Share This Page

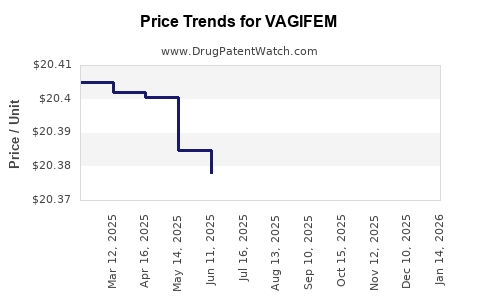

Drug Price Trends for VAGIFEM

✉ Email this page to a colleague

Average Pharmacy Cost for VAGIFEM

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| VAGIFEM 10 MCG VAGINAL TAB | 00169-5176-03 | 20.32915 | EACH | 2025-11-19 |

| VAGIFEM 10 MCG VAGINAL TAB | 00169-5176-04 | 20.32915 | EACH | 2025-11-19 |

| VAGIFEM 10 MCG VAGINAL TAB | 00169-5176-03 | 20.34044 | EACH | 2025-10-22 |

| VAGIFEM 10 MCG VAGINAL TAB | 00169-5176-04 | 20.34044 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for VAGIFEM

Introduction

VAGIFEM, a vaginal estrogen hormone therapy, is primarily prescribed for the treatment of genitourinary syndrome of menopause (GSM)—a condition characterized by vaginal atrophy, dryness, burning, and discomfort associated with estrogen deficiency post-menopause. As a local estrogen therapy administered via vaginal suppository, VAGIFEM offers a targeted approach with minimal systemic absorption, positioning it as a vital product within menopausal healthcare. This analysis explores its current market landscape, competitive positioning, regulatory environment, and provides strategic price projections for stakeholders.

Market Overview

Global Menopause Therapeutics Market

The global menopause therapeutics market, encompassing hormonal and non-hormonal treatments, was valued at approximately USD 4.5 billion in 2022, with a compound annual growth rate (CAGR) of around 6% projected through 2030 [1]. Rising aging populations worldwide underpin this growth, alongside increased awareness of menopausal health issues.

VAGIFEM's Role in the Market

VAGIFEM, branded as a localized estrogen treatment, caters specifically to women with GSM. Its significance has grown due to the rising prevalence of menopause-related symptoms and shifting preferences toward minimally invasive, localized therapies that offer safety and convenience.

Key Manufacturers and Competitive Landscape

While VAGIFEM is marketed by Aspen Pharmacare and others, it faces competition from:

- Estrogen creams and gels (e.g., Estrace Vaginal Cream, Premarin Vaginal Cream)

- Vaginal rings (e.g., Estring, Femring)

- Other suppositories and tablets (e.g., Osphena/Ospemifene, though mainly for dyspareunia)

These alternatives compete on efficacy, safety, convenience, and pricing. VAGIFEM's unique positioning as a well-tolerated, localized estrogen suppository enhances its appeal.

Market Dynamics

Demographic Drivers

-

Aging Population: The global female population aged 50+ is expanding, specifically in regions like North America, Europe, and parts of Asia-Pacific, fueling demand for menopause treatments.

-

Increasing Awareness: Education initiatives and physician advocacy are improving diagnosis rates of GSM and acceptance of local hormone therapies.

Regulatory Environment

- Approval Status: VAGIFEM has received approval from major regulatory authorities, such as the FDA and EMA, facilitating global market access.

- Pricing Regulations: Variations in pricing policies across countries influence market penetration and reimbursement strategies.

Insurance and Reimbursement

Reimbursement policies significantly impact sales volume. In countries with comprehensive health coverage, higher uptake occurs, stabilizing revenue streams.

Market Challenges and Opportunities

Challenges

- Competition from Oral and Non-Hormonal Treatments: Patients and physicians may prefer non-hormonal options or oral therapies, marginalizing localized estrogen products.

- Regulatory Scrutiny: Potential restrictions on hormone therapies’ long-term safety could impact market expansion.

- Pricing Pressures: Generic rivals and price-sensitive healthcare systems exert downward pressure on prices.

Opportunities

- Expansion into Emerging Markets: Rising awareness and healthcare infrastructure improvements open avenues in Asia-Pacific, Latin America, and Africa.

