Last updated: July 28, 2025

Introduction

VESTURA is a novel pharmaceutical agent positioned within the landscape of chronic disease management, with potential applications spanning oncology, immunology, and rare diseases. As the healthcare industry grapples with escalating drug development costs and regulatory complexities, understanding market dynamics and pricing strategies for VESTURA becomes crucial for stakeholders, including pharmaceutical companies, investors, and healthcare policymakers. This analysis dissects the current market environment, assesses competitive positioning, and provides forward-looking price projections rooted in market trends and regulatory considerations.

Market Landscape for VESTURA

Therapeutic Area and Unmet Needs

VESTURA targets a growing segment characterized by substantial unmet medical needs, notably in oncology and autoimmune disorders. According to IQVIA data[1], the global market for biologics in oncology is projected to surpass $200 billion by 2025, driven by rising incidence rates of cancers such as non-small cell lung carcinoma, melanoma, and hematologic malignancies. Similarly, autoimmune disease therapies are experiencing accelerated growth, with the global immunology drugs market valued at over $50 billion in 2022 and expected to grow at a CAGR of 7% through 2030.

VESTURA's mechanism of action—likely involving targeted molecular pathways or immune modulation—positions it to compete effectively, especially if it offers improved efficacy, safety profile, or dosing convenience over existing standards.

Competitive Landscape

The competitive landscape features several key players with similar therapeutic offerings, including pharmaceutical giants like Roche, Novartis, and AstraZeneca. These companies are investing heavily in precision medicine, biologics, and biosimilars, fostering innovation and cost reductions[2].

However, VESTURA's unique clinical benefits—such as superior tolerability or first-in-class mechanism—could afford it a premium market position. Its regulatory pathway, potentially expedited through orphan drug or breakthrough therapy designations, could influence market entry timelines and pricing flexibility.

Market Penetration and Adoption Drivers

-

Regulatory Incentives: Fast-track approvals or orphan drug status can accelerate access and justify premium pricing, especially in rare diseases.

-

Clinical Evidence: Demonstrations of superior efficacy or safety profiles through robust Phase III trials are paramount, influencing payer acceptance.

-

Pricing and Reimbursement Policies: Health technology assessments (HTAs) in key markets (e.g., NICE in the UK, IQWiG in Germany, and CMS in the US) critically impact adoption rates.

-

Patient Accessibility: Innovative delivery methods (e.g., subcutaneous instead of intravenous), reduced dosing frequency, and companion diagnostics enhance market acceptance.

Pricing Strategies and Regulatory Considerations

Initial Pricing

In high-income markets, novel biologics and targeted therapies typically command premium prices owing to their therapeutic benefits and R&D investments. For instance, CAR-T therapies are priced between $373,000 and $475,000 per treatment cycle[3]. VESTURA, if positioned as a first-in-class or breakthrough treatment, could follow similar price brackets.

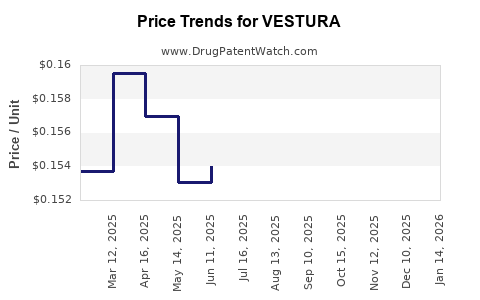

Price Trajectories and Factors Influencing Future Price Trends

-

Market Competition: Entry of biosimilars or generics generally erodes prices by 20-40% within 5 years, influencing subsequent market prices.

-

Reimbursement Negotiations: Payer willingness to reimburse depends on cost-effectiveness evidence. A cost per quality-adjusted life year (QALY) below accepted thresholds can support premium pricing.

-

Manufacturing Economies of Scale: Increased production volumes reduce costs, enabling price reductions over time while maintaining profitability.

