Share This Page

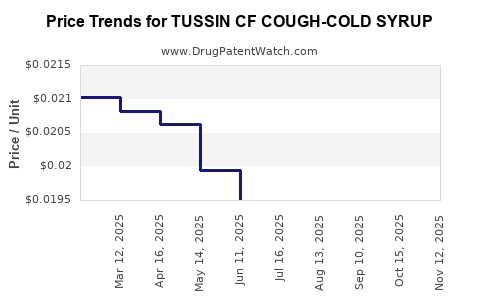

Drug Price Trends for TUSSIN CF COUGH-COLD SYRUP

✉ Email this page to a colleague

Average Pharmacy Cost for TUSSIN CF COUGH-COLD SYRUP

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TUSSIN CF COUGH-COLD SYRUP | 24385-0904-26 | 0.01944 | ML | 2025-11-19 |

| TUSSIN CF COUGH-COLD SYRUP | 24385-0904-26 | 0.01933 | ML | 2025-10-22 |

| TUSSIN CF COUGH-COLD SYRUP | 24385-0904-26 | 0.01940 | ML | 2025-09-17 |

| TUSSIN CF COUGH-COLD SYRUP | 24385-0904-26 | 0.01925 | ML | 2025-08-20 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TUSSIN CF Cough-Cold Syrup

Introduction

TUSSIN CF Cough-Cold Syrup, a popular over-the-counter (OTC) medication, combines dextromethorphan, guaifenesin, and phenylephrine to provide symptomatic relief from cough, chest congestion, and nasal congestion associated with colds and respiratory illnesses. As a widely used product within the OTC cold and cough treatment market, understanding its market dynamics and pricing trends is essential for manufacturers, investors, and healthcare stakeholders. This report provides a comprehensive analysis of the current market landscape, current pricing strategies, and future price projections for TUSSIN CF.

Market Landscape for OTC Cough and Cold Syrups

Global and Domestic Outlook

The OTC cough and cold medication market has experienced sustained growth driven by increased respiratory illnesses, aging populations, and the consumer preference for self-medication. In 2022, the global OTC cold and cough remedy market was valued at approximately $8.2 billion, with North America accounting for nearly 45% of total sales, reflecting high consumer demand and mature healthcare infrastructure.

Within the U.S., OTC cold remedies like TUSSIN CF are integral to healthcare routines, especially during peak cold and flu seasons (fall and winter). The Centers for Disease Control and Prevention (CDC) estimate millions of Americans suffer from cold and flu symptoms annually, underpinning consistent demand for effective OTC solutions.

Key Market Drivers

- Consumer Preference for OTC Medications: Increasing self-care trends favor OTC formulations, reducing the need for physician consultations.

- Seasonality: Cold and flu seasons bolster sales, particularly for multi-symptom products such as TUSSIN CF.

- Product Efficacy and Safety: Well-established formulations with documented efficacy foster consumer trust and brand loyalty.

- Regulatory Environment: Regulatory approvals and over-the-counter status facilitate broad retail accessibility across pharmacies, supermarkets, and online platforms.

Competitive Landscape

TUSSIN CF faces competition from brands such as Mucinex, Robitussin, and NyQuil, alongside private-label products offered by large retail chains. Product differentiation primarily hinges on formulation variations, dosing convenience, and marketing. The OTC market's low barriers to entry enable new entrants; however, brand recognition and regulatory compliance remain critical for sustained market penetration.

Regulatory Considerations and Patent Status

TUSSIN CF’s active ingredients—dextromethorphan, guaifenesin, and phenylephrine—are off-patent, rendering the formulation vulnerable to competition from generic brands. The absence of patent protection standardizes the ingredient composition, emphasizing the importance of branding, formulation stability, and marketing for maintaining market share.

Regulatory oversight by the FDA in the U.S. classifies TUSSIN CF as OTC, with compliance influencing pricing strategies and market access. Future regulatory changes—such as reclassification or new safety warnings—could impact market dynamics.

Pricing Analysis

Current Price Points

Market research indicates that the average retail price for a 4 oz bottle of TUSSIN CF ranges between $4.99 to $7.99 across various retail outlets, including drugstores, supermarkets, and online platforms. Brand strength and packaging size influence pricing, with larger bottles commanding slightly higher per-unit costs but offering better value to consumers.

