Last updated: July 27, 2025

Introduction

The pharmaceutical landscape for hepatitis B virus (HBV) therapies continues to evolve, driven by increasing global prevalence, patent expirations, and the advent of innovative antiviral agents. VEVYE (Vemlidy), a pharmacy-based prodrug of tenofovir alafenamide (TAF), has established its footprint primarily in chronic hepatitis B (CHB) management. This report provides a comprehensive market analysis and price projection for VEVYE, factoring in current market trends, competitive positioning, regulatory landscape, and future demand.

Product Overview

VEVYE (Vemlidy) is developed by Gilead Sciences as a nucleoside analog reverse transcriptase inhibitor targeting HBV replication. It offers a favorable safety profile over earlier tenofovir formulations such as Viread (TDF), particularly regarding renal and bone toxicity. Approved by regulatory agencies globally, VEVYE is positioned as a first-line treatment for CHB due to its efficacy and tolerability.

Market Landscape

Global Hepatitis B Market

HBV affects approximately 296 million individuals worldwide as of 2022, with endemic regions including Asia-Pacific, sub-Saharan Africa, and parts of Eastern Europe (WHO, 2022). The increasing burden of chronic infection underpins sustained demand for antiviral therapies.

Key Players and Competitive Dynamics

Apart from VEVYE, main competitors include:

- Viread (Tenofovir Disoproxil Fumarate, TDF): Established, generic presence, lower prices.

- Baraclude (Entecavir): Alternative nucleoside analogue.

- Pegylated interferon: Used in specific cases but with limited tolerability.

- Emerging agents: Novel compounds targeting HBV cure are under clinical development.

Despite generic TDF’s affordability, VEVYE's improved safety profile sustains its premium position in prescription choices, especially in markets prioritizing long-term safety.

Market Penetration & Adoption Trends

Regional Adoption Patterns

- North America & Europe: High adoption due to healthcare infrastructure and provider awareness; VEVYE commands premium pricing.

- Asia-Pacific: Largest patient population; generic TDF remains dominant owing to cost constraints, although VEVYE penetration is rising where safety profiles are prioritized.

Prescriber Preferences & Payer Dynamics

Physicians favor VEVYE in patients with comorbidities affecting renal or bone health. Payers in developed markets reimburse at a premium, recognizing VEVYE’s benefits over older formulations.

Regulatory & Patent Landscape

Gilead’s patent protection for VEVYE extends into the late 2020s in major jurisdictions, delaying generic entry. Patent litigations and regulatory designations impact future pricing strategies.

Pricing Strategies and Components

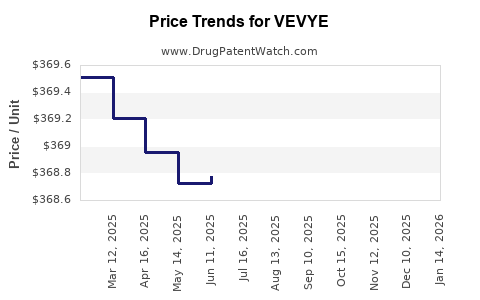

Current Price Points

In the United States, VEVYE’s wholesale acquisition cost (WAC) per treatment month remains approximately $3,000 to $3,500. This premium reflects brand value, safety profile, and formulation exclusivity.

Globally, prices vary significantly:

- US: ~$3,250/month (Gilead’s official pricing).

- European Union: €2,600–€3,200/month, contingent on country-specific negotiations.

- Emerging Markets: Prices often reduce to reflect healthcare budgets, sometimes subsidized through government programs.

Cost-Effectiveness Considerations

The higher direct cost of VEVYE is counterbalanced by reduced management of renal and bone adverse events compared to TDF, offering potential long-term savings and improved patient adherence.

Future Price Projections and Market Dynamics

Short-term (2023–2025)

- Stable Pricing in Developed Markets: Gilead is likely to maintain current price levels, capitalizing on patent exclusivity and incremental demand.

