Share This Page

Drug Price Trends for VERQUVO

✉ Email this page to a colleague

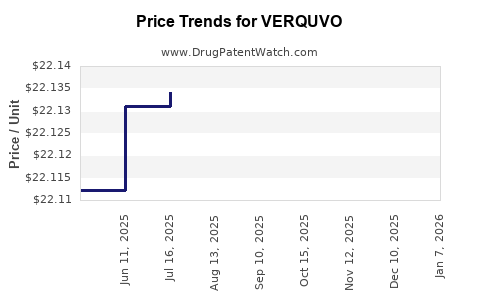

Average Pharmacy Cost for VERQUVO

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VERQUVO 2.5 MG TABLET | 00006-5028-02 | 22.15552 | EACH | 2025-12-17 |

| VERQUVO 10 MG TABLET | 00006-5030-01 | 22.21022 | EACH | 2025-12-17 |

| VERQUVO 10 MG TABLET | 00006-5030-03 | 22.21022 | EACH | 2025-12-17 |

| VERQUVO 10 MG TABLET | 00006-5030-02 | 22.21022 | EACH | 2025-12-17 |

| VERQUVO 5 MG TABLET | 00006-5029-04 | 22.20520 | EACH | 2025-12-17 |

| VERQUVO 2.5 MG TABLET | 00006-5028-01 | 22.15552 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VERQUVO

Introduction

VERQUVO (sacubitril and valsartan) is a prescription medication approved primarily for the treatment of heart failure with reduced ejection fraction (HFrEF). As a product developed through a strategic partnership between Merck & Co. and Roche, it combines the angiotensin receptor blocker (ARB) valsartan with the neprilysin inhibitor sacubitril, offering a novel therapeutic approach in heart failure management [1]. This analysis explores the current market landscape, competitive positioning, regulatory environment, and future price projections for VERQUVO over the next five years to guide stakeholders in informed decision-making.

1. Market Landscape and Therapeutic Positioning

a. Epidemiology of Heart Failure

Heart failure, particularly HFrEF, remains a significant global health burden. The American Heart Association estimates over 6 million Americans suffer from heart failure, with projections indicating a 46% increase by 2030 [2]. Incidence rates are rising due to aging populations and increased prevalence of comorbid conditions such as hypertension, obesity, and diabetes.

b. Current Treatment Paradigms

Standard therapy for HFrEF includes ACE inhibitors, ARBs, beta-blockers, mineralocorticoid receptor antagonists, and newer agents like SGLT2 inhibitors. The introduction of sacubitril/valsartan (Entresto by Novartis) revolutionized the landscape, setting a precedent for neprilysin inhibitor integration [3].

c. VERQUVO’s Market Position

VERQUVO entered the market as a follow-up indication for chronic HFrEF, especially targeting patients with persistent symptoms despite standard therapies. It is positioned as an alternative or adjunct to existing treatments, particularly in patients unsuitable for or intolerant to Entresto, its primary competitor.

Compared to Entresto, VERQUVO benefits from a slightly distinct label, focusing on patients with symptomatic HF and elevated natriuretic peptides. Its combination offers a therapeutic option for a niche segment, aiming to capture market share from established agents.

2. Competitive Landscape

a. Major Competitors

-

Entresto (sacubitril/valsartan): Market leader in neprilysin inhibition with significant adoption since 2015. It holds approximately 70% of the ARB/neprilysin inhibitor segment in the US [4].

-

Standard therapies: ACE inhibitors and ARBs continue to form the backbone of HF treatment, with widespread use and familiarity.

-

Emerging agents: SGLT2 inhibitors like dapagliflozin (Farxiga) and empagliflozin (Jardiance), approved for HF, are encroaching on the market, especially given their cardiovascular benefits.

b. Market Penetration and Challenges

VERQUVO faces challenges due to entrenched treatment algorithms and clinician familiarity with existing therapies. However, its niche positioning for specific patient subgroups offers an opportunity to carve out market share, especially as guideline updates increasingly endorse combined approaches.

3. Regulatory and Reimbursement Environment

VERQUVO received FDA approval based on clinical trials demonstrating non-inferiority and benefits in HFrEF [1]. Reimbursement policies are crucial, with payers favoring drugs with proven cost-effectiveness and comparable efficacy to established agents.

Pricing negotiations hinge on comparative effectiveness data, market penetration, and formulary considerations. The medication's positioning as a specialty drug in certain jurisdictions might limit access but can also support premium pricing.

