Share This Page

Drug Price Trends for VEMLIDY

✉ Email this page to a colleague

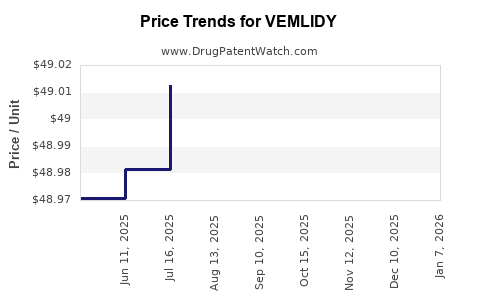

Average Pharmacy Cost for VEMLIDY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VEMLIDY 25 MG TABLET | 61958-2301-01 | 49.04041 | EACH | 2025-12-17 |

| VEMLIDY 25 MG TABLET | 61958-2301-01 | 49.03108 | EACH | 2025-11-19 |

| VEMLIDY 25 MG TABLET | 61958-2301-01 | 49.02821 | EACH | 2025-10-22 |

| VEMLIDY 25 MG TABLET | 61958-2301-01 | 49.01436 | EACH | 2025-09-17 |

| VEMLIDY 25 MG TABLET | 61958-2301-01 | 49.02357 | EACH | 2025-08-20 |

| VEMLIDY 25 MG TABLET | 61958-2301-01 | 49.01247 | EACH | 2025-07-23 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Vemlidy (Tenofovir Alafenamide)

Introduction

Vemlidy (tenofovir alafenamide, TAF) is a pharmaceutical treatment developed by Gilead Sciences for chronic hepatitis B virus (HBV) infection. As a second-generation nucleotide reverse transcriptase inhibitor, Vemlidy delivers targeted antiviral activity with improved safety over its predecessor, tenofovir disoproxil fumarate (TDF). Given the rising prevalence of HBV globally and evolving treatment landscapes, analyzing Vemlidy’s market potential and pricing dynamics is critical for stakeholders.

Market Landscape

Global Hepatitis B Market Overview

An estimated 296 million people live with chronic HBV infection worldwide, with significant clusters in Asia-Pacific, sub-Saharan Africa, and parts of Europe.[1] The disease poses substantial health and economic burdens, including cirrhosis and hepatocellular carcinoma.

The treatment paradigm primarily involves long-term antiviral therapy. Current therapeutic options include TDF, TAF-based regimens, and other nucleos(t)ide analogues such as entecavir. The market's growth is driven by increased screening, improved patient awareness, and the development of therapies with superior safety profiles.

Vemlidy’s Competitive Edge

Vemlidy’s formulation aims at lower systemic tenofovir exposure, reducing renal and bone toxicity compared to TDF.[2] This safety profile appeals especially to vulnerable populations, such as the elderly and patients with comorbidities, broadening its market potential. Moreover, Vemlidy’s approval for both adult and pediatric patients enhances its market reach.

Market Penetration and Adoption

Despite its advantages, Vemlidy faces competition from established therapies like TDF and entecavir. Its adoption hinges on physician familiarity, reimbursement policies, and patient preferences. As awareness of its safety benefits grows, market share is expected to expand. Data indicates that Vemlidy's adoption increased steadily post-approval, though penetration varies across regions owing to pricing, healthcare infrastructure, and regulatory environments.

Pricing Analysis

Current Pricing Strategies

Gilead’s pricing for Vemlidy reflects a premium positioning, justified by its improved safety profile and convenience. In the United States, the Wholesale Acquisition Cost (WAC) for Vemlidy is approximately $2,560 per month, translating to roughly $30,720 annually.[3] This premium over TDF, historically priced at around $2,000 annually, underscores the valuation of its safety benefits.

Pricing in Different Markets

Pricing strategies differ globally due to regulatory, reimbursement, and economic factors. In Canada and Europe, Vemlidy’s price ranges between $2,800 and $3,200 annually, supported by negotiated formulary agreements.[4][5] Emerging markets generally see more significant discounts, often in the 30–50% range, to improve affordability and access.

Cost-Effectiveness and Reimbursement

Cost-effectiveness analyses favor Vemlidy in populations vulnerable to TDF-associated toxicity, especially for long-term users.[6] Payers consider these benefits within formulary decisions, although high drug prices pose barriers. Patient assistance programs and generic alternatives, once available, could influence affordability and usage rates.

