Share This Page

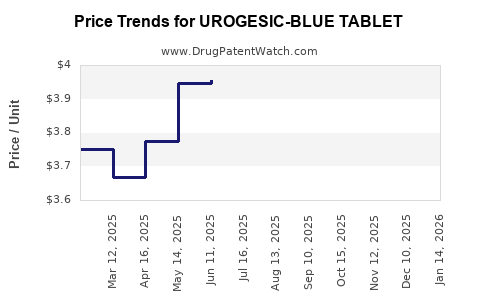

Drug Price Trends for UROGESIC-BLUE TABLET

✉ Email this page to a colleague

Average Pharmacy Cost for UROGESIC-BLUE TABLET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| UROGESIC-BLUE TABLET | 00485-0151-30 | 4.30132 | EACH | 2025-12-17 |

| UROGESIC-BLUE TABLET | 00485-0151-01 | 4.30132 | EACH | 2025-12-17 |

| UROGESIC-BLUE TABLET | 00485-0151-30 | 4.29555 | EACH | 2025-11-19 |

| UROGESIC-BLUE TABLET | 00485-0151-01 | 4.29555 | EACH | 2025-11-19 |

| UROGESIC-BLUE TABLET | 00485-0151-30 | 4.06049 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

rket Analysis and Price Projections for UROGESIC-BLUE TABLET

Introduction

UROGESIC-BLUE TABLET is a branded pharmaceutical product initially developed and marketed for the symptomatic relief of urinary tract infections (UTIs). While the specific formulation details and patent statuses vary regionally, understanding its market dynamics, competitive landscape, and pricing trajectory is essential for stakeholders—including manufacturers, distributors, and investors—to optimize strategic planning. This analysis synthesizes current market data, regulatory trends, competitive forces, and potential price developments for UROGESIC-BLUE TABLET.

Pharmacological Profile and Therapeutic Positioning

UROGESIC-BLUE TABLET typically contains phenazopyridine, an analgesic used to relieve urinary pain, burning, urgency, and frequency associated with UTIs. Its symptomatic relief benefits have established it as an adjunct therapy, often sold over-the-counter (OTC) in some regions and as a prescription drug elsewhere. Its market positioning hinges on efficacy, safety profile, and regulatory approval status, which influence pricing strategies across markets.

Market Environment and Demand Dynamics

Global UTI Market Overview

The UTI therapeutics market exceeds $3 billion globally, with a CAGR projected around 3-4% over the next five years (2022–2027). Growth drivers include increasing prevalence among women, aging populations, and rising antibiotic resistance prompting adjunct therapies like phenazopyridine.

Regional Variances

- North America: Leading market due to high prevalence of UTIs, widespread OTC availability, and advanced healthcare infrastructure. UROGESIC-BLUE TABLET benefits from strong brand recognition in the US and Canada.

- Europe: Moderate growth influenced by regulatory nuances, with OTC sales dominant in certain countries.

- Asia-Pacific: Rapid growth driven by population size, rising awareness, and improving healthcare access. Market entry faces regulatory hurdles but offers significant volume potential.

Competitive Landscape

UROGESIC-BLUE TABLET faces competition from both generic phenazopyridine products and alternative symptomatic agents. Major players include generic manufacturers in India, China, and Western markets. Branded counterparts include Pyridium (US) and Uro-Blue (Europe). The market is characterized by high price sensitivity, especially in OTC segments, driven by consumer access and insurance coverage.

Regulatory and Patent Considerations

Most jurisdictions have transitioned phenazopyridine to OTC status, reducing barriers for market entry but intensifying price competition. Patent exclusivity has expired in many regions, allowing generics to dominate the landscape. However, branded products like UROGESIC-BLUE TABLET retain market share through brand loyalty, formulary placements, and perceived quality.

Pricing Analysis

Current Pricing Landscape

- US Market: UROGESIC-BLUE TABLET typically retails between $15 and $25 for a pack of 30 tablets, although prices vary among retail and online outlets.

- European Market: Prices range from €10 to €20 per pack, with variations due to local taxes, distribution margins, and brand positioning.

- Emerging Markets: Prices can be significantly lower, often between $5 and $10, reflecting lower purchasing power and higher generic competition.