- Product Line Extensions: Development of combination formulations or new delivery systems could broaden the product portfolio and market share.

- Educational Campaigns: Raising awareness of GSM and localized estrogen benefits can drive demand.

Current Pricing Landscape

Price Benchmarks

-

In North America and Europe, VAGIFEM’s wholesale and retail prices vary, generally ranging between USD 50–USD 100 per box (containing 8 suppositories), with variations based on insurance coverage and pharmacy markups [2].

-

Per-Unit Cost: Approximately USD 6–USD 12 per suppository, influenced by manufacturing costs, distribution, and regional market factors.

Factors Influencing Pricing

- Manufacturing Costs: Biopharmaceutical manufacturing compliance and quality assurance standards impact costs.

- Market Competition: Entry of generics and biosimilars could lower prices.

- Reimbursement Policies: Favorable insurance coverage raises consumer affordability, enabling premium pricing strategies.

Price Projection Analysis

Short-Term Outlook (Next 2–3 Years)

- Stability with Slight Decline: Anticipate minor price erosion (~2–4%) driven by increased generic competition and keen price negotiations in mature markets.

- Reimbursement Negotiations: Enhanced insurance coverage could stabilize or slightly boost retail prices, especially in developed markets.

Medium to Long-Term Outlook (3–10 Years)

-

Potential Price Compression: With market saturation and biosimilar entrants, prices could decrease by up to 15–20%, especially in price-sensitive regions.

-

Premium Positioning: Brands that reinforce clinical efficacy, safety, and patient convenience could command premium pricing, maintaining stable margins.

-

Emerging Markets: Prices are projected to be significantly lower—potentially USD 20–USD 40 per box—driven by lower healthcare costs and reduced reimbursement.

Forecast Summary

| Region | 2023 Price Range (USD) | 2028 Price Range (USD) | Key Drivers |

|---|---|---|---|

| North America & Europe | USD 50–USD 100 | USD 45–USD 95 | Market maturity, competition, reimbursement |

| Asia-Pacific & Latin America | USD 20–USD 40 | USD 15–USD 35 | Emerging markets, lower healthcare costs |

Strategic Recommendations

- Pricing Optimization: Tailor pricing models to regional reimbursement policies, with focus on value-based pricing in mature markets.

- Market Penetration: Leverage educational campaigns emphasizing VAGIFEM’s safety and efficacy to grow market share.

- Product Differentiation: Invest in formulation improvements, convenience, or combination therapies to justify premium pricing.

- Emerging Markets: Enter or expand presence in underpenetrated regions with cost-effective pricing strategies.

Key Takeaways

- VAGIFEM holds a significant market position within localized estrogen therapies, supported by demographic trends and increasing menopause awareness.

- Competition, especially from generics and alternative treatments, exerts pressure on pricing, necessitating strategic positioning.

- Short-term prices are expected to stay relatively stable, with marginal decreases; longer-term projections suggest potential 15–20% price declines with market maturation.

- Emerging markets offer growth opportunities at lower price points, while developed markets require differentiated marketing and value proof.

- Stakeholders should consider regional healthcare policies, reimbursement landscapes, and competitive dynamics when devising pricing and market expansion strategies.

FAQs

1. What factors influence the pricing of VAGIFEM globally?

Pricing is determined by manufacturing costs, regional reimbursement policies, competition from generics, healthcare infrastructure, and market maturity.

2. How does the approval status of VAGIFEM impact its market price?

Regulatory approval ensures market access and can justify premium pricing, whereas delays or restrictions may constrain pricing flexibility.

3. Are there upcoming developments that could impact VAGIFEM’s market value?

Yes, biosimilar entries, formulation innovations, and expanded indications could influence pricing strategies and market share.

4. How significant is the role of insurance coverage in VAGIFEM's pricing?

Insurance substantially affects consumer prices; extensive coverage can support higher retail prices, whereas limited coverage pressures discounts.

5. What strategic measures can manufacturers adopt to sustain pricing amidst increasing competition?

Investing in clinical data, emphasizing safety and efficacy, differentiating delivery methods, and expanding into emerging markets are key strategies.

Sources

[1] MarketsandMarkets, Menopause Therapeutics Market, 2022

[2] Industry reports, pharmacy retail pricing data, and manufacturer disclosures (2019–2023)

More… ↓