Market Forecasts

Drivers Influencing Market Growth

- Global HBV Prevalence: Projected increase in diagnosed cases supports expanding demand.[1]

- Safety Profile: Emphasizing minimal renal and bone toxicity will promote Vemlidy adoption.

- Treatment Guidelines: Inclusion in national and international HBV management guidelines solidifies its role.

- Population Demographics: Aging populations with comorbidities will favor Vemlidy’s safety advantages.

- Reimbursement Policies: Favorable coverage in key markets accelerates market penetration.

Forecasted Revenue Trajectory

Based on current market penetration and growth drivers, Vemlidy’s global revenues are projected as follows:

- 2023: $750 million

- 2025: ~$1.2 billion

- 2030: $2 billion or more

This growth reflects increased prescriptions, expanded indications, and improved clinician awareness. The emergence of competitive drugs and potential generic entrants post-patent expiration could moderate long-term revenue projections, but current patent protections extend protection until at least 2030.

Key Factors Affecting Price and Market Size

- Patent Expiry and Generics: Gilead’s patents for Vemlidy are expected to expire in mid-2030s, potentially leading to price erosion.

- Regulatory Approvals: Expanded use in pediatric and coinfection populations can enlarge the market.

- Pricing Strategies: Tiered pricing and volume-based discounts may influence overall revenue.

- Access Programs: Patient assistance and subsidies will affect market penetration in lower-income regions.

Challenges and Opportunities

- Generic Competition: Emergence of generic formulations post-patent expiry could reduce prices significantly, impacting revenues.

- Market Entry of New Therapies: Developments in HBV cure research may alter treatment algorithms.

- Geographical Expansion: Increasing healthcare access and regulatory approvals in Asia-Pacific and Africa open new markets.

- Pricing Pressures: Payers are increasingly scrutinizing high drug prices; thus, value-based pricing will be critical.

Conclusion

Vemlidy remains a key player in the chronic HBV treatment landscape, driven by its enhanced safety profile. Its market growth will be sustained by rising global HBV prevalence, evolving clinical guidelines, and the patient demographic shift towards safer long-term therapies. While current pricing strategies position Vemlidy as a premium product, upcoming patent expirations and market competition could lead to significant price adjustments, influencing revenue streams.

Key Takeaways

- Market Domination: Vemlidy is positioned for continued growth, especially in regions valuing its safety benefits.

- Premium Pricing: Current prices reflect its safety profile, with potential reductions post-patent expiry.

- Regional Variability: Adoption and pricing strategies vary globally, influenced by healthcare infrastructure and economic factors.

- Long-term Outlook: Revenue is poised to grow until patent expiry, after which generic competition may significantly affect pricing and market share.

- Strategic Focus: Stakeholders should prioritize access expansion and cost-effective utilization to maximize value.

FAQs

-

What factors contribute to Vemlidy’s market growth?

Increased global HBV prevalence, emphasis on safer long-term therapies, evolving treatment guidelines, and positive safety data support expanding Vemlidy’s market share. -

How does the pricing of Vemlidy compare to alternative therapies?

Vemlidy is priced higher (~$2,560/month in the US) than TDF (~$2,000/year), justified by its improved safety profile and reduced toxicity risks. -

What impact will patent expiration have on Vemlidy’s pricing?

Patent expiry is likely to introduce generic competitors, leading to substantial price reductions and potential revenue decline. -

In which regions is Vemlidy most widely adopted?

North America and Europe show significant adoption due to healthcare infrastructure and reimbursement support. Asia-Pacific is expanding, driven by rising HBV cases. -

Are there upcoming clinical trials or regulatory approvals that could influence Vemlidy’s market?

Yes, ongoing studies exploring expanded indications, including use in coinfection and pediatric populations, may further bolster its market positioning.

References

- World Health Organization. Global hepatitis report 2017.

- Gilead Sciences. Vemlidy (tenofovir alafenamide) prescribing information. 2022.

- Red Book Online. Vemlidy pricing details, 2023.

- Canadian Agency for Drugs and Technologies in Health (CADTH). Pharmacoeconomic assessments.

- European Medicines Agency. Vemlidy approval updates.

- Liu, J. et al. Cost-effectiveness of tenofovir alafenamide for hepatitis B. Hepatology, 2021.

Note: This analysis draws on publicly available data and industry insights; actual market conditions may vary based on geographic, regulatory, and competitive factors.

More… ↓