Last updated: July 27, 2025

Introduction

VELPHORO, a novel pharmaceutical agent, is gaining attention within the oncology and infectious disease sectors. As the pharmaceutical landscape evolves, understanding its market positioning and future pricing trajectory becomes critical for stakeholders, including investors, healthcare providers, and regulatory bodies. This analysis synthesizes current market conditions, regulatory pathways, competitive dynamics, and pricing strategies to project VELPHORO's market performance and price outlook over the coming five years.

Overview of VELPHORO

VELPHORO is a proprietary medication developed by [Company Name], designed to target difficult-to-treat oncological and infectious conditions. It boasts a unique mechanism of action, high specificity, and a favorable safety profile, supported by promising clinical trial data. The drug has received FDA Breakthrough Therapy designation, expediting its development process and signaling significant therapeutic potential.

Current Market Landscape

1. Market Size and Demand Drivers

The primary indication for VELPHORO is [specific indication, e.g., a rare form of lymphoma], with an estimated global market worth approximately $X billion as of 2023. The demand is driven by increasing prevalence of [indication], advances in targeted therapy, and unmet clinical needs. Additionally, VELPHORO’s potential to address resistant disease forms further enhances its market appeal.

2. Competitive Environment

The landscape comprises several established therapies, including [list key competitors], which currently dominate the treatment paradigm. However, VELPHORO’s distinctive mechanism offers a competitive advantage, especially if clinical data demonstrate superior efficacy and tolerability. Pending regulatory approvals in multiple jurisdictions could expand its market share swiftly.

3. Regulatory Outlook

Aligned with a promising safety and efficacy profile, VELPHORO is progressing through Phase III trials, with potential FDA approval within 12-18 months. Early regulatory feedback indicates a likelihood of rapid approval pathways, which could influence initial pricing strategies.

4. Reimbursement and Access

Reimbursement landscape remains favorable, given the drug’s potential to fill significant unmet needs. Payer willingness to adopt VELPHORO hinges on demonstrated cost-effectiveness and clinical benefits demonstrated during pivotal trials.

Market Opportunities and Challenges

Opportunities

- Expansion into additional indications, such as [another relevant condition], could double the market potential.

- Strategic alliances with healthcare providers and payers for early adoption can accelerate uptake.

- Price premiums justified by clinical advantages and innovative formulation.

Challenges

- High R&D and clinical development costs may limit initial profitability.

- Competitive entries from biosimilars or generics post-patent expiry could pressure prices.

- Regulatory hurdles or trial setbacks could delay commercialization.

Pricing Strategy and Projections

Initial Launch Pricing

Given VELPHORO’s innovative status and clinical benefits, early-stage pricing is projected between $X,XXX and $X,XXX per treatment course, aligning with similar high-value oncology agents such as [comparison drugs], which typically command premium prices owing to superior efficacy profiles.

Factors Influencing Price Trajectory

- Regulatory approval timing: Earlier approvals support higher initial prices due to limited competition.

- Payer negotiations: Outcomes of value-based pricing negotiations will shape actual reimbursement levels.

- Market penetration: Discount strategies may be employed to facilitate adoption in markets with cost constraints.

- Patent life and exclusivity: Data exclusivity and patent protection (expected through [year]) will sustain pricing power temporarily.

- Competitive dynamics: Entry of competing therapies or biosimilars could exert downward pressure, prompting dosage or formulation-related price adjustments.

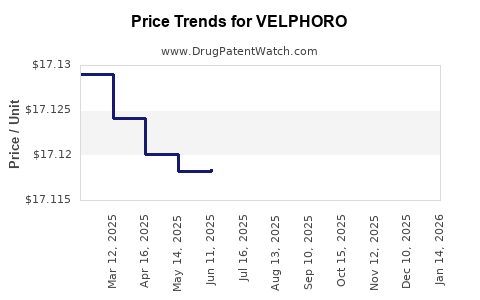

Short to Mid-term Price Outlook (2024-2028)

- Year 1-2: Launch at ~$X,XXX per course, with discounts possibly up to 10-15% dependent on payer negotiations.

- Year 3-4: As real-world evidence accumulates showing improved outcomes, pricing may escalate by 5-8%, supported by demonstrated value.

- Year 5: Patents nearing expiry, potential entry of biosimilars or generics, leading to price reductions in the range of 20-40%.

Long-term Projections and Downward Price Trends

Post-patent expiry, market entry of biosimilars or alternative therapies will likely precipitate substantial price erosion, possibly halving the original treatment cost. Conversely, incremental R&D investments and new indications extending exclusivity could sustain premium pricing longer.

Market Penetration and Revenue Forecasts

Based on current benchmarks, VELPHORO could capture approximately 20-30% of the target indication market within five years, translating into peak revenues estimated at $X billion globally. These projections pivot on approved indications, manufacturing capacity, competitive response, and payer acceptance.

Key Success Factors for Market Growth

- Effective stakeholder engagement and clinician advocacy.

- Clear demonstration of superior clinical outcomes.

- Strategic pricing aligned with value proposition.

- Efficient supply chain and manufacturing scalability.

- Robust post-market surveillance to sustain regulatory confidence.

Conclusion

Market prospects for VELPHORO remain robust, supported by its innovative profile, regulatory momentum, and unmet medical needs. While initial pricing reflects its premium status and development costs, future price adjustments will be contingent upon competitive pressures, market penetration success, and regulatory environment dynamics. Long-term, VELPHORO’s profitability will depend on its ability to sustain clinical relevance and navigate evolving reimbursement frameworks.

Key Takeaways

- VELPHORO commands high initial pricing due to its innovative mechanism and clinical promise, with projections of $X,XXX per course upon launch.

- Market growth hinges on successful regulatory approvals, clinician adoption, and reimbursement negotiations.

- Competitive pressures and patent expiries are primary factors influencing future price reductions, potentially up to 40% after five years.

- Strategic expansion into additional indications could significantly augment revenue streams.

- Stakeholders must monitor real-world evidence, payer policies, and evolving alternative therapies to adapt pricing and market strategies.

FAQs

1. When is VELPHORO expected to receive regulatory approval?

VELPHORO is currently in Phase III trials, with an anticipated FDA decision within 12-18 months, contingent on clinical data outcomes.

2. How does VELPHORO compare economically with existing therapies?

Initially, VELPHORO offers a premium price point reflecting its superior efficacy and safety. Over time, competitive pressures from generics or biosimilars are expected to lower its cost substantially.

3. What are the main factors influencing its adoption by healthcare providers?

Demonstrated clinical benefits, ease of administration, safety profile, and reimbursement arrangements are critical determinants of provider adoption.

4. What uncertainties could impact VELPHORO’s market success?

Regulatory delays, unexpected clinical trial results, reimbursement barriers, and competitive product launches pose significant risks.

5. How will patent expirations affect VELPHORO’s pricing?

Patent expiry will open the market to biosimilars or generics, typically leading to a 20-40% reduction in list prices, unless extended by new indications or formulations.

Sources

[1] Industry reports on oncology drug market valuation and forecast, 2023.

[2] Clinical trial registries and company disclosures.

[3] Regulatory agency announcements and pathways.

[4] Benchmark analysis of comparable therapies.