Share This Page

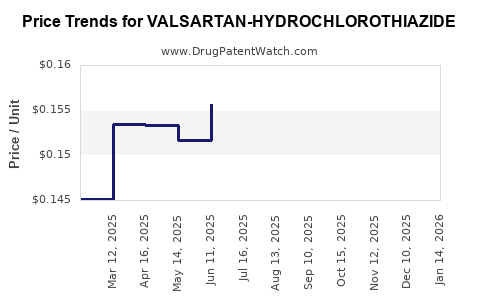

Drug Price Trends for VALSARTAN-HYDROCHLOROTHIAZIDE

✉ Email this page to a colleague

Average Pharmacy Cost for VALSARTAN-HYDROCHLOROTHIAZIDE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VALSARTAN-HYDROCHLOROTHIAZIDE 160-12.5 MG TAB | 33342-0075-15 | 0.14078 | EACH | 2025-12-17 |

| VALSARTAN-HYDROCHLOROTHIAZIDE 160-12.5 MG TAB | 33342-0075-10 | 0.14078 | EACH | 2025-12-17 |

| VALSARTAN-HYDROCHLOROTHIAZIDE 80-12.5 MG TAB | 65862-0547-99 | 0.13912 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VALSARTAN-HYDROCHLOROTHIAZIDE

Introduction

Valsartan-Hydrochlorothiazide (HCTZ) is a fixed-dose combination medication primarily prescribed for managing hypertension and reducing the risk of cardiovascular events. As the healthcare landscape evolves with regulatory shifts and market dynamics, understanding the current positioning and future price trajectory of this drug is crucial for stakeholders, including pharmaceutical companies, healthcare providers, and investors. This analysis assesses the market environment, competitive landscape, regulatory influences, and provides a comprehensive price forecast for Valsartan-HCTZ over the coming years.

Market Overview

Therapeutic Indication and Usage Trends

Valsartan-HCTZ combines an angiotensin II receptor blocker (ARB), valsartan, with a diuretic, hydrochlorothiazide, offering synergistic antihypertensive effects. It is extensively prescribed for managing high blood pressure, especially in patients requiring multiple mechanisms to control hypertension effectively. The global hypertension market remains substantial, driven by aging populations, rising obesity rates, and increased awareness, setting a robust foundation for the continued demand for fixed-dose combinations like Valsartan-HCTZ.

Market Size and Penetration

Globally, the hypertension drug market is projected to reach approximately USD 30 billion by 2027, with ARBs and combination therapy formulations commanding a significant share (Grand View Research, 2022). The Valsartan-HCTZ segment is notably dominant in North America and Europe, internationally benefiting from brand familiarity and prescriber preferences predicated on efficacy and safety profiles. The increasing adoption of combination therapy to improve adherence further fuels growth.

Competitive Landscape

The market features multiple generic manufacturers, following patent expirations of branded Valsartan (Novartis) and combination formulations. Major players include Teva Pharmaceuticals, Mylan (now part of Viatris), Sandoz, and Hikma Pharmaceuticals. The entry of generics has precipitated significant price erosion, contributing to a highly competitive environment. Notably, the availability of generic options has improved accessibility but exerted downward pressure on pricing.

Regulatory Environment and Manufacturing Dynamics

The 2018 recall of certain valsartan formulations due to NDMA contamination prompted increased regulatory scrutiny, impacting supply chains and pricing. Post-recall, manufacturers enhanced manufacturing oversight, leading to temporary price fluctuations but ultimately stabilizing supply. Ongoing regulatory vigilance and quality assurance remain critical factors influencing pricing and market stability.

Current Pricing Landscape

Brand vs. Generic Pricing

The branded formulations of Valsartan-HCTZ generally command higher prices, often 2-3 times the cost of generic equivalents. However, given the widespread adoption of generics, the market primarily revolves around competitive generic pricing.

Regional Price Variations

- North America: The average wholesale price (AWP) for a 30-day supply of generic Valsartan-HCTZ (80 mg/25 mg) ranges between USD 10-15, reflecting aggressive price competition.

- Europe: Similar pricing trends noticed, with wholesale prices paralleling North American benchmarks due to cross-border generic circulation.

- Emerging Markets: Prices are considerably lower, sometimes below USD 5, driven by local manufacturing and procurement policies.

