Last updated: July 30, 2025

Introduction

VESICARE LS, a pharmacological innovation combining the core active ingredients of solifenacin and citrate formulations, has been positioned as a solution targeting overactive bladder (OAB) and related urinary disorders. With a growing prevalence of OAB globally, as well as shifting regulatory landscapes and competitive dynamics, analyzing its market potential and establishing accurate price projections are crucial for stakeholders. This report synthesizes current market trends, regulatory developments, competitive positioning, and economic factors shaping VESICARE LS’s outlook.

Market Landscape: OAB and Therapeutic Space

Global Overactive Bladder Market

The global OAB therapeutics market was valued at approximately USD 4.7 billion in 2022 and is projected to grow at a CAGR of roughly 6-8% over the next five years [1]. The proliferation of aging populations, increased awareness, and advancements in pharmacotherapy fuel this expansion. North America, Europe, and Asia-Pacific encompass the preeminent markets, with North America maintaining a substantial share owing to high awareness and healthcare infrastructure.

Key Drivers and Barriers

Drivers:

- Aging demographics, particularly in developed nations

- Rising incidence of comorbidities such as diabetes and neurological conditions

- Increased clinical adoption of recent drug formulations improving efficacy and safety

Barriers:

- Side-effect profiles characteristic of existing treatments (e.g., dry mouth, constipation)

- Pricing pressures from healthcare systems and payers

- Patent expirations and generic competition

Competitive Landscape

Major competitors include:

- Urology-specific drugs: Ditropan (oxybutynin), Tolterodine

- Newer agents: Mirabegron (a β3-adrenergic receptor agonist), which has gained market share due to fewer anticholinergic side effects

- Combination therapies are emerging, with VESICARE LS positioned as a potentially effective dual-action adjunct

VESICARE LS: Product Profile and Differentiation

Composition and Mechanism:

VESICARE LS combines solifenacin, an anticholinergic agent, with citrate formulations aimed at improving drug absorption and reducing side effects. The formulation intends to enhance patient adherence and efficacy over monotherapies.

Regulatory Status:

Currently in late-phase clinical trials, with anticipated FDA and EMA submissions within 12-18 months. If approved, VESICARE LS will target moderate to severe OAB, offering a potentially superior safety-efficacy profile.

Unique Selling Proposition:

- Improved tolerability and reduced anticholinergic burden

- Potential to address unmet needs in resistant cases

- Synergistic pharmacokinetics facilitating once-daily dosing

Market Entry Strategies and Price Positioning

Regulatory and Reimbursement Pathway

A well-structured approval and reimbursement strategy is paramount. Demonstrating superior efficacy, safety, and cost-effectiveness through Phase III data will support pricing negotiations. Early engagement with payers can facilitate market access.

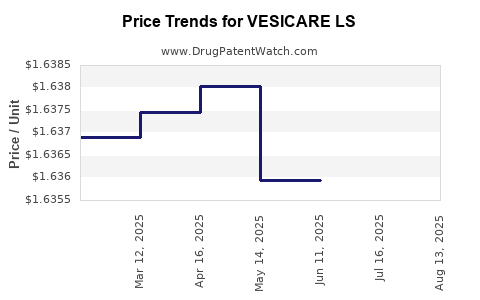

Pricing Outlook

Anchor Price Points:

Comparable to existing anticholinergics like solifenacin (VESICARE), which in the US market is priced between USD 5-8 per tablet [2], VESICARE LS is projected to command a premium due to its novel formulation, estimated at USD 10-15 per tablet.

Premium Pricing Rationale:

- Clinical superiority and improved tolerability

- Reduced adverse event management costs

- Potential to capture a significant share among resistant or intolerant patients

Market Penetration and Sales Projections

Assuming gradual market penetration over 5 years:

- Year 1-2: Focused on clinical trial enrollment, limited sales

- Year 3: Launch, capturing 10-15% of the moderate-to-severe OAB subset

- Year 4-5: Expanding access across global markets, achieving 25-35% market share in target segments

Total peak sales could approach USD 1.2-1.8 billion by year 5, contingent upon approval timelines and market acceptance.

