Share This Page

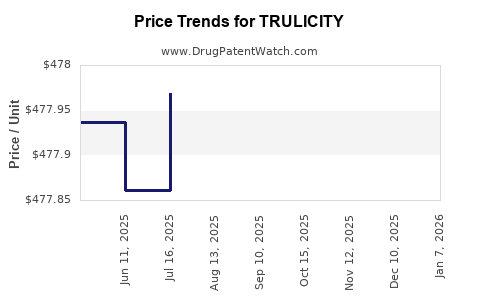

Drug Price Trends for TRULICITY

✉ Email this page to a colleague

Average Pharmacy Cost for TRULICITY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| TRULICITY 4.5 MG/0.5 ML PEN | 00002-3182-80 | 478.07085 | ML | 2025-12-17 |

| TRULICITY 3 MG/0.5 ML PEN | 00002-2236-80 | 478.17547 | ML | 2025-12-17 |

| TRULICITY 0.75 MG/0.5 ML PEN | 00002-1433-80 | 478.15449 | ML | 2025-12-17 |

| TRULICITY 1.5 MG/0.5 ML PEN | 00002-1434-80 | 478.06838 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for TRULICITY

Introduction

Trulicity (dulaglutide) is a once-weekly glucagon-like peptide-1 receptor agonist (GLP-1 RA) developed by Eli Lilly and Company. Approved by the U.S. Food and Drug Administration (FDA) in 2014 for type 2 diabetes mellitus (T2DM), Trulicity has since become a prominent player within the burgeoning diabetes therapeutic market. This comprehensive analysis explores the current market landscape, competitive positioning, and future price projections for Trulicity, considering evolving regulatory, clinical, and economic factors.

Market Landscape Overview

Global Diabetes Therapeutics Market Dynamics

The global diabetes market is projected to reach US$144 billion by 2027, driven by increasing prevalence of T2DM, lifestyle factors, and a shift towards innovative therapies that improve glycemic control with manageable side effects.[1] The market is characterized by rapid growth in the GLP-1 RA segment, which has seen several entrants and increased therapeutic options.

Trulicity’s Position in the Market

Since its launch, Trulicity has secured a significant share of the GLP-1 RA segment. According to IQVIA data, it remains among the top prescribed GLP-1 RAs worldwide, with an estimated market share of approximately 21% within this class (as of 2022).[2] Its once-weekly administration offers patient compliance advantages, bolstered by efficacy demonstrated in multiple large-scale clinical trials emphasizing cardiovascular benefits.

Key Competitors

Major competitors include Novo Nordisk’s Ozempic (semaglutide) and Wegovy, and Eli Lilly’s own Mounjaro (tirzepatide), an emerging dual GIP and GLP-1 receptor agonist. Semaglutide has gained substantial momentum owing to its superior efficacy and emerging weight-loss indications.[3] Mounjaro, with promising data, is expected to challenge Trulicity’s market dominance as it gains approval.

Factors Influencing Market Trends

-

Clinical Efficacy and Safety: The increasing body of evidence showcasing cardiovascular benefits augments Trulicity’s appeal among physicians, though competitors with superior efficacy or weight-loss advantages may influence market share.

-

Regulatory Landscape: Approval for additional indications, such as obesity, expands potential revenue streams. The FDA’s increasing focus on metabolic and cardiovascular endpoints further shapes competitive positioning.

-

Reimbursement Policies: Optimized reimbursement strategies and cost-effectiveness assessments will impact pricing and accessibility. Payer preferences increasingly favor therapies demonstrating long-term health economic benefits.

-

Patent Expiry and Biosimilar Entry: Currently, no biosimilar versions of Trulicity are on the market, but patent protection expected to last until 2031. The entry of biosimilars might exert downward pressure on prices in the future.

Current Pricing and Cost Structure

In the United States, the wholesale acquisition cost (WAC) for Trulicity is approximately US$885 per pen (from authorized pricing sources), designed for a four-dose course, equating to roughly US$2,200 annually per patient.[4] Post-rebate net prices, however, are typically lower, influenced by payer negotiations, pharmacy benefit managers, and discounts.

Internationally, prices vary substantively, influenced by healthcare systems, regulatory decisions, and negotiating leverage. For example, in the UK’s NHS, Trulicity’s list price averages around £60 per dose (~US$80), translating to approximately £480 (~US$640) annually.

