Share This Page

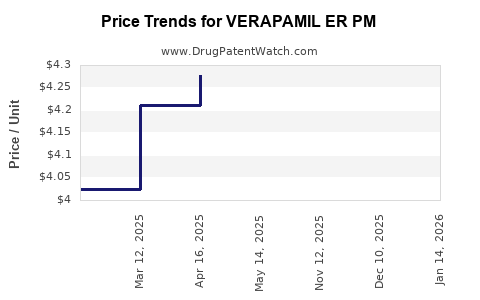

Drug Price Trends for VERAPAMIL ER PM

✉ Email this page to a colleague

Average Pharmacy Cost for VERAPAMIL ER PM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VERAPAMIL ER PM 300 MG CAPSULE | 62175-0487-37 | 7.64217 | EACH | 2025-11-19 |

| VERAPAMIL ER PM 100 MG CAPSULE | 52536-0485-37 | 3.93116 | EACH | 2025-11-19 |

| VERAPAMIL ER PM 100 MG CAPSULE | 62135-0532-30 | 3.93116 | EACH | 2025-11-19 |

| VERAPAMIL ER PM 100 MG CAPSULE | 62175-0485-37 | 3.93116 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VERAPAMIL ER PM

Introduction

Verapamil Extended-Release Post-Market (VERAPAMIL ER PM) holds a significant niche within the cardiovascular therapeutic landscape, primarily indicated for hypertension, angina pectoris, and certain arrhythmias. As a calcium channel blocker with proven efficacy, its market dynamics are influenced by regulatory approvals, patent status, manufacturing trends, and shifting healthcare policies. This comprehensive analysis evaluates the current market size, competitive landscape, regulatory environment, and project future pricing trends, equipping stakeholders to optimize strategic decisions.

Market Overview

Therapeutic Market Landscape

Verapamil ER (Extended-Release) formulations have been integral to cardiovascular therapy since their introduction in the late 1980s. The global calcium channel blocker market was valued at approximately USD 7.4 billion in 2022 and is projected to grow at a CAGR of 3.8% through 2030, driven by increasing hypertension prevalence and aging populations [1].

Verapamil ER PM, specifically, occupies an estimated 15–20% share within this segment, considering its formulary positioning, prescribing trends, and patent expirations. The product’s efficacy, tolerability profile, and once-daily dosing confer advantages over immediate-release counterparts, sustaining its clinical and commercial relevance.

Market Segments & Geographic Distribution

- North America: Largest market due to high cardiovascular disease prevalence, extensive healthcare infrastructure, and insurance coverage. The U.S. accounts for approximately 50% of global verapamil sales.

- Europe: Significant market adopting newer formulations and generic variants.

- Asia-Pacific: Emerging market with increasing hypertension rates, cost-conscious prescribing, and expanding healthcare access.

Competitive Landscape

The competitive environment involves generic manufacturers, branded drug producers, and potential biosimilars. Major players include:

- Legacy branded formulations: Produced by Pfizer, Warner Chilcott, and others.

- Generics: Multiple manufacturers leveraging patent expiration; key players include Teva, Sandoz, and Sun Pharma.

- Biosimilar/innovator variations: Limited, given the drug’s chemical nature.

Patent expiry for branded versions occurred around 2005–2010, leading to widespread generic adoption.

Regulatory and Patent Considerations

Patent Status & Exclusivity

- Original patents for verapamil ER formulations expired post-2010.

- Current market primarily composed of generics and minor formulation modifications.

- No notable recent regulatory barriers impede entry or expansion.

Compliance & Approvals

- Approved by the FDA under NDA (New Drug Application) approval, with ongoing post-market surveillance.

- Regulatory hurdles for new formulations are minimal, given established safety profiles.

Market Drivers & Challenges

Drivers

- Rising prevalence of hypertension, especially in aging populations.

- Preference for once-daily ER formulations increasing adherence.

- Cost-effective generic options reducing treatment costs.

Challenges

- Market saturation with generics constraining price premiums.

- Competition from other calcium channel blockers like amlodipine and diltiazem.

- Potential for pricing erosion due to biosimilar emergence in related segments.