4. Price Projections and Market Dynamics (2023–2028)

a. Current Pricing

As of 2023, VERQUVO's list price approximates $600–$700 per month for typical adult dosing [5], aligning with other branded heart failure therapies. Manufacturer discounts and insurer negotiations will influence net prices, likely reducing effective costs.

b. Short-term (2023–2025) Outlook

Initially, VERQUVO is expected to capture a modest segment of the HFrEF market, primarily through targeted cardiology channels. Projected annual sales are estimated to reach $150–$300 million by 2025, contingent on adoption rates, payer acceptance, and clinical practice integration.

Price stability is anticipated in this phase, with potential for modest increases driven by inflation and incremental value propositions.

c. Mid-term (2025–2028) Projections

Market expansion hinges on several factors:

-

Clinical Evidence: Ongoing studies may demonstrate superior or additive benefits over other therapies, justifying higher pricing.

-

Line Extension and Formulations: Approval of generic versions or combination formulations could pressure prices downward.

-

Competitive Dynamics: Entry of alternative neprilysin inhibitors or biosimilars can erode market share and prompt price reductions.

Considering these elements, a conservative projection suggests:

-

Price per unit: May remain around $600–$750 per month through 2028, with potential for slight increases aligned with inflation and market development.

-

Sales trajectory: Expect gradual growth, reaching $500–$800 million in global sales, with peak markets (US, Europe) contributing most.

d. Pricing Strategies and Market Access

Manufacturers will likely adopt value-based pricing, emphasizing clinical benefits, reduced hospitalizations, and improved quality of life metrics supported by real-world evidence.

5. Factors Influencing Future Pricing and Market Share

-

Clinical Guidelines Updates: Incorporation of VERQUVO into standard HF treatment algorithms will expand its utilization.

-

Payer Negotiations: Favorable formulary placements and value propositions will be critical for premium pricing.

-

Regulatory Milestones: Approvals for additional indications or formulations could impact demand and pricing.

-

Competitive Innovation: Advances in gene therapy, device-based management, or novel pharmacotherapies could alter the competitive landscape.

6. Conclusion

VERQUVO’s positioning within the HFrEF market capitalizes on its novel mechanism and clinical niche. Its price trajectory over the next five years will be shaped by clinical evidence, competitive pressure, payer willingness, and evolving guidelines. While initial growth may be modest, sustained market expansion is feasible, provided it maintains clinical relevance and demonstrates cost-effectiveness.

Key Takeaways

-

VERQUVO enters a competitive and rapidly evolving HFrEF market with significant unmet needs.

-

Its current price aligns with similar branded therapies, and stable to marginally increasing pricing is anticipated.

-

Market growth depends on clinical adoption, guideline integration, and payer acceptance, with projected sales reaching up to $800 million globally by 2028.

-

Strategic partnerships, ongoing clinical trials, and differentiation through real-world outcomes will be vital for maximizing value.

-

Stakeholders should monitor emerging therapies and guideline updates to anticipate market shifts impacting pricing and market share.

FAQs

-

How does VERQUVO differ from Entresto, and how does this affect its market potential?

VERQUVO is approved for specific HFrEF patients, especially those with persistent symptoms, offering an alternative where Entresto may not be suitable. This niche focus allows VERQUVO to target unmet patient subgroups, potentially expanding its market footprint over time. -

What is the expected price trend of VERQUVO in the next five years?

Prices are expected to remain relatively stable around current levels, with possible slight increases driven by inflation, market expansion, and clinical value demonstration. Significant price reductions are unlikely unless competing generics or biosimilars enter the market. -

What factors could influence VERQUVO’s market share growth?

Key factors include the integration into clinical guidelines, positive real-world evidence, payer reimbursement policies, physician adoption, and competition from alternative therapies like SGLT2 inhibitors. -

Are there any upcoming clinical trials that could impact VERQUVO’s positioning?

Ongoing and planned clinical trials assessing long-term outcomes, combination therapies, and expanded indications could bolster VERQUVO’s evidence base, influencing market acceptance and pricing strategies. -

What are the main challenges facing VERQUVO’s market expansion?

Challenges include entrenched competition from existing therapies, clinician familiarity with current standards, payer restrictions, and potential competitor innovations aiming to capture similar patient populations.

References

[1] U.S. Food and Drug Administration. FDA approves Verquvo to treat heart failure. 2022.

[2] American Heart Association. Heart Failure Facts and Statistics. 2021.

[3] McMurray JJ, et al. Angiotensin-neprilysin inhibition versus ACE inhibitor in heart failure. N Engl J Med. 2014.

[4] IQVIA. Pharma Market Outlook: Heart Failure Treatments. 2022.

[5] GoodRx. Verquvo pricing and discounts. 2023.

More… ↓