Last updated: July 27, 2025

Introduction

Vancomycin stands as a cornerstone antibiotic in the treatment of severe Gram-positive bacterial infections, notably methicillin-resistant Staphylococcus aureus (MRSA). As antimicrobial resistance escalates and the demand for potent, reliable antibiotics increases, Vancomycin's market dynamics attract heightened interest from pharmaceutical manufacturers, healthcare providers, and policymakers. This analysis delineates current market conditions, future pricing trajectories, and key factors influencing Vancomycin’s commercial landscape.

Market Overview

Global Market Size

The global Vancomycin market was valued at approximately USD 940 million in 2022 and is projected to reach USD 1.3 billion by 2030, expanding at a compound annual growth rate (CAGR) of approximately 4.2% (2023–2030) [1]. This growth aligns with the rising prevalence of MRSA infections, increased hospital-acquired infections (HAIs), and the broadening scope of Vancomycin’s indications.

Key Market Segments

- Therapeutic Applications: Predominantly utilized in hospital settings for serious infections such as bacteremia, endocarditis, meningitis, and pneumonia.

- Formulations: Both intravenous (IV) and oral formulations, with the IV form accounting for the majority of use, especially for systemic infections. Oral Vancomycin is restricted mainly to Clostridioides difficile infections.

Geographical Distribution

North America dominates the Vancomycin market, driven by high healthcare expenditure, prevalence of resistant infections, and extensive hospital infrastructure. Europe follows, with Asia-Pacific showing rapid growth due to expanding healthcare access and antimicrobial resistance trends.

Market Drivers

Rising Antibiotic Resistance

The proliferation of resistant strains, notably MRSA and vancomycin-resistant enterococci (VRE), sustains high demand for Vancomycin. The CDC estimates that MRSA affects roughly 80,000 people annually in the US alone, emphasizing ongoing therapeutic needs [2].

Healthcare Infrastructure and Hospitalization Rates

An increase in hospital admissions for infectious diseases propels Vancomycin use. In particular, ICU settings heavily rely on Vancomycin for empiric therapy.

Regulatory Approvals and Off-Label Use

Continuous approvals for new Vancomycin formulations and indications promote market expansion. Off-label uses, while less prevalent, contribute indirectly to market size.

Pricing and Reimbursement Policies

Reimbursement frameworks in key markets, including Medicare and private insurers, influence procurement and pricing strategies.

Market Challenges

- Resistance Development: The emergence of Vancomycin-intermediate and resistant strains pressures manufacturers to innovate.

- Generic Competition: As patents expire, generic formulations dominate, exerting downward price pressure.

- Toxicity Concerns: Adverse effects such as nephrotoxicity and ototoxicity limit dosage and duration, influencing prescribing habits.

Pricing Landscape

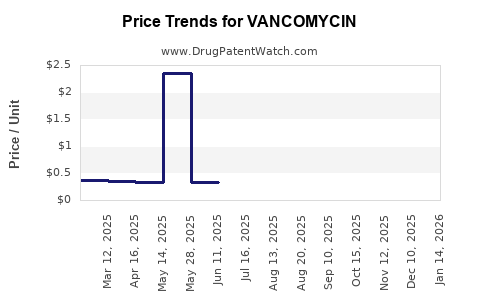

Historical Pricing Trends

In major markets, the average wholesale price (AWP) for IV Vancomycin in 2022 ranged between USD 12–20 per 1-gram vial (generic formulations). Oral Vancomycin remains relatively affordable, often below USD 10 per 500 mg tablet.

Factors Influencing Pricing

- Patent Status: The original formulation has been off-patent since the early 2000s; however, brand-name drugs like Vancocin (Eli Lilly) initially commanded premiums before generic entry.

- Supply Chain Dynamics: Manufacturing costs, raw material availability, and regulatory compliance impact pricing.

- Market Competition: Multiple generic manufacturers create pricing pressures, tending to decrease prices over time.

Projected Price Trends

Given the expanding generic market and increasing pressure on drug pricing, the prices of Vancomycin are expected to decline modestly over the next decade, with a compound annual decline rate of approximately 2-3%. However, prices for specialized formulations or branded variants may stabilize or even increase due to R&D investments or formulation innovations.

Future Market and Price Projections

Market Growth Factors

Projections indicate steady growth driven by:

- Increasing antibiotic resistance necessitating sustained Vancomycin use.

- Emerging multidrug-resistant Gram-positive pathogens.

- Increased global healthcare investments, particularly in emerging economies.

- Development of targeted formulations to mitigate toxicity and improve pharmacokinetics.

Innovations and Their Impact

New formulations, such as liposomal Vancomycin or compounds with improved safety profiles, could command premium pricing temporarily. Additionally, novel delivery mechanisms, such as localized or sustained-release formulations, will influence pricing structures.

Regulatory and Policy Influence

Policy initiatives focused on antimicrobial stewardship could temper prescribing volumes, potentially impacting sales and influencing price strategies. Conversely, incentives for developing resistant infection treatments could bolster R&D investments and associated costs.

Conclusion

The Vancomycin market remains resilient, underpinned by the ongoing threat of resistant bacteria and significant clinical reliance. While generic entry has lowered traditional injectable prices, the introduction of innovative formulations and evolving resistance patterns will modulate future pricing. The overall outlook suggests moderate growth; however, price declines driven by commoditization are anticipated to continue, barring breakthroughs in formulation or resistance management.

Key Takeaways

- The global Vancomycin market is projected to grow at a CAGR of approximately 4.2% from 2023 to 2030.

- Increased antimicrobial resistance sustains robust demand, particularly for hospital-acquired infections caused by MRSA and VRE.

- Pricing is primarily influenced by generic competition, with IV formulations declining in price, whereas branded or novel formulations could temporarily command higher prices.

- Supply chain factors, regulatory policies, and antimicrobial stewardship initiatives significantly impact market dynamics and pricing trends.

- Innovations in formulation and delivery are poised to shape future market segments and pricing structures.

FAQs

1. How is antimicrobial resistance impacting Vancomycin's market?

Resistance, especially VRE, threatens Vancomycin’s efficacy, prompting increased usage, development of derivatives, and adherence to stewardship policies, potentially influencing demand stability.

2. What are the primary drivers for Vancomycin's market growth?

Rising infection rates by resistant bacteria, expanding hospitalizations, and development of new formulations are key drivers.

3. How do patent expirations affect Vancomycin pricing?

Patent expirations have led to a surge of generic manufacturers, decreasing prices for IV formulations but potentially increasing in branded or specialized products.

4. What future innovations could influence Vancomycin's market?

Novel formulations with improved safety profiles, targeted delivery systems, and combination therapies could shift market dynamics.

5. Which regions are expected to lead future Vancomycin market growth?

North America and Europe will likely continue to dominate, with significant growth potential in Asia-Pacific due to expanding healthcare infrastructure and rising resistance.

References

- MarketWatch. "Vancomycin Market Size, Share & Industry Analysis." 2022.

- CDC. "Antibiotic Resistance Threats in the United States, 2019." Centers for Disease Control and Prevention.