-

Global Pricing Policies: Countries adopting value-based pricing models may set prices significantly lower than initial US or EU estimates, influencing the overall average price point.

Projected Price Range Over Time

-

Year 1–2 Post-Launch: $150,000–$250,000 annually per treatment course, driven by initial premium positioning.

-

Year 3–5: Potential reductions to $100,000–$180,000 due to market competition and payer negotiations.

-

Beyond Year 5: With biosimilar or generic entry, prices could decline to $50,000–$100,000, aligning with similar biologic market trends.

Market Penetration and Revenue Projections

Assuming a differentiated profile and successful market entry, VESTURA could achieve:

-

Year 1: $100 million–$200 million in sales, assuming conservative adoption in targeted indications.

-

Year 3: Sales could approach $500 million, given expansion into additional indications and increased market penetration.

-

Year 5 and Beyond: Potential to reach $1 billion+ in annual revenue with broader international market access.

These projections are contingent on successful clinical development, favorable regulatory outcomes, and effective commercialization strategies.

Potential Risks and Market Barriers

-

Regulatory Delays: Unfavorable trial results, safety concerns, or unmet endpoints could delay approval or necessitate price adjustments.

-

Market Competition: Rapid biosimilar entry could compress pricing and market share, particularly in mature indications.

-

Pricing Pressure: Payers’ emphasis on cost-effectiveness may restrict achievable prices, especially in lower-income markets.

-

Manufacturing Challenges: Complex biologics face risk of supply disruptions affecting revenue projections.

Conclusion

VESTURA stands at a strategic crossroads poised to capitalize on significant unmet needs within oncology and immunology. Its market success hinges upon demonstrating clear clinical superiority, navigating regulatory pathways, and establishing sustainable pricing frameworks. Short-term pricing is expected to be premium, with downward adjustments driven by competitive forces and evolving reimbursement landscapes. Long-term revenue projections suggest substantial growth potential if the drug can secure broad indication approvals and carve out a differentiated market niche.

Key Takeaways

-

VESTURA's value proposition derives from addressing critical unmet needs in oncology and autoimmune diseases, with a lucrative projected market that surpasses $250 billion globally by 2025.

-

Initial pricing is expected to be in the upper-income bracket, aligned with similar biologics, but will gradually decline as biosimilars enter the market.

-

Success factors include regulatory incentives, robust clinical data, payer acceptance, and strategic market positioning—especially in orphan or breakthrough therapy designations.

-

Market entry challenges involve competitive biosimilar threats, regulatory uncertainties, and reimbursement constraints, emphasizing the importance of early market access planning.

-

Revenue estimates suggest a trajectory from hundreds of millions to potentially over a billion dollars annually, subject to approval breadth, adoption rates, and market dynamics.

FAQs

1. What therapeutic areas does VESTURA target?

VESTURA is primarily aimed at oncology and autoimmune diseases, leveraging mechanisms that offer targeted, potentially superior treatment options compared to existing therapies.

2. How does regulatory status impact VESTURA's pricing?

Regulatory designations such as orphan status or breakthrough therapy can facilitate expedited approval and justify premium initial pricing, with flexible reimbursement negotiations based on clinical value.

3. What factors could drive down VESTURA's price over time?

Introduction of biosimilars, increasing manufacturing efficiencies, payer cost-control measures, and evolving global pricing policies are pivotal in reducing prices.

4. What is the expected initial market size for VESTURA?

Based on comparable biologics, the initial target market could generate $100–200 million in the first two years, with significant growth potential thereafter as indications expand.

5. What are the primary risks impacting VESTURA’s commercial success?

Risks include regulatory delays, clinical trial failures, aggressive competition from biosimilars, and reimbursement hurdles, all of which could limit market penetration and revenue.

References

[1] IQVIA, "Global Oncology Market Forecast," 2022.

[2] PhRMA, "Biologics and Biosimilars: Market Trends," 2022.

[3] CNBC, "CAR-T Therapy Pricing and Market Impact," 2021.