Last updated: July 27, 2025

Introduction

Valacyclovir hydrochloride (HCl) is an antiviral medication primarily prescribed for managing herpes simplex virus (HSV) infections, including recurrent genital herpes, cold sores, and herpes zoster (shingles). Its pharmacological profile offers enhanced bioavailability over acyclovir, making it a preferred choice in antiviral therapies. Analyzing its market landscape and projecting future prices is essential for stakeholders, including pharmaceutical companies, healthcare providers, investors, and policymakers.

Market Overview

Global Market Size and Growth Dynamics

The global antiviral market, estimated at approximately USD 36 billion in 2022, exhibits consistent growth driven by rising herpesvirus infections, expanding aging populations, and increasing awareness of sexually transmitted infections. Among antivirals, drugs targeting herpes simplex virus (HSV) and varicella-zoster virus (VZV) account for a significant market share, with valacyclovir representing a substantial segment owing to its superior pharmacokinetics.

The market for valacyclovir HCl is characterized by steady demand in both developed and emerging markets. The increasing prevalence of herpes infections, particularly in regions with high STI rates, sustains its consumption. Furthermore, the rising incidence of shingles among older adults fuels the segment's growth, which directly benefits valacyclovir sales.

Key Market Drivers

-

Epidemiological Factors: Approximately 3.7 billion people under age 50 globally harbor HSV-1, and 491 million people aged 15-49 have HSV-2, according to WHO [1]. These figures underscore the high demand for antivirals.

-

Medical Advancements: Improved formulations and dosing regimens enhance adherence, supporting market expansion.

-

Regulatory Approvals: Recent approvals for extended indications and combination therapies bolster sales prospects.

-

Generic Entry: Patent expiration in key markets around the late 2010s has led to a surge in generic versions, lowering prices and increasing accessibility.

Regional Market Insights

-

North America: Largest market, driven by high awareness, robust healthcare infrastructure, and extensive insurance coverage. The U.S. alone accounts for over 40% of the global antivirals revenue.

-

Europe: Similar market trends with high prevalence rates; stringent regulatory frameworks encourage generic competition.

-

Asia-Pacific: Rapid growth fueled by increasing healthcare spending, rising herpes prevalence, and expanding pharmaceutical manufacturing capacities. Countries like China and India are becoming major production hubs.

Competitive Landscape

Major pharmaceutical companies like GSK (Valtrex), Teva, Mylan, and Sandoz dominate the market, offering both branded and generic valacyclovir formulations. Patent expirations have precipitated a shift toward generics, intensifying price competition.

Emerging biotech firms are investing in novel delivery mechanisms and combination therapies, potentially expanding the pharmacological landscape but currently exerting minimal influence on existing pricing.

Pricing Analysis

Current Price Points

-

Brand-Name (Valtrex): As of 2023, the average retail price for a 30-count, 500 mg tablet in the U.S. hovers around USD 350–450, based on Medicare and private insurance data [2].

-

Generics: Reduced to approximately USD 100–150 per 30-count pack for 500 mg tablets, making generic versions significantly more accessible.

Pricing Factors

-

Patent Status: The expiration of GSK’s patent in major markets has catalyzed price reductions due to increased generic competition.

-

Manufacturing Costs: Production costs for generics are lower, enabling price declines.

-

Market Penetration Strategies: Dynamic pricing models, discounts, and insurance coverage influence actual consumer prices.

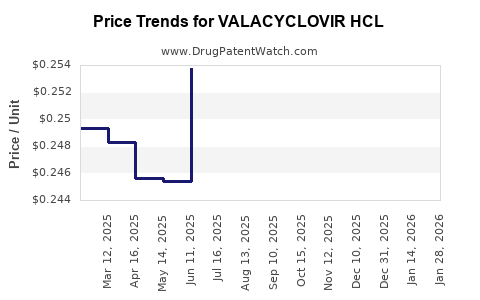

Future Price Trends

-

Generic Domination: As patent exclusivity further diminishes globally, generic prices are expected to decline by approximately 25–40% over the next 2–3 years, driven by intensified competition [3].

-

Brand Premium: The branded drug may retain a premium of 2–3 times the generic price in certain markets, particularly where branding and trust influence purchasing decisions.

-

Price Stabilization or Slight Decline: After initial reductions post-patent expiry, prices are projected to stabilize due to low manufacturing costs and high-volume sales.

Market Opportunities and Challenges

Opportunities

-

Emerging Markets: Growth opportunities lie in regions with increasing herpes prevalence and limited healthcare infrastructure, such as Southeast Asia and Africa, where price-sensitive affordable generics can expand access.

-

New Formulations: Development of extended-release formulations or combination therapies may command premium pricing.

-

Digital Health Integration: Remote adherence monitoring and telemedicine services could augment sales and optimize treatment outcomes.

Challenges

-

Price Sensitivity: High competition among generics exerts continuous downward pressure on prices.

-

Regulatory Hurdles: Variability in approval processes across jurisdictions can delay market entry.

-

Patent Strategies: Patent litigation or supplementary protection certificates could temporarily extend exclusivity, influencing pricing dynamics.

Future Market Projections and Price Outlook

Based on current trends, the following projections are reasonable:

-

Market Growth Rate: With an estimated CAGR of 4–6% through 2028, primarily driven by expanding herpes infection rates and aging populations, the valacyclovir segment is positioned for steady growth.

-

Price Trends: Generic prices are forecasted to decline incrementally by 10–15% annually over the next 3–5 years, contingent upon market saturation and manufacturing efficiencies.

-

Regional Highlights:

- North America and Europe will experience stabilization or marginal declines in branded prices.

- Asia-Pacific markets will see substantial volume growth, with prices remaining competitive due to local manufacturing.

Such forecasts assume an absence of disruptive innovations or regulatory policies affecting drug pricing, but potential patent challenges and new formulations could alter these dynamics.

Key Takeaways

- The global valacyclovir HCl market is mature, with declining prices driven by generic competition but sustained by high demand.

- Strategic opportunities lie in emerging markets and via innovation in drug delivery.

- Price projections suggest a gradual decline in generic costs, with regional variability influenced by regulatory and market conditions.

- Stakeholders should monitor patent expirations, manufacturing costs, and regional health trends for informed decision-making.

- Partnerships and investments in bioequivalent generics are poised to capitalize on cost efficiencies and expanding access.

FAQs

Q1: What factors influenced the decline in valacyclovir prices over recent years?

Patent expirations, increased generic competition, manufacturing efficiencies, and regulatory approvals for biosimilars contribute to price reductions.

Q2: How does regional variation affect valacyclovir pricing?

Healthcare infrastructure, regulatory environment, pharmaceutical market maturity, and purchasing power influence pricing; prices tend to be lower in emerging markets.

Q3: Are new formulations or delivery methods expected to impact valacyclovir markets?

Potentially. Extended-release formulations or combination therapies could command higher prices, expanding market share among premium product segments.

Q4: What risks might impact future valuation and pricing?

Regulatory changes, patent disputes, the emergence of resistances, and disruptive innovations may influence pricing and market size.

Q5: Who are the primary competitors in the valacyclovir market?

Major players include GSK (branded Valtrex), Teva, Mylan, Sandoz, and other generic manufacturers.

References

[1] World Health Organization. (2022). Global prevalence of herpes simplex virus.

[2] GoodRx. (2023). Valacyclovir prices and discounts.

[3] IMS Health. (2022). Generic drug market trends.