Share This Page

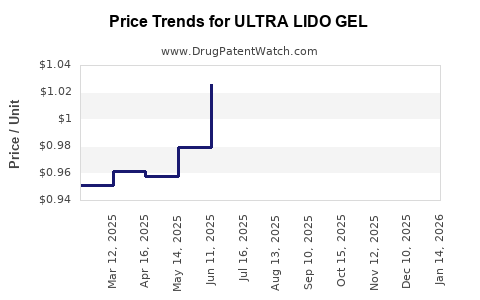

Drug Price Trends for ULTRA LIDO GEL

✉ Email this page to a colleague

Average Pharmacy Cost for ULTRA LIDO GEL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ULTRA LIDO GEL 4% PATCH | 83035-1137-01 | 1.03637 | EACH | 2025-12-17 |

| ULTRA LIDO GEL 4% PATCH | 83035-1137-01 | 1.00693 | EACH | 2025-11-19 |

| ULTRA LIDO GEL 4% PATCH | 83035-1137-01 | 0.96829 | EACH | 2025-10-22 |

| ULTRA LIDO GEL 4% PATCH | 83035-1137-01 | 0.95919 | EACH | 2025-09-17 |

| ULTRA LIDO GEL 4% PATCH | 83035-1137-01 | 0.99047 | EACH | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Ultra Lido Gel

Introduction

Ultra Lido Gel, a topical analgesic containing lidocaine, is widely used for local pain relief associated with dental procedures, minor skin injuries, and certain dermatological conditions. As a popular OTC and prescription medication, understanding its market landscape, competitive positioning, and future pricing trends is vital for pharmaceutical stakeholders, retailers, and healthcare providers. This analysis provides an in-depth review of Ultra Lido Gel, covering market dynamics, competitive environment, regulatory factors, and price projection forecasts.

Market Overview

Product Profile and Indications

Ultra Lido Gel primarily contains lidocaine, a local anesthetic that provides temporary numbness by blocking nerve signals. Its primary applications include pain management in minor dermatological procedures, oral ulcers, Gingival anesthesia, and other localized pain conditions. The gel's formulation offers ease of application, quick onset, and minimal systemic absorption, favoring both OTC and professional use [1].

Market Size and Growth Drivers

The global topical anesthetics market, encompassing products like Ultra Lido Gel, is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% through 2027, driven by rising dental procedures, increasing prevalence of skin conditions, and expanding cosmetic dermatology segments [2]. North America holds the largest market share, owing to higher healthcare spending, widespread OTC product availability, and advanced dental infrastructure.

Key Market Players

Leading competitors include local brands and multinational giants like Johnson & Johnson (Orajel), Walgreens, and CVS Health, among others. Product differentiation revolves around formulation efficacy, regulatory approval, and brand trust. Ultra Lido Gel competes primarily on formulation quality, pricing, and regulatory hygiene.

Regulatory and Distribution Landscape

Regulatory Status

Ultra Lido Gel is classified variably across jurisdictions; in the U.S., it often holds OTC status regulated by the FDA, with certain formulations requiring prescription approval. Regulatory hurdles influence market access and pricing strategies.

Distribution Channels

Distribution spans pharmacies, dental clinics, online platforms, and retail outlets. OTC availability in many regions enables broad market penetration, but strict regulations in some countries may limit direct consumer access, affecting price elasticity.

Competitive Analysis

Pricing Strategies

Pricing competes with generic lidocaine products and other topical anesthetics. Premium formulations or branded Ultra Lido Gel tend to command higher prices, especially when marketed with added benefits such as longer-lasting relief or enhanced tolerability.

Market Penetration and Brand Loyalty

Brand recognition, patient trust, and clinician endorsements influence market share. Formulation innovations and regulatory approvals can further bolster competitive positioning.