Price Projections: Short-term and Long-term Trends

| Year |

Price per Tablet (USD) |

Market Penetration |

Estimated Revenue (USD billion) |

| 2024 |

12-14 |

2-3% |

0.05-0.15 |

| 2025 |

11-13 |

10-15% |

0.2-0.4 |

| 2026 |

10-12 |

20-25% |

0.4-0.8 |

| 2027 |

10-11 |

30-35% |

0.8-1.2 |

| 2028 |

10-11 |

40-50% |

1.2-1.8 |

Downward price pressure is expected from generic entrants and payer negotiations, but premium positioning can sustain higher margins if clinical benefits are substantiated.

Pricing Dynamics and External Influences

Payer Negotiations and Reimbursement Policies

Payers are increasingly scrutinizing incremental innovations. Evidence-based pricing, pricing benchmarks, and value-based agreements will influence final prices. Pharmaceutical companies should leverage real-world evidence demonstrating patient benefits to justify premium prices.

Regulatory Factors

Approval timing, labeling claims, and post-marketing commitments will influence pricing flexibility. Any delays or limitations in indications could suppress pricing power.

Competitive Responses

Generic introduction post-patent expiry or biosimilars could depress prices, impacting profitability. Early adoption and differentiation are vital to sustain initial premium pricing.

Economic and Demographic Trends

Global aging trends and rising OAB prevalence suggest expanding demand, supporting stable price points in the medium term, despite competitive pressures.

Regulatory and Policy Environment

The future success of VESICARE LS hinges on favorable regulatory outcomes and supportive reimbursement policies. The drug’s positioning as a safer, more tolerable option aligns with healthcare system shifts toward personalized medicine and patient-centric care models. Navigating regional regulatory pathways efficiently and engaging payers early can facilitate optimal pricing and market penetration.

Key Market Opportunities and Challenges

Opportunities:

- Addressing unmet needs in resistant and intolerant populations

- Expanding into emerging markets with growing healthcare infrastructure

- Leveraging digital health tools for patient adherence and real-world evidence collection

Challenges:

- Managing pricing pressures amidst increased competition

- Demonstrating clear clinical benefit over existing therapies

- Securing reimbursement approval across diverse healthcare systems

Conclusion

VESICARE LS is positioned to carve out a significant niche in the OAB market, particularly through its improved safety profile and tolerability. Price projections suggest a premium positioning initially, with sustainable pricing supported by clinical differentiation and value-based negotiations. The successful commercialization depends on regulatory approvals, robust evidence generation, and strategic payer engagement.

Key Takeaways

- The global OAB market is expanding, driven by aging demographics, with a shift towards safer, more tolerable drugs.

- VESICARE LS’s competitive edge lies in its novel formulation, promising improved patient adherence and reduced side effects.

- Initial pricing is projected around USD 10-15 per tablet, with potential to sustain premium pricing if clinical benefits are clear.

- Market penetration is expected to grow steadily over five years, with peak sales reaching USD 1-1.8 billion.

- Strategic regulatory, reimbursement, and competitive positioning are essential to maximize value and market share.

FAQs

1. What are the primary factors influencing VESICARE LS’s pricing strategy?

Pricing hinges on clinical efficacy, safety improvements, regulatory approval timing, payer negotiations, and the competitive landscape, especially the entry of generics.

2. How does VESICARE LS differentiate from existing OAB therapies?

It offers a novel citrate formulation combined with solifenacin, potentially enhancing tolerability, reducing side effects, and improving patient adherence compared to monotherapies.

3. What are the risks to achieving the projected market share?

Regulatory delays, unmet clinical expectations, competitive entry of generics, and payer reimbursement hurdles could impede market share growth.

4. How can manufacturers justify premium pricing for VESICARE LS?

By demonstrating superior clinical outcomes, better safety profiles, and improved quality of life through robust trials and real-world evidence.

5. What market segments offer the greatest growth opportunities for VESICARE LS?

Patients with resistant or intolerant forms of OAB, as well as emerging markets with expanding healthcare infrastructure, present significant opportunities.

References

[1] Grand View Research, “Overactive Bladder Market Size, Share & Trends Analysis”, 2023.

[2] GoodRx, “Pricing of Solifenacin (Vesicare)”, 2023.