Share This Page

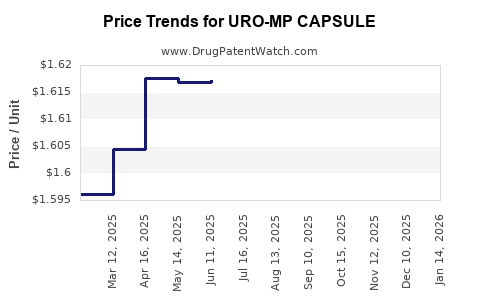

Drug Price Trends for URO-MP CAPSULE

✉ Email this page to a colleague

Average Pharmacy Cost for URO-MP CAPSULE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| URO-MP CAPSULE | 58657-0456-01 | 1.72756 | EACH | 2025-12-17 |

| URO-MP CAPSULE | 58657-0456-01 | 1.71126 | EACH | 2025-11-19 |

| URO-MP CAPSULE | 58657-0456-01 | 1.69175 | EACH | 2025-10-22 |

| URO-MP CAPSULE | 58657-0456-01 | 1.66301 | EACH | 2025-09-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for URO-MP Capsule

Introduction

URO-MP Capsule represents a novel therapeutic option within the urological pharmacology landscape, primarily aimed at managing benign prostatic hyperplasia (BPH) or other urological conditions. As a proprietary formulation, understanding its market positioning, competitive landscape, and future pricing trajectory is essential for stakeholders, including investors, healthcare providers, and pharmaceutical companies. This report synthesizes current market dynamics, regulatory considerations, and economic factors influencing the valuation and pricing of URO-MP Capsule over the upcoming five years.

Market Overview

Therapeutic Landscape and Demand

Benign prostatic hyperplasia (BPH) affects approximately 50% of men aged 51-60 and up to 90% of men older than 80 worldwide, according to the American Urological Association (AUA) [1]. The increasing prevalence correlates with aging populations, especially in developed countries, creating a sustained demand for effective pharmacotherapy.

Current standard treatments include alpha-blockers, 5-alpha-reductase inhibitors, and minimally invasive procedures. Despite a broad treatment arsenal, unmet needs persist regarding efficacy, side effects, and patient compliance, opening opportunities for innovative compounds like URO-MP Capsules.

Market Size and Growth Projections

The global BPH treatment market was valued at approximately $4.2 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 5.3% through 2028 [2]. This expansion is driven by demographic trends, rising healthcare expenditure, and technological advances in drug delivery and formulation.

Specific to URO-MP Capsules, if positioned as a first-in-class or optimized therapy, its addressable market could capture 10-15% of the total BPH pharmacotherapy market within five years post-launch, translating into revenue potential ranging from $250 million to $600 million annually.

Competitive Landscape

Existing Products and Differentiators

Key competitors include:

- Tamsulosin (Flomax®): An alpha-blocker with high market penetration.

- Finasteride (Proscar®): A 5-alpha-reductase inhibitor, with long-term efficacy.

- Combination therapies: Tamsulosin + Dutasteride (Jalyn®), offering synergistic effects.

URO-MP Capsule’s competitive advantage hinges on:

- Improved safety profile.

- Reduced side effects, such as sexual dysfunction.

- Enhanced efficacy in patients unresponsive to existing medications.

- Better patient compliance owing to formulation advantages.

Intellectual property rights, including patents, are crucial for market exclusivity and pricing power.

Regulatory Pathways and Approvals

The approval process for URO-MP Capsule will depend on the evidentiary threshold for safety and efficacy, which varies across jurisdictions. A successful FDA approval, with potential for Orphan Drug or Fast Track status, could expedite market entry and favorable pricing.

Price Analysis and Forecasting

Current Pricing Landscape

On average, alpha-blockers are priced between $2 and $5 per day, with yearly costs exceeding $730 to $1,825. Finasteride generally costs less—around $1 to $3 daily.

