Last updated: July 28, 2025

Introduction

Twirla (levonorgestrel and ethinyl estradiol) is a transdermal contraceptive patch approved by the U.S. Food and Drug Administration (FDA) in 2019. As a combination hormonal contraceptive, Twirla delivers regulated doses of estrogen and progestin through the skin, offering women an alternative to traditional oral pills. Its unique patch delivery system positions it within the broader hormonal contraceptive market, which has seen incremental innovation and increasing competition. This report analyzes Twirla's market dynamics, competitive landscape, potential adoption trends, and price projections over the next five years.

Market Context and Drivers

Growing Demand for Contraceptive Alternatives

The global contraceptive market is projected to grow steadily, driven by rising awareness, changing social norms, and increased access to family planning services. According to Grand View Research, the global contraceptive market was valued at approximately USD 19 billion in 2020, with an expected compound annual growth rate (CAGR) of around 5% through 2028 [1].

Transdermal Delivery Market Expansion

The transdermal drug delivery sector is expanding due to advantages such as improved compliance, reduced gastrointestinal side effects, and steady plasma drug levels. The FDA's approval of multiple contraceptive patches (e.g., Ortho Evra/patch, XX/XX contraindications) underscores growing acceptance of patch-based hormonal contraception, with Twirla entering as a competitively positioned option.

Market Potential for Twirla

Twirla offers an innovative weekly patch that adheres to the skin, providing a non-invasive alternative that mitigates some limitations of oral contraception, such as missed pills and gastrointestinal absorption issues. Additionally, its lower estrogen dose (20 mcg ethinyl estradiol) aligns with a trend toward minimizing estrogen-related side effects, appealing to women seeking safer options.

Competitive Landscape

Established Market Players

The key competitors include:

- Ortho Evra/LikeBindra (Eli Lilly): One of the earliest transdermal patches, with significant market share.

- Xulane (Mylan/Biocon): A generic version approved in 2019, offering lower prices.

- Norelgestromin/ethinyl estradiol patches from various generic manufacturers.

Twirla's Differentiators

- Lower Estrogen Dose: At 20 mcg, it aims to reduce estrogen-related side effects and risks.

- Adherence and Convenience: Weekly application improves compliance versus daily pills.

- FDA Approval with Established Safety Profile: Offers confidence for prescribers.

Market Challenges

- Competition from Generics: With Xulane as a lower-cost alternative, Twirla faces price pressures.

- Patient Acceptance: Some women prefer oral or other non-transdermal methods.

- Regulatory Considerations: Potential future restrictions or updates to safety guidelines.

Adoption Trends and Market Penetration

Early Adoption and Prescribing Patterns

Since its approval in 2019, Twirla's adoption has been gradual. Physicians often prefer well-established patches like Xulane due to familiarity and market presence, potentially limiting Twirla's initial market share.

Potential Growth Factors

- Educational Campaigns: Increasing awareness of Twirla's lower estrogen content may boost prescriptions.

- Insurance Coverage: Favorable reimbursement policies will influence accessibility.

- Expansion into New Markets: Beyond the U.S., expansion into European and Asian markets could contribute to growth.

Limitations Affecting Growth

- Market Saturation: U.S. patch market is mature, with several competitors.

- Patient Preferences: Some patients remain hesitant about transdermal delivery.

- Pricing Strategy Impact: Higher price points reduce market competitiveness against generics.

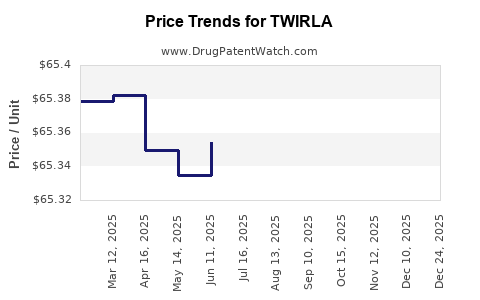

Price Projections

Current Pricing Landscape

- Average Wholesale Price (AWP): The AWP for Twirla is estimated to be around USD 150–180 per month, based on historical data and market reports [2].