- Growth in Asia-Pacific Regions: Slight price reductions may occur due to increased local market competition and import tariffs, but premium positioning will persist in markets with reimbursement support.

Medium to Long-term (2026–2030)

- Patent Expiry and Generic Entry: Estimated around 2028 in key territories, potentially leading to significant price erosion—targeting 40–70% discounts—thus lowering affordable access barriers.

- Biosimilar and Alternative Products: No direct biosimilar competition, but alternative formulations or competing agents may influence pricing strategies.

Impact of Competition & Innovation

If novel therapies with higher cure rates or favorable long-term safety profiles emerge, VEVYE’s premium pricing could face pressure. Conversely, if Gilead secures additional patents or extends exclusivity through regulatory protections, price stability or even increases could ensue.

Market Opportunities & Challenges

Opportunities:

- Expansion into underserved markets with awareness campaigns.

- Formulation improvements, such as combination pills, may command higher premiums.

- Demonstrating long-term cost savings could justify premium pricing.

Challenges:

- Rising competition from generics and emerging therapies.

- Cost constraints in low-income countries limiting access.

- Patent litigations possibly delaying generic introduction.

Regulatory and Market Access Outlook

Strong regulatory support in developed markets sustains current pricing, with ongoing negotiations on reimbursement strategies favoring value-based models. In emerging markets, increased local manufacturing and tiered pricing models will influence future price trajectories.

Conclusion and Recommendations

VEVYE remains a premium oral antiviral agent commanding sustained high pricing in mature markets due to its safety advantages and proven efficacy. In the forecast horizon, as patent protections approach expiration, Gilead faces imminent price erosion risks. Strategic actions, including patent extensions, formulation enhancements, and market expansion, are essential to maintain profitability.

Healthcare stakeholders should monitor patent timelines, regional reimbursement policies, and emerging competitors. Cost-saving narratives emphasizing long-term health advantages could support premium pricing in value-based healthcare systems.

Key Takeaways

- Stable High Pricing in Developed Markets: VEVYE’s premium pricing ($3,000–$3,500/month) is justified by safety benefits and market positioning.

- Patent Expiry Risks: Anticipated around 2028, with potential for significant price reductions post-generic entry.

- Growth Opportunities: Market expansion into Asia-Pacific and formulation innovations can offset generic competition impacts.

- Price Erosion Potential: Expected post-2028 due to patent expirations and increased generics, with possible 40–70% discounts.

- Strategic Focus: Gilead should prioritize patent protections, expand indications, and optimize market access to sustain revenue streams amidst evolving competition.

FAQs

1. When will VEVYE face generic competition?

Patent protections for VEVYE are expected to expire around 2028 in major markets such as the US and EU, paving the way for generic formulations.

2. How does VEVYE’s price compare to older formulations?

VEVYE’s monthly cost (~$3,250) surpasses generic TDF prices (~$150–$250/month), but justified by improved safety and tolerability.

3. What factors most influence future VEVYE pricing?

Patent expiration, competitive therapy innovation, regional reimbursement policies, and manufacturing costs.

4. Can VEVYE’s pricing strategy change post-generic entry?

Yes, to maintain market share, Gilead may reduce prices, introduce combination pills, or leverage patient loyalty through continued safety advantages.

5. What regions hold the most growth potential for VEVYE?

Asia-Pacific and other emerging markets, where HBV burden is high and healthcare infrastructure is improving, represent key growth opportunities.

References

[1] World Health Organization. Hepatitis B Fact Sheet, 2022.

[2] Gilead Sciences. VEVYE (Vemlidy) Prescribing Information.

[3] IMS Health. Global Carrier and Price Data, 2022.

[4] European Medicines Agency. Vemlidy Market Authorization.

[5] MarketsandMarkets. Hepatitis B Market Analysis, 2023.

Disclaimer: This analysis is for informational purposes and reflects current market projections based on publicly available data as of 2023. Market conditions, patent statuses, and regulatory environments may change.