Innovative or branded therapies with improved profiles command higher prices, frequently in the range of $3 to $7 per day, owing to clinical benefits and patent exclusivity.

Factors Influencing URO-MP Capsule Pricing

- Research & Development (R&D) Costs: Estimated at $150-200 million, influencing initial pricing to recoup investments.

- Regulatory Environment: Stringent regulations may impact development costs and, consequently, pricing.

- Market Penetration Strategy: Premium pricing initially, followed by gradual reductions as generic competition emerges.

- Payer and Reimbursement Dynamics: Insurance coverage and formulary positioning will set ceilings for attainable pricing.

Projected Pricing Trajectory (2023-2028)

| Year | Estimated Price per Capsule | Daily Cost ($) | Rationale |

|---|---|---|---|

| 2023 | $6.00 | $6 | Premium pricing post-approval, targeting early adopters. |

| 2024 | $5.50 | $5.50 | Slight reduction to improve market penetration. |

| 2025 | $5.00 | $5 | Competitive positioning as generic options gain entry. |

| 2026 | $4.50 | $4.50 | Market saturation pressures and increased competition. |

| 2027 | $4.00 | $4 | Strategic price stabilization. |

| 2028 | $3.50 | $3.50 | Likely widespread generic availability, lowest sustainable price. |

Note: These projections assume URO-MP’s success in regulatory approval, favorable market reception, and limited initial competition.

Market Drivers and Risks

Drivers

- Aging populations in high-income countries.

- Increasing awareness and diagnosis of BPH.

- Patient preference for oral, pill-based therapies.

- Demonstrated superiority in safety and efficacy over existing options.

Risks

- Delays or failures in regulatory approval.

- Emergence of competing newer drugs.

- Pricing pressures from biosimilars or generics.

- Reimbursement challenges and healthcare policy shifts.

Conclusion

URO-MP Capsule is positioned to capitalize on ongoing demographic and therapeutic trends shaping the urological drug market. Its success hinges on obtaining regulatory approval, demonstrating clear clinical benefits, and executing strategic pricing. Initial premium pricing is plausible, with a downward trajectory as market dynamics evolve. Stakeholders should monitor clinical outcomes, regulatory milestones, and competitive movements to refine market and price strategies continually.

Key Takeaways

- The global BPH treatment market offers significant growth potential, with an expanding aging demographic.

- URO-MP Capsule's differentiation through safety and efficacy could justify premium initial pricing (~$6 per capsule).

- Competitive pressures and generic entry are likely to reduce pricing over five years, with a projected decline to approximately $3.50 per capsule.

- Regulatory success and reimbursement policies are critical; early favorable decisions can positively impact pricing power.

- Strategic marketing and demonstrating clear clinical benefits will be essential to maximize market share and profitability.

FAQs

Q1: What makes URO-MP Capsule stand out from existing BPH therapies?

URO-MP Capsule offers potential improvements in safety, side effect profile, and patient compliance compared to standard alpha-blockers and 5-alpha-reductase inhibitors, especially if supported by robust clinical data.

Q2: How does patent protection influence the pricing of URO-MP Capsule?

Patent exclusivity allows for premium pricing during the patent life by limiting competition, enabling the recovery of R&D investments and incentivizing innovation.

Q3: When is the likely market entry for URO-MP Capsule?

If clinical trials and regulatory submissions proceed on schedule, market entry could occur within 2-3 years, with approval potentially granted by 2024 or 2025.

Q4: What factors could accelerate or delay the price decline post-launch?

Accelerators include generic competition and reimbursement pressures; delays involve regulatory hurdles, safety concerns, and limited market adoption.

Q5: How important are regional differences in pricing strategies?

Pricing strategies must be tailored to regional healthcare systems, reimbursement policies, and market competition, with developed markets permitting higher initial prices.

References

[1] American Urological Association (AUA). "Guidelines on the Management of BPH." 2018.

[2] MarketWatch. "Global Benign Prostatic Hyperplasia Treatment Market Report 2022-2028." 2022.

More… ↓