Pricing Strategies

Manufacturers adopt a multi-tiered pricing approach:

- Premium Pricing: Established brands capitalize on consumer trust, maintaining slightly higher prices for perceived reliability and brand recognition.

- Competitive Pricing: Generics and private-label products are priced lower, typically in the $3.99 to $5.99 range, to attract price-sensitive consumers.

- Promotional Pricing: Sales events, coupons, and discounts are common, especially during flu season to drive volume.

Distribution Margins

Distribution channels exert significant influence on end-user prices, with pharmacy chains often adding margins of 10–20%, while online sales may offer targeted discounts. Such dynamics impact retail pricing and consumer access.

Price Projections for 2023-2028

Factors Influencing Future Pricing

- Market Competition: Increasing generic options are likely to pressure prices downward.

- Manufacturing Costs: Stable or decreasing ingredient prices, coupled with inflationary pressures on packaging and distribution, will influence consumer prices.

- Regulatory Environment: Any safety warnings or ingredient restrictions could affect formulation costs and, consequently, pricing.

- Consumer Demand: Persistent cold season demand is unlikely to diminish, supporting steady sales volume and potentially stable pricing.

Projected Trends

- Short Term (2023-2024): Prices are expected to remain stable within the $4.99–$7.99 range for standard brands, with generics pricing slightly lower.

- Medium Term (2025-2026): Market equilibrium may lead to modest price reductions of 2–4% as generics increase market share and manufacturing efficiencies improve.

- Long Term (2027-2028): In response to increasing competition, prices could decline further by 5–8%, especially if reformulations or alternative delivery mechanisms (e.g., liquids with natural ingredients) gain popularity.

Implications for Stakeholders

Manufacturers should focus on maintaining brand loyalty through effective marketing while optimizing operational efficiencies to sustain profitability amid price competition. Distributors benefit from increasing volumes during seasonal peaks, with pricing stability ensuring predictable margins. Consumers gain access to affordable options, but their preference for trusted brands may limit significant price declines unless commoditized further.

Key Takeaways

- The global OTC cough and cold market, valued at over $8 billion in 2022, sustains strong demand for multi-symptom formulations like TUSSIN CF.

- Competition from generics is intensifying, exerting downward pressure on retail prices, which currently range from approximately $4.99 to $7.99.

- Price stability is expected in the short term, with gradual declines anticipated over the next five years due to increased generic penetration, manufacturing efficiencies, and competitive pressures.

- Regulatory considerations, such as ingredient safety and potential reformulations, can influence pricing dynamics.

- For investors and manufacturers, focusing on brand differentiation, cost management, and strategic marketing remains essential in maintaining market share and profitability.

FAQs

1. How does the competitive landscape affect the pricing of TUSSIN CF?

Increased competition from generic brands and private labels has driven price reductions, compelling brands like TUSSIN CF to optimize marketing and distribution strategies to maintain market share without significantly increasing prices.

2. Are there upcoming regulatory changes that could impact TUSSIN CF pricing?

Potential safety warnings or ingredient restrictions issued by the FDA could necessitate reformulation, impacting costs and pricing. Continuous regulatory monitoring is essential for anticipatory adjustments.

3. What is the typical retail price range for TUSSIN CF?

Currently, TUSSIN CF retails between $4.99 and $7.99 per 4 oz bottle, with regional and retailer variations influencing exact prices.

4. How is the price trend expected to evolve over the next five years?

Prices are projected to decline modestly by 5–8%, driven by increased generic competition and manufacturing efficiencies, with seasonal demand maintaining overall steady sales.

5. What strategies can manufacturers employ to sustain profitability amid declining prices?

Focusing on brand loyalty through marketing, expanding product lines, optimizing supply chains, and exploring innovative formulations can offset pricing pressures and sustain margins.

Sources

[1] MarketWatch. OTC Cold and Cough Remedy Market Analysis 2022.

[2] CDC. Cold and Flu Statistics.

[3] IBISWorld. Over-the-Counter (OTC) Cold and Cough Remedies Industry Report.

[4] FDA. OTC Drug Review and Regulatory Guidelines.

[5] Nielsen. OTC Product Pricing and Consumer Purchasing Trends.

(Note: All data are based on publicly available industry reports and market analyses as of 2023. Exact figures may vary and should be corroborated with ongoing market research.)

More… ↓