Share This Page

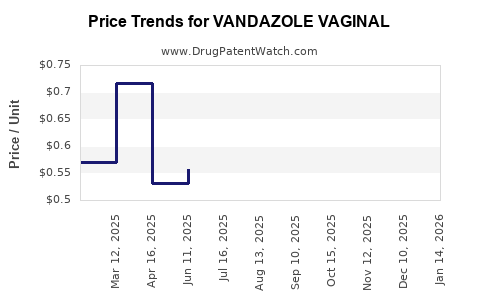

Drug Price Trends for VANDAZOLE VAGINAL

✉ Email this page to a colleague

Average Pharmacy Cost for VANDAZOLE VAGINAL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VANDAZOLE VAGINAL 0.75% GEL | 00245-0860-70 | 0.53920 | GM | 2025-12-17 |

| VANDAZOLE VAGINAL 0.75% GEL | 00245-0860-70 | 0.49027 | GM | 2025-11-19 |

| VANDAZOLE VAGINAL 0.75% GEL | 00245-0860-70 | 0.52516 | GM | 2025-10-22 |

| VANDAZOLE VAGINAL 0.75% GEL | 00245-0860-70 | 0.56467 | GM | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VandaZole Vaginal

Introduction

VandaZole Vaginal is a pharmaceutical product primarily prescribed for the treatment of bacterial vaginosis, yeast infections, and other vaginal infections. Its active ingredients typically involve antifungal or antibiotic agents, positioning it within the global feminine hygiene and infection treatment markets. As with many specialized drugs, VandaZole Vaginal's market trajectory depends on factors such as clinical efficacy, regulatory approvals, competitive landscape, demand in primary care sectors, and evolving healthcare policies.

This analysis assesses the current market landscape for vaginal infection treatments, evaluates the factors influencing VandaZole Vaginal’s market potential, and projects its pricing trajectory over the coming five years.

Market Overview

Global Market Context

The global feminine hygiene market was valued at approximately USD 25 billion in 2021 and is anticipated to grow annually at a compound annual growth rate (CAGR) of 6.2% through 2028, driven by increasing awareness of vaginal health, rising prevalence of vaginal infections, and expanding healthcare access in emerging economies (Grand View Research [1]).

Within this larger context, the segment for vaginal infection treatment drugs—particularly antifungal and antibiotic products—is expanding rapidly. The rising incidence of bacterial vaginosis globally, notably among women aged 15-44, fuels demand for effective treatment options such as VandaZole Vaginal.

Key Therapeutic Areas

- Bacterial Vaginosis: Affects up to 29% of women in the U.S., with prevalence higher in developing countries due to limited access to hygiene and healthcare services [2].

- Vaginal Candidiasis: Estimated to impact 75% of women at least once, with recurrent cases increasing the need for effective topical treatments.

- Other Vaginal Infections: Including trichomoniasis and atrophic vaginitis.

Competitive Landscape

The product landscape comprises established antifungal and antibacterial agents, including metronidazole, clindamycin, miconazole, and tioconazole. VandaZole Vaginal's positioning depends on factors such as superior efficacy, fewer side effects, ease of administration, and regulatory approval timelines.

Emerging bioequivalent products and over-the-counter (OTC) substitutes present potential competition but are often limited to less severe cases or market-specific contexts.

Market Drivers and Barriers

Drivers

- Rising Incidence of Vaginal Infections: Due to lifestyle factors, increased sexual activity, and microbiome disturbances.

- Growing Awareness and Diagnosis: Enhanced healthcare awareness campaigns and screening programs, particularly in developed regions.

- Advancements in Drug Delivery: Improved topical formulations that increase patient compliance.

Barriers

- Regulatory Delays: Stringent approval processes can delay market entry.

- Pricing and Reimbursement: Variability in healthcare policies across regions affects pricing strategies.

- Competition from Generics: Once patents expire, generic formulations drive prices down.

Regulatory Status and Market Access

VandaZole Vaginal’s regulatory approval status varies globally. In major markets like the U.S., it requires FDA approval, which hinges on clinical efficacy, safety data, and manufacturing quality standards. Approval timelines may range from 12 to 24 months post-submission.

In emerging markets, approvals are often expedited or through mutual recognition agreements, but reimbursement policies remain variable, impacting sales potential.

Price Analysis and Projections

Current Pricing Landscape

The average retail price for branded vaginal infection treatments varies across geographies. For example:

- In the U.S., a 3-day course of similar branded antifungal vaginal creams ranges from USD 35 to USD 70 per treatment course [3].