Reimbursement and Insurance Influence

In the U.S., reimbursement policies heavily influence retail prices, with insurance plans favoring generics, thus limiting patient out-of-pocket expenses and maintaining low retail prices. Similar dynamics exist in other markets with centralized healthcare coverage models.

Market Drivers and Challenges

Drivers

- Aging Population: The increasing prevalence of hypertension among older adults sustains high demand.

- Regulatory Acceptance: Post-recall market stabilization has eased supply concerns, supporting stable pricing.

- Patient Adherence: Fixed-dose combination therapy improves adherence, hence steady prescribing of Valsartan-HCTZ.

Challenges

- Price Competition: Generics entering the market constrain pricing power.

- Regulatory Scrutiny: Ongoing quality oversight may introduce costs that impact margins.

- Patent Expirations: Future patent expirations or extensions could alter market dynamics.

Price Projection (2023–2028)

Short-Term (2023–2024)

The immediate outlook reflects continued price stability, with minimal upward trend due to persistent generic competition. Prices are expected to hover around USD 8-15 per 30-day supply across mature markets. Any shocks from regulatory changes or supply chain disruptions could induce short-lived price fluctuations.

Mid to Long-Term (2025–2028)

Forecasting indicates gradual decline in base prices, primarily driven by increasing generic penetration. However, specific circumstances such as:

- Market Consolidation: Major generics manufacturers forming alliances or acquiring smaller players may exert some pricing influence.

- Regulatory Policies: Introduction of policies incentivizing biosimilars or generic promotions could induce further price erosion.

- Innovation or Patent Extensions: Lacking significant clinical advances for this fixed-dose combination, price stability may persist, but without substantial increases.

By 2028, prices are projected to decrease by approximately 20-30% from current levels, with generic prices stabilizing around USD 5-10 per 30-day supply in mature markets.

Impact of Regulatory and Economic Factors

- Patent Litigation: Extended exclusivity or patent litigations could temporarily sustain higher prices.

- Global Economic Fluctuations: Currency valuation and inflation rates influence import costs and thus, retail prices.

- Healthcare Policy Changes: Increased emphasis on cost containment in healthcare systems could sustain downward pressure on drug prices.

Conclusion and Strategic Insights

The Valsartan-HCTZ market remains stable with an overarching trend towards reduced prices, guided by pervasive generic competition. Stakeholders should anticipate steady pricing with occasional volatility linked to regulatory or supply chain events. Investment strategies should emphasize cost leadership and supply chain robustness to capitalize on market opportunities. Moreover, the focus on improving patient adherence through fixed-dose combinations will continue to underpin demand.

Key Takeaways

- Market is dominated by generics, exerting downward pressure on prices but offering volume opportunities.

- Prices are expected to decline by 20-30% over the next five years as competition intensifies.

- Regulatory scrutiny, especially from past NDMA concerns, influences manufacturing and pricing strategies.

- Reimbursement policies significantly impact retail prices and market accessibility.

- Innovation in fixed-dose combinations with improved safety profiles may provide future growth avenues, but current trends favor cost-containment.

FAQs

1. What factors most influence the price of Valsartan-HCTZ?

Market competition from generics, regulatory policies, manufacturing costs, and reimbursement frameworks predominantly determine pricing dynamics.

2. How has past regulatory scrutiny affected Valsartan-HCTZ pricing?

The 2018 NDMA contamination recall temporarily reduced supply and increased prices; subsequent regulatory reforms stabilized the market and pricing.

3. What is the expected trend in Valsartan-HCTZ prices over the next five years?

Prices are projected to decline gradually by 20-30% due to increasing generic competition and market saturation.

4. Which regions have the highest and lowest prices for Valsartan-HCTZ?

North America and Europe exhibit higher prices (~USD 10-15 per month supply), while emerging markets often pay less (~USD 3-7).

5. Are there innovative formulations or combinations expected that could impact pricing?

Potential development of new fixed-dose combinations with improved efficacy or safety could influence future pricing and market share.

References

[1] Grand View Research. (2022). Hypertension Drugs Market Size, Share & Trends Analysis Report.

[2] IQVIA. (2022). Global Trends in Hypertension Medications.

[3] U.S. Food and Drug Administration. (2019). Post-market regulatory updates on Valsartan.

[4] WHO. (2021). Price and availability of antihypertensive medicines.

More… ↓