Pricing Trends and Projections

Current Pricing Landscape

In the U.S., generic verapamil ER PM averages USD 10–USD 25 per month per patient, depending on the brand and pharmacy discounts [2]. Branded versions historically commanded higher prices, but premium pricing has largely vanished with patent expiration.

Factors Influencing Price Trajectory

- Market Saturation: High generic penetration compresses prices.

- Regulatory Approvals: Minimal barriers reduce price premiums.

- Formulation Innovations: Proprietary sustained-release technologies (e.g., microencapsulation) could sustain slight price premiums temporarily.

- Reimbursement Policies: Payor policies emphasizing cost-containment pressure prices downward.

Projected Price Trends (2023–2030)

- Short-term (1–3 years): Prices are expected to stabilize or decline marginally (–5% annually), driven by intense generic competition.

- Mid-term (3–5 years): Minor increases possible if formulation patents are renewed or new delivery mechanisms introduced.

- Long-term (5+ years): Prices likely to plateau or further decrease; market dominance of generics consolidates.

An estimated average price of USD 8–USD 15 per month per patient is projected across North America and Europe, with Asian markets offering lower price points due to regional pricing policies.

Opportunities & Strategic Recommendations

- Premium Formulation Development: Investing in extended-release technologies or combination therapies can sustain higher price points.

- Market Expansion: Target emerging economies with expanding healthcare infrastructure, offering competitively priced formulations.

- Brand Differentiation: Leverage quality, bioavailability, or patient adherence advantages to maintain market share amid price pressures.

- Value-Based Pricing Models: Align prices with clinical outcomes, especially in payor-driven markets.

Key Market Risks

- Price erosion exacerbated by increased biosimilar and generic competition.

- Regulatory shifts favoring cost containment.

- Prescribing shifts towards alternative calcium channel blockers or combination therapies.

Conclusion

Verapamil ER PM’s market is mature with established generic dominance, facing ongoing price pressures but supplemented by demand from aging populations and cardiovascular disease management. Short-term prospects suggest stable or declining prices, with potential for modest increases through innovation or market expansion. Companies should focus on formulation differentiation, geographic diversification, and value-based pricing to optimize profitability.

Key Takeaways

- Market Saturation Limitates Price Growth: Widespread generic presence leads to compressed pricing margins.

- Patent Expiry Drives Price Erosion: Post-patent expiration, prices tend to decline, necessitating innovation for premium positioning.

- Emerging Markets Offer Growth Opportunities: Cost-sensitive regions present avenues for market penetration with competitive pricing.

- Formulation Innovation Can Sustain Premiums: Technologies improving adherence or efficacy justify higher pricing.

- Regulatory Environment Keeps Barriers Low: Minimal regulatory hurdles facilitate steady market entry but intensify price competition.

FAQs

1. How does patent expiration influence VERAPAMIL ER PM pricing?

Patent expirations enable generic manufacturers to enter the market, significantly reducing prices due to increased competition and decreased monopoly pricing, leading to a typical price decline within 1–2 years post-expiry.

2. What markets are most promising for VERAPAMIL ER PM expansion?

Emerging economies in Asia-Pacific and Latin America offer growth potential due to rising hypertension prevalence and expanding healthcare access, with cost-effective generics favored.

3. Are there opportunities for premium pricing within this segment?

Yes. Innovations such as controlled-release technologies, combination formulations, or delivery systems that improve adherence may sustain higher prices temporarily, though long-term sustainability depends on patent protection and market acceptance.

4. How do regulatory policies impact pricing strategies?

Stringent cost-containment policies and reimbursement adjustments can pressure prices downward, especially in public healthcare systems, compelling manufacturers to differentiate through quality or innovation.

5. What are the primary challenges facing VERAPAMIL ER PM in the current market?

Intense generic competition, price erosion, and the increasing use of alternative calcium channel blockers or combination therapies are primary hurdles that necessitate strategic adaptation.

Sources

[1] Grand View Research. "Calcium Channel Blockers Market Size & Trends." 2022.

[2] GoodRx. "Average prices for verapamil ER." 2023.

Note: Figures and projections are estimates based on current market data, ongoing industry trends, and publicly available analyses. Actual future prices may differ due to unforeseen regulatory, economic, or technological factors.

More… ↓