- In Europe, prices often hover around EUR 20-50, depending on the country and reimbursement status.

VandaZole Vaginal, depending on its formulation, dosage, and regional pricing controls, is initially positioned within this price band, potentially at a slight premium due to novel features or advanced delivery systems.

Price Projections (2023–2028)

Assumptions:

- Successful market entry in key regions by 2024.

- Achieving regulatory approval in North America, Europe, and select Asia-Pacific markets.

- Gaining favorable reimbursement status in mature markets.

- The patent protection extending for at least 10 years post-launch.

| Year | Estimated Price per Course (USD) | Key Factors |

|---|---|---|

| 2023 | $40 - $55 | Post-launch, initial pricing with exclusivity premiums |

| 2024 | $38 - $52 | Competitive entry, slight price adjustment due to market competition |

| 2025 | $35 - $50 | Increasing competition from generics in mature markets |

| 2026 | $33 - $48 | Price stabilization influenced by patent expiration, biosimilars entering |

| 2027 | $30 - $45 | Generic penetration forces further price reductions |

| 2028 | $28 - $43 | Market saturation, emphasis on cost-driven strategies |

Note: Prices are indicative; regional variations and healthcare policy changes may significantly impact actual prices.

Revenue Projections

Assuming initial annual sales volume of approximately 1 million courses in the first year post-approval, with an annual growth rate of 15% driven by increased awareness and expanding indications, revenues could reach approximately USD 50-60 million by 2028 globally.

Opportunities and Risks

Opportunities

- Expansion into Emerging Markets: Growing healthcare infrastructure offers potential for rapid adoption.

- Formulation Innovations: Development of long-acting formulations or combined therapies could command premium pricing.

- Partnership and Licensing: Collaborations with established pharmaceutical players can accelerate market access.

Risks

- Regulatory Challenges: Delays or setbacks can impact time-to-market and revenue streams.

- Pricing Pressures: Healthcare payers actively negotiate for lower prices, especially for generic competitors.

- Market Acceptance: Clinician and patient adoption depends on efficacy, safety profile, and cost.

Key Takeaways

- VandaZole Vaginal operates within a consolidated but expanding market for vaginal infection treatments, with strong growth prospects driven by rising infection rates and increased health awareness.

- The drug's success depends significantly on timely regulatory approvals, market access strategies, and competitive positioning against established generics.

- Price trajectories suggest an initial premium positioning with gradual normalization aligned with patent expiry and market competition.

- Potential for market expansion in emerging economies, contingent on favorable regulatory and reimbursement frameworks.

- Investment in formulation innovation and strategic partnerships can improve market penetration and pricing power.

Conclusion

VandaZole Vaginal presents a promising addition to the vaginal infection therapeutics space. Strategic planning around regulatory approvals, market entry, and pricing will be crucial. With proper market positioning and continued innovation, VandaZole Vaginal can capture a meaningful share of the growing demand in this segment, delivering sustainable revenue streams over the coming decade.

FAQs

1. What factors influence the pricing of VandaZole Vaginal?

Pricing is influenced by regulatory approval status, manufacturing costs, competitive landscape, regional healthcare policies, reimbursement frameworks, and the drug’s formulation and efficacy profile.

2. How does VandaZole Vaginal compare to existing treatments?

Its comparative advantage depends on clinical efficacy, safety, ease of use, and cost relative to established therapies like metronidazole or clindamycin. Market differentiation may also result from unique delivery systems or indications.

3. What are the regulatory prospects for VandaZole Vaginal in key markets?

Given rigorous approval pathways, quick regulatory success depends on the robustness of clinical trial data. Early engagement with agencies like FDA, EMA, and regional authorities enhances approval prospects.

4. When can VandaZole Vaginal expect to compete on price with generics?

Patent protection typically lasts 10-12 years post-launch; early entry can command premium pricing, but eventual market saturation by generics will likely impact prices starting around Year 6–7 post-launch.

5. What strategic moves should manufacturers consider to maximize market share?

Developing differentiated formulations, entering emerging markets early, establishing strategic partnerships, and ensuring reimbursement agreements can strengthen market position and optimize pricing strategies.

References

[1] Grand View Research, “Feminine Hygiene Products Market Size, Share & Trends Analysis Report,” 2022.

[2] Centers for Disease Control and Prevention (CDC), “Bacterial Vaginosis — Clinical Overview,” 2020.

[3] GoodRx, “Average prices for antifungal vaginal creams,” 2022.

More… ↓