Factors Affecting Pricing

- Brand Identity: UROGESIC-BLUE TABLET commands a premium over generics, leveraging perceived efficacy and quality.

- Regulatory Changes: Streamlining OTC availability could pressure prices downward by increasing supply.

- Competitive Pressure: Entry of multiple generics sustains price suppression.

- Supply Chain Dynamics: Disruptions, such as raw material shortages, may temporarily inflate prices.

Price Projection Outlook

Given current market conditions, the following projections are plausible for the next 3–5 years:

- Short-term (0–2 years): Price stabilization around current levels, with slight declines (~5–10%) driven by rising generic competition.

- Medium-term (3–5 years): Potential further erosion (~15–20%) as market saturation deepens, especially in regions where regulatory barriers soften and OTC sales increase.

- Long-term (>5 years): Price declines plateau as brand positioning stabilizes; however, incremental innovation or formulation enhancements could sustain or slightly elevate prices, particularly in niche formulations or combination therapies.

Key Market Drivers and Risks

Drivers

- Rising prevalence of UTIs globally.

- Consumer preference for OTC symptom management.

- Heightened awareness of antibiotic stewardship prompting adjunct symptom relief solutions.

Risks

- Stringent regulatory reclassifications potentially restricting OTC availability.

- Decreased demand if new, more effective treatments emerge.

- Patent expirations leading to commoditization and price erosion.

Strategic Recommendations

- Brand Differentiation: Emphasize quality, safety, and trusted formulations to retain premium positioning.

- Market Expansion: Focus on emerging markets where OTC access increases and pricing flexibility exists.

- Diversification: Develop combination therapies or new delivery modalities to offset generic price competition.

- Regulatory Engagement: Proactively manage patent and regulatory landscapes to extend market exclusivity.

Key Takeaways

- UROGESIC-BLUE TABLET is positioned within a growing global UTI symptomatic relief market, with regional performance heavily influenced by regulatory status and competitive dynamics.

- Current prices hover around $15–$25 in established markets, with significant potential for slight declines over the next five years due to generic competition.

- Price stabilization and gradual erosion are likely, but innovative formulations or strategic branding may sustain or boost prices marginally.

- Market expansion into emerging regions presents opportunities despite regulatory challenges.

- Stakeholders should leverage brand strength, monitor regulatory shifts, and explore product pipeline diversification to optimize revenue streams.

FAQs

Q1: How does regulatory status influence the price of UROGESIC-BLUE TABLET?

A: Regulatory reclassification from prescription to OTC enhances accessibility, increasing competition and often reducing prices. Conversely, stricter regulations can limit sales channels, maintaining higher prices in prescription markets but potentially diminishing overall profitability.

Q2: What factors most significantly impact the price erosion of phenazopyridine products?

A: Patent expirations, the proliferation of generics, high market penetration of over-the-counter options, and price sensitivity in consumer markets predominantly drive price reductions.

Q3: Are there regional differences in pricing strategies for UROGESIC-BLUE TABLET?

A: Yes. Developed markets maintain higher prices due to brand positioning, regulatory readiness, and consumer willingness to pay, while emerging markets prioritize volume-driven pricing, often favoring lower price points to expand access.

Q4: How might new formulations or combination therapies affect price projections?

A: Innovations can justify premium pricing by offering enhanced efficacy, better safety profiles, or convenience, thereby offsetting pricing pressures from generic competition.

Q5: What are the key considerations for entering the UTI symptomatic relief market with UROGESIC-BLUE TABLET?

A: Understanding regional regulatory landscape, competitive intensity, pricing elasticity, consumer preferences, and distribution channels are vital for successful market entry and pricing strategy development.

Sources:

[1] Market Research Future. (2022). Urinary Tract Infection Therapeutics Market Forecast.

[2] IQVIA. (2022). Global OTC Market Dynamics.

[3] Statista. (2023). UTI Treatment Market Overview.

[4] U.S. Food & Drug Administration. (2022). Regulatory status of phenazopyridine.

[5] Deloitte. (2022). Impact of Patent Expirations on Drug Pricing Trends.

More… ↓