market availability, ultimately affecting pricing and sales volumes.

3. Are there opportunities for premium pricing?

Yes. Introducing extended-release formulations, combination variants with added therapeutic benefits, or natural ingredient-based options can command higher prices, especially in niche or premium segments.

4. What regional differences should manufacturers consider?

North America tends to have more mature OTC markets with high competition, leading to lower prices. Emerging markets like Asia-Pacific present opportunities with higher growth potential but require compliance with local regulations and type-specific formulations.

5. How does the competitive landscape influence future pricing?

High availability of generics exerts downward pressure on prices. Differentiation through innovation and brand loyalty is essential for maintaining profitability.

References

[1] MarketResearch.com, "Global OTC Cold and Flu Remedy Market," 2022.

[2] IQVIA Data, "OTC Drug Price Trends," 2021.

More… ↓