Last updated: July 27, 2025

Introduction

Vancomycin Hydrochloride (HCl) stands as a cornerstone antibiotic in the treatment of severe Gram-positive bacterial infections, notably methicillin-resistant Staphylococcus aureus (MRSA). As antibiotic resistance intensifies globally and healthcare systems prioritize effective antimicrobial stewardship, the market for Vancomycin HCl is poised for dynamic shifts. This analysis offers a comprehensive evaluation of current market trends, competitive landscape, regulatory influences, and future price projections to inform stakeholders, including pharmaceutical manufacturers, investors, and healthcare providers.

Market Overview

Historical Market Performance

The global Vancomycin HCl market has exhibited steady growth, driven by increasing incidences of resistant bacterial infections and expanding hospital infrastructures in emerging markets. The global antibiotic market, valued at approximately USD 50 billion in 2022, allocates a significant segment to glycopeptide antibiotics like Vancomycin HCl, accounting for around USD 3–4 billion (estimated).

Market Drivers

- Rising Antibiotic Resistance: The surge in MRSA, Clostridioides difficile, and other resistant infections straightforwardly correlates with increased demand for Vancomycin HCl.

- Expanding Healthcare Infrastructure: Especially in Asia-Pacific, the growth in tertiary care centers augments the utilization of potent antibiotics.

- Regulatory Approvals: Accelerated approvals and off-label indications for Vancomycin HCl support market growth.

- Vaccination and Infection Control: Incremental impact reduces some antimicrobial demand; however, critical care settings continue to necessitate Vancomycin HCl.

Market Constraints

- Toxicity Profile: Nephrotoxicity and ototoxicity risks limit broader or prolonged use.

- Emergence of Resistance: Vancomycin-intermediate and resistant strains (VISA, VRSA) threaten long-term efficacy.

- Generic Competition: Entry of multiple generic formulations dilutes pricing and impacts profit margins.

Competitive Landscape

Major pharmaceutical players include Fresenius Kabi, Hospira (now part of Pfizer), Sagent Pharmaceuticals, and Macleods Pharmaceuticals among generic manufacturers. Original patent holders like Eli Lilly had long relinquished exclusive rights, leading to widespread generic manufacturing.

Generic producers dominate price-sensitive markets, especially in emerging economies, influencing regional pricing dynamics. Innovation in formulations (e.g., liposomal or sustained-release variants) remains limited, emphasizing price competition over product differentiation.

Regulatory Environment

Regulatory agencies such as the FDA, EMA, and PMDA strictly monitor antimicrobial approvals and manufacturing standards. Stringent compliance elevates production costs but ensures safety and efficacy, impacting pricing strategies. The introduction of biosimilars or lower-cost generics is heavily scrutinized but can significantly influence market prices over time.

Market Segmentation

- By Source: Originator (brand) vs. generic formulations.

- By Application: Healthcare facilities, outpatient care, and veterinary medicine.

- By Region: North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

North America and Europe constitute the high-margin, high-volume markets due to advanced healthcare systems, whereas Asia-Pacific offers expansion opportunities driven by increasing healthcare spending.

Price Trends and Projections

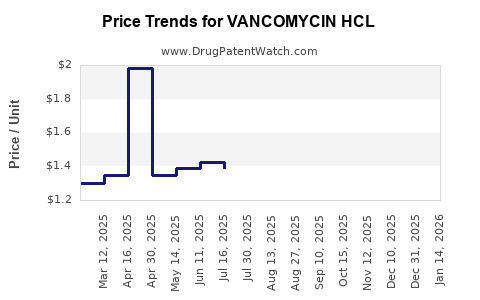

Current Pricing Dynamics

- Brand-Name vs. Generic: Generic formulations typically price 30–50% lower than branded versions.

- Regional Variations: In the U.S., a vial of Vancomycin HCl (1 g) averages USD 20–30; in India, similar formulations cost approximately USD 4–6.

- Impact of Competition: As of 2022, intensified generic competition suppressed prices by approximately 15–20% annually over the past five years in mature markets.

