Last updated: July 28, 2025

Introduction

VYZULTA (netarsudil ophthalmic solution) is an innovative drug developed by Aerie Pharmaceuticals, approved by the FDA in 2017 for the reduction of intraocular pressure (IOP) in patients with open-angle glaucoma or ocular hypertension. As the first Rho kinase (ROCK) inhibitor approved for glaucoma, VYZULTA occupies a niche in the ophthalmic therapeutics market primarily driven by unmet medical needs, evolving treatment paradigms, and rising glaucoma prevalence globally.

This article provides a comprehensive market analysis and price projection outlook for VYZULTA, examining competitive positioning, market dynamics, pricing strategies, and future prospects to assist clinicians, investors, and stakeholders in strategic decision making.

Market Overview

Glaucoma and Ocular Hypertension Landscape

Glaucoma remains a leading cause of irreversible blindness worldwide, affecting over 76 million people in 2020 and projected to reach 112 million by 2040 according to the World Glaucoma Association [1]. Its management involves lowering IOP, the only modifiable risk factor. Currently, first-line treatments include prostaglandin analogs, beta-blockers, and combination therapies. However, challenges such as inadequate response, side effects, and patient adherence create an ongoing demand for novel agents targeting different pathways, including Rho kinase inhibition.

VYZULTA’s Clinical Positioning

VYZULTA distinguishes itself by targeting the Rho kinase pathway, which facilitates aqueous humor outflow through the trabecular meshwork. Its unique mechanism offers potential benefits over traditional therapies, including possibly fewer systemic side effects and enhanced IOP lowering efficacy in some patient subsets [2].

Regulatory Status and Market Penetration

Since its FDA approval in 2017, VYZULTA has secured regulatory approvals in multiple regions, including Japan and the European Union. As of 2022, its market penetration remains modest relative to established generic treatments, but its unique positioning positions it as a promising candidate for growth, particularly among patients intolerant or resistant to conventional drugs.

Market Dynamics

Competitive Landscape

VYZULTA faces competition from a diverse portfolio of glaucoma treatments:

- Prostaglandin analogs: Latanoprost, Travoprost, Tafluprost, and Bimatoprost dominate market share due to high efficacy and once-daily dosing.

- Beta-blockers: Timolol and Betaxolol still hold significant shares, especially in combination products.

- Other novel agents: Rhopressa (netarsudil) by Aerie Pharmaceuticals and other ROCK inhibitors are direct competitors. Rhopressa, approved in 2017 alongside VYZULTA, targets the same pathway.

The presence of multiple brand and generic options makes pricing and adoption strategies critical for VYZULTA to expand its footprint.

Pricing Strategies and Reimbursement

VYZULTA’s initial pricing positions it as a premium therapy, with list prices approximately $350–$400 per bottle in the U.S., reflecting its novelty and research investment[3]. Insurance coverage dynamics and formulary placements influence patient access considerably.

Market Adoption Drivers

- Medical Candidacy: VYZULTA’s potential for patients unresponsive to or intolerant of existing drugs.

- Physician Education: Awareness of ROCK inhibitors’ role in glaucoma.

- Patient Adherence: Once-daily dosing favors compliance, indirectly boosting market penetration.

- Pricing and Reimbursement: Competitive pricing and favorable reimbursement policies are essential for broader adoption.

Price Projections and Market Forecast

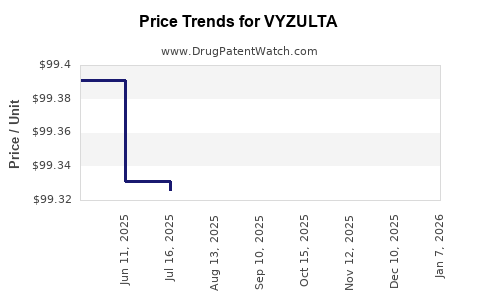

Historic Pricing Trends

Since launch, VYZULTA has maintained a premium pricing model by targeting specific patient segments. List prices in the U.S. have remained relatively stable but subject to negotiation and discounts within managed care systems.