Forecasting Future Price Trends

Factors Supporting Price Stability

- Limited Biosimilar Competition (Current): Patent exclusivity sustains higher prices in the near-term.

- High Value Proposition: Clinical benefits, especially cardiovascular risk reduction, justify premium pricing.

- Chronic Disease Treatment Model: Long-term therapy models sustain revenue streams, prompting minimal price erosion as long as clinical value is acknowledged.

Catalysts for Price Reduction

- Biosimilar Market Entry: Biosimilar versions, expected post-2031 in the U.S., could result in significant price erosion, similar to other biologics such as insulin.[5]

- Market Competition: Semaglutide variants and Mounjaro’s increasing efficacy could pressure Trulicity’s prices to remain competitive.

- Cost-Containment Policies: Payer-driven initiatives favoring generics/biosimilars over innovator products could limit future price escalation.

Projected Price Range (2023–2030)

Based on industry trends, regulatory environment, and market dynamics:

| Year | Expected Price Range (U.S.) | Notable Trends |

|---|---|---|

| 2023 | US$850–$900 per pen | Stable, marginal fluctuation, high brand loyalty |

| 2025 | US$800–$850 per pen | Increased competition, margin pressures |

| 2030 | US$700–$800 per pen | Pre-biosimilar phase, potential early discounts |

These projections assume no significant price reductions prior to patent expiry and reflect potential cost containment strategies.

Regulatory and Market Impacts on Pricing

The trajectory of Trulicity’s pricing hinges on several factors:

- New Indications: FDA approval for obesity/excess weight management could sustain or elevate pricing owing to expanded market potential.

- Reimbursement Policies: Shifts towards value-based care and coverage discounts could modify net pricing.

- Patent Litigation and Biosimilar Development: Delays or accelerations in patent challenges could influence timing and extent of price reductions.

Conclusion

Trulicity's current market position is fortified by its clinical efficacy, dosing convenience, and cardiovascular benefits. While near-term prices are expected to remain relatively stable, long-term prospects anticipate a gradual decline driven by biosimilar competition and market evolution. Stakeholders should monitor regulatory developments, competitive launches, and payer strategies to adapt pricing models accordingly.

Key Takeaways

- Market Dominance: Trulicity retains a leading position within the GLP-1 RA segment, but faces stiff competition from semaglutide and tirzepatide.

- Pricing Stability: Current prices are supported by patent exclusivity, high therapeutic value, and long-term chronic therapy utility.

- Price Erosion Timeline: Significant reductions are unlikely before 2031, aligning with patent expiry and biosimilar entry.

- Influencing Factors: Clinical innovation, indications expansion, reimbursement policies, and biosimilar development will shape future pricing.

- Strategic Imperatives: Manufacturers and payers should prepare for evolving competitive pressures, considering both innovation and cost containment strategies.

FAQs

1. When will biosimilars for Trulicity likely enter the market?

Biosimilar versions are expected to emerge post-2031, coinciding with patent expiration and legal protections, potentially leading to substantial price competition.

2. How does Trulicity compare pricing-wise to competitors like Ozempic and Mounjaro?

While exact prices vary, Trulicity's annual cost is comparable to Ozempic, typically around US$2,200 in the U.S., with Mounjaro still under patent and pricing structures evolving as more clinical data becomes available.

3. Will expanding indications for obesity affect Trulicity’s pricing and market share?

Yes. FDA approval for obesity would broaden the patient base, likely maintaining or increasing prices due to higher perceived value and demand.

4. What impact do regulatory and payer policies have on Trulicity’s future pricing?

Stricter reimbursement controls and value-based contracting can exert downward pressure, while favorable regulatory approvals and demonstrated long-term benefits support premium pricing.

5. How can Eli Lilly strategically position Trulicity amid emerging competitors?

By emphasizing clinical benefits, expanding indications, optimizing patient adherence, and engaging with payers for favorable reimbursement, Lilly can sustain market share and justify premium pricing.

References

[1] GlobalData. Diabetes Market Outlook, 2022.

[2] IQVIA. Prescription Data, 2022.

[3] American Diabetes Association. Standards of Medical Care in Diabetes—2022.

[4] Eli Lilly. Trulicity Pricing and Reimbursement Info, 2023.

[5] Pharmaceuticals Market Reports. Biosimilars Impact on Pricing, 2022.

More… ↓