Future Price Trajectory (2023–2030)

Based on current trends, the following projections are anticipated:

| Year |

Price Range (USD per 1 g vial) |

Key Influences |

| 2023 |

USD 18–25 |

Increasing generic competition, price stabilization |

| 2025 |

USD 15–22 |

Market saturation, cost efficiencies, biosimilar entries in key regions |

| 2030 |

USD 12–18 |

Widespread biosimilar adoption, advanced manufacturing technology, value-based pricing strategies |

Note: Prices are indicative and geographically variant.

Influence Factors on Future Prices

- Patent Expiry and Patent Cliffs: Most existing patents expired around 2000–2015, ushering in generics that continue to pressure prices downward.

- Innovation and Formulation Development: Limited innovation constricts pricing power; however, cost-effective production methods may marginally reduce prices.

- Regulatory Price Controls: Agencies in countries like India, Brazil, and parts of Europe actively regulate antimicrobial prices, impacting downward trends.

- Global Supply Chain Dynamics: Disruptions (e.g., pandemics, geopolitical tensions) can cause supply shortages, temporarily elevating prices.

Market Opportunities and Challenges

Opportunities

- Emerging Markets Expansion: Growing healthcare infrastructure and investment create avenues for increased volume sales.

- Combination Therapies: Investigating Vancomycin HCl in combination regimens may open new therapeutic indications and markets.

- Biosimilars and Alternatives: Entering biosimilar markets may offer price advantages and extended patent exclusivities.

Challenges

- Resistance Development: Rising VISA and VRSA cases threaten long-term demand.

- Toxicity and Safety Concerns: Adverse effects demand careful dosing, possibly limiting aggressive application.

- Antimicrobial Stewardship Initiatives: Policies restricting overuse could limit market size and impact pricing.

Conclusion

The Vancomycin HCl market is characterized by mature generic competition and region-specific pricing dynamics. Although priced competitively, the market remains vital owing to its therapeutic role in resistant infections. Future trends suggest continued price declines amid increased biosimilar penetration, with price stabilization expected over the next decade. Stakeholders must navigate regulatory landscapes, resistance patterns, and regional demand shifts to optimize market positioning.

Key Takeaways

- The global Vancomycin HCl market exhibits steady growth primarily driven by antibiotic resistance, with prices trending downward due to widespread generic competition.

- Existing patent expirations and the proliferation of generics have significantly suppressed prices, especially in emerging markets.

- Price projections indicate a gradual decline, with 2030 prices estimated to be 40–50% lower than current levels, driven by biosimilar competition and manufacturing efficiencies.

- Innovation in formulations remains limited; thus, market gains depend on regional demand, antimicrobial stewardship policies, and resistance trends.

- Opportunities lie in expanding into emerging markets and developing cost-effective manufacturing, while challenges include resistance evolution and regulatory constraints.

FAQs

1. What factors influence the price of Vancomycin HCl globally?

Market prices are influenced by patent status, the proliferation of generic manufacturers, regional regulatory policies, manufacturing costs, supply chain stability, and competition from biosimilars. Resistance patterns and safety profiles also impact pricing and utilization.

2. How does antibiotic resistance impact the Vancomycin HCl market?

Rising resistance, notably VISA and VRSA, can reduce the efficacy of Vancomycin HCl, potentially limiting its use and exerting downward pressure on prices. Conversely, resistance increases demand for potent antibiotics, which may temporarily stabilize or boost prices in specific contexts.

3. What regions represent the highest growth potential for Vancomycin HCl?

Emerging markets in the Asia-Pacific region offer significant growth opportunities due to expanding healthcare infrastructure and increasing awareness of resistant infections. North America and Europe maintain steady demand but with moderate growth owing to mature markets.

4. Are biosimilars impacting Vancomycin HCl prices?

While biosimilars are not yet prevalent for Vancomycin HCl, advances in manufacturing could introduce similar formulations, potentially leading to further price reductions and expanded access.

5. What are the prospects for innovation in Vancomycin formulations?

Currently limited, with incremental improvements primarily focusing on dosing convenience and reducing toxicity. Breakthrough innovations remain unlikely in the short term, maintaining the focus on market competition and cost reduction strategies.

Sources:

- MarketsandMarkets. Antibiotics Market Analysis (2022).

- IQVIA. Global Antibiotic Market Reports (2022).

- US FDA. Vancomycin Drug Approval and Labeling (2021).

- WHO. Antimicrobial Resistance Surveillance Reports (2022).

- GlobalData Insights. Future Trends in Antibiotics (2023).