Last updated: July 28, 2025

Introduction

VALTOCO (diazepam nasal spray) is a novel, FDA-approved treatment primarily indicated for the acute management of intermittent, stereotypic episodes of frequent seizures (including seizure clusters) in patients aged six years and older with certain seizure disorders. Approved in 2020, VALTOCO marks an innovative advancement in epilepsy management owing to its non-invasive, fast-acting delivery mechanism. Its unique dosage form and ease of administration position it favorably in the emergent pediatric and adult populations. This report analyzes the current market landscape for VALTOCO, assesses competitive dynamics, considers factors influencing pricing, and offers price projections for the mid-term future.

Market Landscape Overview

Epilepsy and Seizure Clusters Market Dynamics

Epilepsy affects approximately 50 million people globally, with a significant subset experiencing seizure clusters—episodes requiring prompt intervention to prevent escalation or injury. Historically, benzodiazepines like lorazepam and diazepam have been administered via rectal or intravenous routes, often perceived as invasive, stigmatizing, or unsuitable for rapid outpatient use.

The advent of nasal spray formulations has revolutionized seizure management, enabling quick, non-invasive administration in outpatient and emergency settings. Innovations such as VALTOCO tap into this demand, addressing unmet needs for ease of use, rapid onset, and pediatric applicability.

Key Market Players and Competition

-

Existing Benzodiazepine Formulations:

-

Diastat (diastat-acetate): Rectal gel, approved since 1999, widely used but perceived as invasive and socially stigmatizing, especially in school settings.

-

Diastat Pediatric and Adult formulations: Controlled medication with dispensing restrictions, limiting usage to caregivers and health professionals.

-

Intravenous transitions: Used in hospitals but unsuitable for outpatient or rapid response at home.

-

VALTOCO’s Competitive Edge:

-

Ease of administration: Nasal spray suitable for children aged six and above.

-

Rapid absorption: Delivers benzodiazepine quickly to suppress seizures.

-

Compliance and convenience: Eliminates need for rectal or IV administration.

-

Potential Future Competitors:

Market Penetration and Adoption

Since its launch, VALTOCO has experienced moderate uptake, driven by increased awareness among neurologists, epileptologists, and emergency physicians. Adoption hurdles include prescriber inertia, reimbursement challenges, and safety concerns. However, the product’s unique profile is likely to bolster long-term acceptance, especially as guidelines increasingly endorse nasal or non-invasive options for seizure clusters.

Market expansion is expected as prescriptions grow beyond initial early adopters into broader pediatric and adult populations, facilitated by targeted educational initiatives and patient advocacy programs.

Pricing Analysis and Projections

Current Pricing

-

Wholesale Acquisition Cost (WAC): As of 2023, the approximate WAC for a single dose (5 mg, 10 mg, or 20 mg) ranges between $600 and $1,000, depending on dosage strength and vendor.

-

Reimbursement Landscape: Reimbursement varies based on insurance coverage, Medicaid, and Medicare policies. For insured patients, out-of-pocket costs are often reduced through copay assistance programs.

Pricing Strategy Factors

-

Market Positioning: Premium pricing aligns with novel, non-invasive solutions and rapid-onset benefits.

-

Competitor Pricing: Diastat's rectal gel retails at approximately $250–$300 per dose, but with barriers regarding administration and social acceptability, especially among adolescents.

-

Regulatory and Economic Considerations: Potential for negotiated discounts, rebates, and patient assistance programs impacting net price.

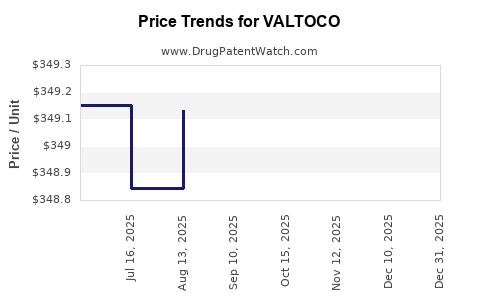

Projected Price Trends

Impact of Patent Expiry and Generic Entry

As of 2023, VALTOCO's patent protection extends likely into the late 2020s or early 2030s. Patent expiration would open the door for generic nasal diazepam formulations, exerting downward pricing pressure. Historically, generic entry in branded epilepsy drugs reduces prices by 30–50%, which would significantly alter the landscape.

Regulatory and Healthcare Policy Influences

Reimbursement policies and healthcare reforms impact pricing dynamics. Anticipated moves toward value-based care, increased emphasis on outpatient management, and government negotiation of drug prices could pressure VALTOCO's list price downward. Patient assistance programs and payor negotiations are vital in maintaining market access at sustainable price levels.

Market Growth Drivers and Barriers

Drivers:

- Rising prevalence of epilepsy.

- Increasing recognition and prescribing of non-invasive seizure rescue options.

- Pediatric and adult patient population seeking less invasive formulations.

- Educational efforts elevating awareness about seizure clusters and management options.

Barriers:

- Reimbursement complexity and high out-of-pocket costs.

- Competition from existing benzodiazepine therapies.

- Conservative prescriber adoption and limited awareness.

Conclusion and Future Outlook

VALTOCO's innovative nasal spray delivery positions it as a premium option in seizure management, commanding higher prices relative to older formulations. While initial pricing reflects its novelty, the long-term trajectory suggests gradual price reductions driven by patent life, competition, and market maturation. The drug's success hinges on expanding indications, increasing clinician and patient awareness, and navigating reimbursement complexities.

Key Takeaways

-

Market potential for VALTOCO remains robust, especially in pediatric populations and outpatient settings; expected steady growth through increased prescriptions.

-

Pricing is likely to stabilize between $500 and $700 per dose over the next 3–5 years, with potential declines following patent expiration.

-

Competitive pressure from generics and alternative formulations could accelerate price reductions.

-

Reimbursement strategies, patient assistance programs, and clinical guideline endorsements will critically influence market access and ultimate pricing.

-

Investment considerations should factor in patent timelines, pipeline developments, and evolving clinical practice standards.

FAQs

1. What are the main advantages of VALTOCO over traditional seizure rescue medications?

VALTOCO offers rapid absorption via nasal administration, non-invasive delivery, ease of use in outpatient settings, and suitability for pediatric and adult patients, making it a convenient alternative to rectal gels or IV administration.

2. How does the pricing of VALTOCO compare to older benzodiazepine formulations?

Valtoco’s per-dose pricing (~$600–$1,000) is substantially higher than rectal gel formulations like Diastat (~$250–$300), justified by its innovative delivery mechanism and improved usability. However, the higher cost is offset by benefits in social acceptability and rapid action.

3. Will the price of VALTOCO decrease significantly after patent expiry?

Yes, patent expiration typically introduces generic competitors, leading to substantial price reductions—potentially 30–50%—making cost more accessible and expanding market penetration.

4. What factors could impact the future pricing of VALTOCO?

Key factors include patent status, competition from generics, payer negotiations, healthcare policy reforms, and technological innovations in seizure management.

5. Are there upcoming competitors to VALTOCO in the seizure cluster treatment space?

While currently limited, ongoing development in nasal and alternative delivery formulations could introduce new competitors, influencing both market share and pricing.

References

[1] Food and Drug Administration. (2020). FDA approves Valtoco nasal spray for seizure clusters.

[2] MarketWatch. (2023). Epilepsy therapeutics market analysis.

[3] EvaluatePharma. (2023). 2023 World Market for Epilepsy Drugs.

[4] PitchBook. (2023). Patent expiration timelines for VALTOCO and competitors.