Forecast Methodology

Price and market volume predictions are grounded in:

- Current market share estimates

- Competitive pricing strategies

- Foreseeable healthcare policy shifts

- Glaucoma prevalence growth

- Adoption rates influenced by clinical positioning

Projected Market Growth

By 2030, the global glaucoma therapeutics market is anticipated to grow at a CAGR of around 6%, reaching approximately $6.2 billion [4]. VYZULTA’s niche positioning and increased recognition could contribute to a compound annual growth rate of 10–12% within the ophthalmic drug segment, provided it achieves broader adoption.

Price Outlook (2023–2030)

- Short-term (2023–2025): Maintaining premium pricing at $350–$400 with stable or modest discounts as market penetration ramps up.

- Mid-term (2026–2028): Slight price reductions driven by increased generic competition from other ROCK inhibitors or biosimilars, if developed, could bring prices to $300–$350.

- Long-term (2029–2030): Market saturation and healthcare system negotiations could further pressure prices downward to approximately $250–$300 per bottle, especially with improved formulary inclusion and patient access programs.

Price reductions of 10–15% annually are plausible amid rising competition and patent expirations, although continued differentiation on clinical outcomes and adherence could mitigate steep decreases.

Future Market Opportunities

- Expanding Indications: Potential exploration for other ocular hypertension conditions may open new revenue streams.

- Combination Therapy: Development of fixed-dose combinations with other IOP-lowering agents could improve adherence and expand market share.

- Global Expansion: Entry into emerging markets with growing ophthalmic healthcare infrastructure can significantly enhance revenue.

- Biosimilars and Generics: Patent cliffs and market entry of generics could reduce prices by 20–40% over the next decade, pressuring premium brand prices but expanding access.

Regulatory and Market Challenges

- Pricing Regulations: Governments worldwide are increasingly scrutinizing drug prices, especially for branded ophthalmic drugs.

- Competitive Innovation: New therapies with superior efficacy, novel mechanisms, or combination options could threaten VYZULTA’s market share.

- Physician and Patient Acceptance: Physician familiarity with existing therapies may slow uptake; educational initiatives are critical.

Key Takeaways

- VYZULTA holds a strategic position in the glaucoma treatment paradigm as a novel Rho kinase inhibitor.

- Its premium pricing reflects innovation but faces long-term pressure from generics and market competition.

- The outlook suggests stable prices in the short term, with gradual reductions due to increased competition and patent expirations.

- Market growth hinges on expanding indications, improving formulary access, and global expansion efforts.

- Collaborations and combination therapies can enhance VYZULTA’s market attractiveness.

FAQs

1. What is the primary differentiator of VYZULTA compared to traditional glaucoma medications?

VYZULTA uniquely targets the Rho kinase pathway, facilitating increased aqueous humor outflow through the trabecular meshwork, offering an alternative mechanism to prostaglandins and beta-blockers.

2. How does the pricing of VYZULTA compare to other glaucoma treatments?

VYZULTA's initial list price is around $350–$400 per bottle, higher than generic options but comparable to other branded therapies, justified by its novel mechanism and clinical benefits.

3. What factors could influence future price reductions for VYZULTA?

Patent expirations, increased competition from generics or biosimilars, formulary negotiations, and healthcare policy reforms could drive prices lower over time.

4. What is the potential market size for VYZULTA over the next decade?

Given the rising prevalence of glaucoma, especially in aging populations, and its niche positioning, VYZULTA could capture a significant share of the $6.2 billion global ophthalmic market, with projected annual growth rates of 10–12%.

5. Are there opportunities for VYZULTA in markets outside the U.S.?

Yes, VYZULTA's regulatory approval in regions like Japan and the EU, along with emerging markets, presents substantial growth opportunities, potentially increasing revenue streams globally.

Sources

[1] World Glaucoma Association. The Global Glaucoma Care Study, 2020.

[2] Aerie Pharmaceuticals. VYZULTA Official Product Information, 2017.

[3] IQVIA. U.S. Prescription Data, 2022.

[4] Grand View Research. Ophthalmic Drugs Market Size & Trends, 2022.