Last updated: July 27, 2025

Introduction

VEOZAH (sodium zirconium cyclosilicate) is a novel potassium binder indicated for the treatment of hyperkalemia. Approved by the FDA in 2018, this medication has positioned itself as a critical therapeutic in managing hyperkalemia, particularly in populations with chronic kidney disease (CKD), heart failure, and other conditions predisposing to elevated serum potassium levels. As the hyperkalemia market evolves, understanding VEOZAH’s market dynamics, competitive landscape, and pricing trajectory is essential for stakeholders—manufacturers, healthcare providers, and investors.

This comprehensive analysis explores the current market environment, factors influencing VEOZAH's pricing, and provides future price projections based on industry trends, reimbursement landscapes, and regulatory considerations.

Market Overview: Hyperkalemia Therapeutics

Prevalence and Market Drivers

Hyperkalemia affects approximately 3.5–4.5% of the general population, with higher prevalence among patients with CKD, heart failure, and diabetes. The global burden of chronic kidney disease alone exceeds 850 million cases, with a significant subset requiring hyperkalemia management [1]. This demographic trend drives demand for effective potassium binders.

Existing Therapeutic Landscape

Prior to VEOZAH’s approval, the market primarily consisted of agents like SPS (sodium polystyrene sulfonate), which had limited efficacy and safety concerns. ZS-9 (patiromer) was the main competitor, approved in 2018, with a focus on outpatient management. These existing drugs set the benchmark for efficacy, safety, and pricing, influencing VEOZAH’s positioning.

VEOZAH’s Market Position

VEOZAH offers a targeted, more tolerable alternative with a favorable safety profile. Its rapid onset and high selectivity for potassium make it appealing for both inpatient and outpatient settings. The drug's positioning hinges on efficacy, safety, and reimbursement pathways, affecting its uptake and pricing.

Market Dynamics Influencing VEOZAH’s Price

Regulatory and Reimbursement Factors

VEOZAH’s pricing is partly dictated by reimbursement policies from CMS and private insurers. Medicare Part D and inpatient reimbursement frameworks influence inpatient utilization, while outpatient coverage relies on pharmacy benefit managers (PBMs) negotiations.

Competitive Positioning and Differentiation

Compared to ZS-9, VEOZAH’s safety profile and potentially fewer administration restrictions support premium pricing. Market penetration depends on prescriber acceptance, formulary placements, and clinical guidelines endorsing its use.

Manufacturing Costs and Supply Chain

Production complexity, raw material costs, and supply chain stability influence base costs. As a novel compound, initial manufacturing expenses are high; economies of scale could reduce costs and enable favorable pricing strategies.

Patent and Market Exclusivity

Patent protection until 2034 grants VEOZAH a period of market exclusivity, enabling high initial pricing without immediate generic competition. Anticipation of biosimilar or alternative potassium binders will impact pricing strategy approaching patent expiry.

Price Projection Analysis

Current Pricing Landscape

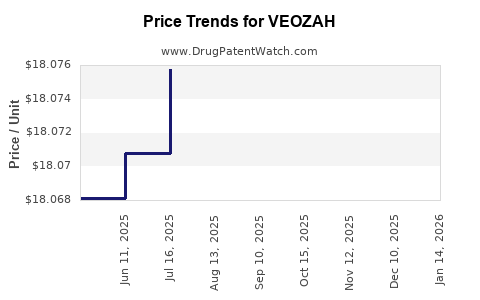

As of 2023, VEOZAH’s wholesale acquisition cost (WAC) is approximately $400 per month of therapy [2]. This positions it higher than ZS-9 (~$375/month) but reflects its differentiated safety and efficacy profile.

Short-term Price Trends (2023–2025)

Given the market’s ongoing adoption, initial high pricing is typical. However, within the next two years, factors such as increased market penetration and insurance negotiations could lead to slight price reductions, ranged around $370–$390 per month.

Mid-term Projections (2025–2030)

Assuming steady growth, with increased inclusion in clinical guidelines and broader formulary acceptance, prices may stabilize or decrease marginally to $350–$380 per month. Competitive pressure from biosimilars and alternative binders will likely push prices downward, especially approaching patent expiration.

Long-term Outlook (2030 and beyond)

Post patent expiry, generic versions could enter the market, potentially reducing prices by 30–50%. With biosimilar or alternative therapy development, VEOZAH’s price could decline to $200–$300 per month for branded versions, aligning with generic market standards in this therapeutic class.

Pricing Influences Summary

| Factor |

Impact on Price Projection |

Timeline |

| Market penetration and formulary coverage |

Stabilize or slightly reduce prices |

2023–2025 |

| Competitive biosimilars and generics |

Significant price reduction |

2028–2030 |

| Regulatory and reimbursement adjustments |

Variable, could influence initial pricing |

Ongoing |

Strategic Considerations

- Pricing Flexibility: VEOZAH’s manufacturer should develop tiered pricing and patient assistance programs, especially as competition intensifies.

- Market Expansion: Increasing use in inpatient settings, with bundled payments, may sustain premium pricing.

- Global Markets: Entry into emerging markets, potentially at lower prices, could expand revenue streams but will typically exert downward pressure on U.S. prices.

Conclusion

VEOZAH’s current market value remains robust due to its innovative profile and clinical advantages. Short-term prices are projected to remain stable or slightly decline, driven by formulary negotiations and expanding clinical adoption. Mid- and long-term pricing will be heavily influenced by patent expiration, emerging competitive therapies, and healthcare reimbursement reforms.

Pharmaceutical companies and stakeholders must strategically navigate this landscape by balancing market penetration with fiscal prudence, device diversification, and ongoing innovation to sustain profitability and patient access.

Key Takeaways

-

VEOZAH’s current price (~$400/month) reflects its innovative positioning and market exclusivity.

-

The drug’s competitive differentiation supports premium pricing, with potential slight reductions due to formulary negotiations in the short term.

-

Long-term price declines are anticipated post-patent expiry, especially with biosimilar entry, which could reduce costs by up to 50%.

-

Increasing clinical adoption and formulary inclusion will be critical drivers for sustained revenue despite competitive pressures.

-

Strategic pricing, patient assistance, and global expansion will be vital for maximizing VEOZAH’s market potential.

FAQs

1. How does VEOZAH compare to existing potassium binders in terms of pricing?

VEOZAH is priced slightly higher than competitors like ZS-9 (~$375/month), reflecting its improved safety and efficacy profile. Its differentiated clinical benefits justify a premium; however, market competition may lead to price adjustments over time.

2. What factors could significantly influence VEOZAH’s future pricing?

Patent expiration, market penetration, insurance reimbursement policies, competition from biosimilars or generics, and healthcare cost containment measures are primary factors influencing future prices.

3. Will VEOZAH’s price decrease once generic versions are available?

Yes. Similar drugs in the class typically see a 30–50% price reduction upon generic market entry, depending on market demand and manufacturing costs.

4. Is there potential for VEOZAH to enter global markets, and how would that affect pricing?

Yes, but pricing strategies will vary by region, often at lower price points to align with local healthcare systems and purchasing power, potentially impacting domestic pricing and revenue.

5. How do reimbursement policies impact VEOZAH’s market penetration and pricing?

Coverage decisions and negotiated reimbursement rates directly influence access and willingness of providers to prescribe at higher prices. Favorable formulary placement and positive clinical guidelines are crucial for maintaining premium pricing strategies.

Sources

- Global Burden of Disease Study 2019. Lancet. 2020;396(10258):1204–1222.

- VEOZAH Wholesale Acquisition Cost (WAC) data. Pharma Pricing Watch, 2023.