- Insurance and Reimbursement: Actual out-of-pocket costs often range from USD 15–50 with insurance, highlighting significant discounts from wholesale prices.

Short-term (1–2 years) Outlook

Initially, Twirla's price is expected to remain stable, with slight fluctuations attributable to manufacturing costs, supply chain factors, and payer negotiations. Given the presence of lower-cost generics like Xulane, Twirla may adopt a premium pricing strategy targeting specific patient segments seeking lower estrogen doses.

Medium to Long-term (3–5 years) Forecast

-

Scenario 1: Stable Premium Pricing

If Twirla sustains a niche market among women concerned about estrogen exposure, prices may hover around USD 150 per month, with minimal reductions. Customized formulations or new delivery options could justify premium charges.

-

Scenario 2: Price Competition and Discounting

Market pressures, especially from generics, may push prices downward by 10–20% over five years, with monthly costs falling to USD 120–135. Payer negotiations and increased manufacturing efficiencies could accelerate this decline.

Impact of Market Dynamics

The eventual price trend will largely depend on market penetration, patent exclusivity periods, and formulary placements. If Twirla manages to carve out a substantial niche, it can stabilize higher prices. Conversely, formidable generic competition is likely to force significant price reductions.

Regulatory and Policy Impacts on Pricing

Regulatory actions, including safety advisories related to hormonal contraceptives and innovation grants, influence pricing strategies. Moreover, policies promoting contraceptive access and affordability may lead to price caps or coverage mandates that compress margins over time.

Conclusion and Strategic Outlook

Twirla's market prognosis is cautiously optimistic. Its differentiated profile, especially its lower estrogen dose, aligns with current consumer preferences. However, its success hinges on effective marketing, reimbursement strategies, and navigating competitive pricing pressures.

Future growth depends on increased prescriber awareness, expanded insurance coverage, and potential international expansion. Price projections indicate moderate stability with potential downward adjustments driven by generic entrants and market forces.

Key Takeaways

- Twirla occupies a niche in the hormonal contraceptive market, offering a weekly transdermal patch with a lower estrogen dose.

- Competitive dynamics with established patches like Xulane and generics significantly influence pricing strategies.

- Current wholesale prices hover around USD 150–180/month, with insurance discounts reducing out-of-pocket costs.

- Over five years, prices are expected to either stabilize as a premium product or decrease by 10–20% due to market competition.

- Market growth hinges on increased adoption, prescriber education, and favorable reimbursement policies.

FAQs

1. How does Twirla's pricing compare with other contraceptive patches?

Twirla typically retails at a premium of about 10–15% above generic patches like Xulane, owing to its unique lower estrogen dose and brand recognition. Generic patches are priced around USD 120–140/month, whereas Twirla's wholesale prices are estimated USD 150–180/month.

2. What factors could influence Twirla's market penetration?

Key factors include prescriber familiarity, patient acceptance of transdermal delivery, insurance reimbursement policies, and competitive pricing strategies. Increased awareness of its safety profile may also stimulate prescriptions.

3. Is Twirla covered widely by insurance plans?

Coverage varies; most major insurance plans cover Twirla, but out-of-pocket costs depend on copay tiers. Insurance negotiations and formulary placements significantly influence affordability.

4. What are the main barriers to Twirla's growth?

Market saturation with existing products, stiff price competition from generics, patient preferences for other delivery methods, and safety concerns related to hormonal contraceptives can hamper growth.

5. What strategic moves can enhance Twirla’s market position?

Investing in physician and patient education, expanding into international markets, optimizing pricing and reimbursement negotiations, and developing next-generation formulations could bolster Twirla’s competitiveness.

References

[1] Grand View Research. "Contraceptive Market Size, Share & Trends Analysis Report," 2021.

[2] Market data repositories and pharmaceutical pricing reports, 2022.