Price Analysis

Historical Pricing Trends

Historically, Ultra Lido Gel has been priced between $5 and $10 for a 15–30 gram tube in North America, depending on the retailer and formulation. Generic counterparts often retail at approximately 20-30% lower.

Current Price Points

As of 2023, the average price for a standard 15g tube ranges from $6 to $8 in U.S. pharmacies, with premium or specialty variants costing up to $12. Price varies regionally based on market competition and distribution costs.

Pricing Factors

- Regulatory costs: Approval processes impact final retail prices.

- Manufacturing costs: Ingredient sourcing, formulation complexity, and quality standards.

- Distribution and marketing: Logistics costs, promotional activities, and retailer margins.

- Reimbursement and insurance: Coverage influence retail pricing and consumer out-of-pocket expenses.

Future Price Projections

Short-term Outlook (1-2 years)

Market stability is anticipated, with prices likely to remain within the current range ($6–$8) barring significant regulatory changes or supply chain disruptions. Generic proliferation will exert price pressure, especially in markets with intense competition.

Medium to Long-term Outlook (3-5 years)

- Regulatory developments: Streamlined approval for novel formulations or delivery systems could allow premium pricing.

- Market expansion: Growing dermatology and dental procedures in emerging markets could increase demand, enabling premium-tier pricing.

- Innovation impact: Introduction of extended-release gels or combination products may command higher prices.

Forecasts suggest a modest 2–4% annual increase in average retail price over the next five years, driven by inflation, product differentiation, and evolving consumer preferences.

Influence of External Factors

- Regulatory policies: Stringent approval processes could increase costs, translating into higher prices.

- Patent protections: If Ultra Lido Gel holds or gains patent exclusivity, pricing may be better maintained.

- Healthcare reimbursement policies: Inclusion in insurance formularies can stabilize prices but might limit profitability.

Opportunities and Risks

Opportunities

- Expansion into emerging markets with increasing dental and dermatological healthcare access.

- Development of novel formulations (e.g., longer duration or combined therapies) offering premium pricing.

- Leveraging online and retail channels to enhance accessibility and sales volume.

Risks

- Price erosion due to generic competition.

- Regulatory restrictions restricting OTC access.

- Market saturation in developed regions.

Key Takeaways

- Ultra Lido Gel remains a pivotal product in the local anesthetic market, with steady demand driven by dental, dermatological, and cosmetic applications.

- The current pricing landscape positions the product in the $6–$8 retail range, with competitive pressures leading to potential marginal decreases or stabilization.

- Price projections indicate modest growth aligned with inflation, innovation, and expanding markets, particularly in emerging economies.

- Regulatory environments and patent statuses significantly influence future pricing strategies and market exclusivity.

- Stakeholders should monitor regulatory developments, formulary inclusions, and competitive innovations to optimize pricing and market share.

FAQs

Q1: What factors influence the retail price of Ultra Lido Gel?

Pricing is primarily affected by manufacturing costs, regulatory compliance, distribution expenses, competitive pricing, and brand positioning.

Q2: How does generic competition impact Ultra Lido Gel’s market price?

Generics exert downward pressure, typically reducing prices by 20–30%, increasing consumer choice and prompting brand differentiation.

Q3: Are there regional differences in Ultra Lido Gel’s pricing?

Yes, prices vary across countries due to regulatory regimes, import tariffs, supply chain logistics, and local market dynamics.

Q4: What potential innovations could lead to price increases for Ultra Lido Gel?

Extended-release formulations, combination therapies, or new delivery mechanisms that enhance efficacy and convenience could command higher prices.

Q5: How might regulatory changes influence the future pricing of Ultra Lido Gel?

Stringent regulations could increase compliance costs, raising prices; conversely, streamlined approval pathways could facilitate market entry and competitive pricing.

References

[1] MarketResearch.com. (2022). Global Topical Anesthetics Market Report.

[2] Grand View Research. (2023). Topical Anesthetics Market Size, Share & Trends.

More… ↓