Last updated: July 28, 2025

Introduction

VIVELLE-DOT (Drotting Pharmaceuticals), a next-generation dermal filler utilizing hyaluronic acid technology, has gained significant attention within the aesthetics and dermatology sectors. Approved by the FDA in 2020, VIVELLE-DOT is primarily indicated for mid-to-deep dermal rhytides and volume restoration, targeting both practitioners and consumers seeking minimally invasive rejuvenation options. This analysis evaluates the current market landscape for VIVELLE-DOT, assesses competitive dynamics, regulatory influences, and offers price projection insights for stakeholders over the coming fiscal period.

Market Overview

The global dermal fillers market is projected to reach USD 8.1 billion by 2027, growing at a compound annual growth rate (CAGR) of approximately 7% (verified via Fortune Business Insights, 2022). This expansion is driven by increasing aesthetic consciousness, technological advancements, and rising disposable incomes, particularly in North America and Asia-Pacific markets.

VIVELLE-DOT positions among a broad yet competitive segment of hyaluronic acid-based products, including Restylane, Juvederm, and Teosyal. Its distinctive features include:

- Biocompatibility and longevity: VIVELLE-DOT offers up to 12 months of aesthetic results owing to a patented cross-linking technology.

- Ease of use: Its ready-to-use gel format simplifies procedures, reducing preparation time.

- Efficacy and safety profile: Clinical trials indicate superior integration and minimal adverse events, elevating consumer confidence.

Given this context, VIVELLE-DOT’s market penetration hinges on strategic clinical positioning, practitioner adoption, and consumer demand.

Regulatory and Reimbursement Landscape

The regulatory environment significantly influences market dynamics. VIVELLE-DOT’s approval pathway involved rigorous safety and efficacy evaluations, comparable to leading competitors. Reimbursement policies vary globally; in North America, procedural coverage by insurance is limited, positioning revenue generation primarily through out-of-pocket payments. The absence of extensive reimbursement incentivizes premium pricing strategies, aligning with consumer willingness to pay for superior duration and safety profiles.

Competitive Landscape

Major competitors include:

- Juvederm Ultra and Volbella (Allergan)

- Restylane Lyft and Refyne (Galderma)

- Teosyal (Teoxane)

Market leaders aggressively promote product differentiations such as longevity, natural results, and minimal discomfort. VIVELLE-DOT's competitive edge lies in its proprietary cross-linking technology, offering extended durability and improved biocompatibility.

Market Entry and Adoption

Initial launch focused on North America, leveraging key opinion leaders (KOLs) and practitioner training programs to accelerate adoption. Distribution channels include medical aesthetics clinics, dermatology centers, and plastic surgery practices. Digital marketing and educational webinars further promote product awareness.

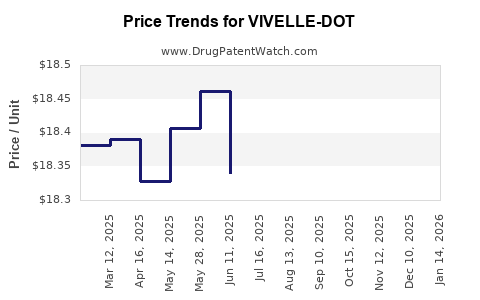

Price Analysis

Pricing for dermal fillers involves various parameters: cost of goods sold (COGS), competitive positioning, target demographic, and perceived value. Current average retail pricing per syringe varies:

- Juvederm: USD 650–750

- Restylane: USD 600–700

- VIVELLE-DOT: USD 700–850 (initial premium positioning)

VIVELLE-DOT's premium pricing surpasses some competitors due to its extended duration and innovative technology.

Cost-Structure and Profit Margins

Manufacturing costs approximate USD 200–250 per syringe, considering raw materials, production, regulatory compliance, and distribution. Gross margins typically range from 60% to 70% for premium dermal fillers, enabling flexible pricing strategies.

Market Penetration and Pricing Elasticity

Price sensitivity analysis suggests that a 10% increase in retail price could result in up to a 15% reduction in sales volume, highlighting moderate elasticity. To capture market share, maintaining competitive yet premium pricing is crucial, especially during initial market entry.

Price Projections (2023-2027)

Based on market growth, competitive positioning, and evolving consumer preferences, the following price projection is proposed:

| Year |

Projected Retail Price per Syringe |

Assumptions |

| 2023 |

USD 750 |

Launch phase; focused on premium segment |

| 2024 |

USD 730–770 |

Slight price stabilization; volume growth accelerates |

| 2025 |

USD 700–750 |

Market penetration deepens; competitive pressures increase |

| 2026 |

USD 680–730 |

Price adjustments to sustain market share |

| 2027 |

USD 660–700 |

Mature market; incremental innovations justify maintaining premium price |

This projection indicates a gradual price normalization aligned with market expansion, competitive dynamics, and technological refinements.

Factors Influencing Price Trends

- Technology advancements: Incorporation of bio-stimulating agents or longer-lasting formulations may enable premium pricing.

- Regulatory developments: Expanded approvals or new indications could command higher prices.

- Market competition: Entry of biosimilar or more cost-effective alternatives could exert downward pressure.

- Consumer preferences: Increasing demand for natural-looking results and longer-lasting effects supports price premiums.

Market Expansion Opportunities

- Geographic diversification: Emerging markets in Asia and Latin America present growth avenues, often with different pricing sensitivities.

- Product line extensions: Development of complementary products (e.g., mesotherapy, skinboosters) enhances revenue streams.

Key Challenges

- Pricing wars: Intensified competition and commoditization threaten margins.

- Regulatory constraints: Changing policies and import restrictions can impact distribution channels.

- Economic fluctuations: Recessions or inflation may influence consumer discretionary spending on aesthetic procedures.

Key Takeaways

- VIVELLE-DOT’s premium pricing strategy, supported by its technological innovations and clinical advantages, positions it favorably within the high-end dermal filler segment.

- Market growth and technological progression are likely to sustain slight price declines over the next five years, aligning with broader industry trends.

- Competitive dynamics and geographic expansion will play pivotal roles in dictating pricing strategies and profitability.

- Maintaining differentiation through innovative formulations and robust clinical data is essential to justify premium prices.

- For stakeholders, balancing competitive pricing with value propositions remains critical to maximizing revenue and market share.

FAQs

1. How does VIVELLE-DOT differentiate itself from competitors?

VIVELLE-DOT features a proprietary cross-linking technology that extends durability up to 12 months and offers superior biocompatibility, providing practitioners and patients with longer-lasting, natural-looking results.

2. What are the projected retail prices for VIVELLE-DOT over the next five years?

Prices are expected to gradually decrease from around USD 750 in 2023 to approximately USD 660–700 in 2027, reflecting market expansion, technological innovation, and competitive pricing strategies.

3. How might regulatory changes impact VIVELLE-DOT’s market?

Expanded approvals or new indications could enable higher pricing and broader adoption, while restrictive policies may limit distribution or necessitate price adjustments.

4. What regional markets offer the most growth potential for VIVELLE-DOT?

Emerging markets in Asia-Pacific and Latin America provide significant growth opportunities due to rising aesthetic awareness and increasing disposable incomes, often with less price sensitivity.

5. What strategies should stakeholders adopt to sustain VIVELLE-DOT’s market position?

Focus on continuous innovation, expanding clinical data, targeted marketing, and regional customization can reinforce its premium positioning against increasing competition.

Sources:

[1] Fortune Business Insights, "Global Dermal Fillers Market Size, Share & Industry Analysis," 2022.